[ad_1]

Happening on Thursday: Sujeet Indap discusses his newly published book The Caesars Palace Coup (here’s an excerpt) and the distressed debt industry with leading investors and advisers. Details and sign up to watch live or on-demand later here.

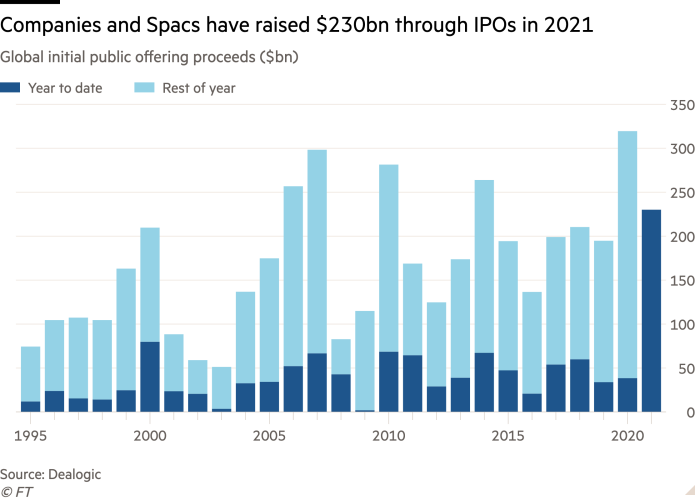

One chart to start: Proceeds from IPOs have hit a record-setting $230bn this year, well above the previous peak of $80bn set at this point in time in 2000. Go deeper.

Welcome to Due Diligence, your briefing on dealmaking, private equity and corporate finance from the Financial Times. Want to receive DD in your inbox? Sign up here. Get in touch with us anytime: Due.Diligence@ft.com.

China’s Tencent found a nifty way to invest in a hot Indian start-up

When India clamped down on foreign investment last April, it hit Chinese tech groups like Tencent and Alibaba hard.Â

The groups had been spearheading an explosion of Chinese funding of India’s burgeoning tech scene since 2017. But when the pandemic struck India, it spread along with it fears of opportunistic takeovers.

Prime minister Narendra Modi’s government implemented extra hurdles for foreign investors such as a requirement for special government approvals before neighbouring countries could invest, in a move clearly aimed at China.

Tensions worsened between the two countries in June, following a border clash that killed several Indian soldiers. Since then, India has banned at least 200 Chinese apps, including popular social media platforms like TikTok and WeChat, among others.

Here’s the irony: app bans created a fertile environment for Indian social media companies to flourish, with apps like ShareChat doubling their workforce and hitting all-time highs of 160m monthly active users, but it only furthered demand for investment in these cash-hungry start-ups.

And, the largest source of late-stage money in Indian tech is — you’ve guessed it — China. The nation’s tech titans hold stakes in at least two-thirds of Indian start-ups valued at more than $1bn, according to data from think-tank Gateway House.Â

To keep pumping cash into India, which they consider a second and very lucrative home market, Chinese investors would need a creative solution to evade government scrutiny.Â

That brings us back to India’s latest tech darling ShareChat, which raised $501m in its Series E round this month, a combination of debt and equity investment from Silicon Valley groups like Twitter and Snap, and venture capital funds Tiger Global and Lightspeed Venture Partners.Â

When the FT’s Madhumita Murgia asked whether Chinese investors like Tencent were involved on the debt side, the company’s chief executive Ankush Sachdeva didn’t want to comment.

However, Madhumita and the FT’s Ben Parkin were able to track down regulatory filings that showed Tencent had quietly backed the Indian social media start-up, investing $225m via two Dutch entities — Zennis Capital BV and Hlodyn BV — or 19.74 per cent of ShareChat, if their debt were to be converted into equity stakes.

Both companies were registered in February of this year, and list the same two directors on their public records — Jingsi He, the current head of finance for Tencent Europe, and Constant Pieter van der Merwe, senior counsel for Tencent in Europe.

Tencent confirmed to the FT that it was, in fact, the debt investor in ShareChat.

There’s no suggestion that Tencent or ShareChat have broken any rules, since the debt deal enables the companies to circumvent India’s restrictions.

Indian venture capitalists and lawyers say that Tencent and others are finding even more entrepreneurial ways to continue funding Indian tech start-ups, including, for example, pooling cash into funds in which the Chinese investor isn’t a beneficial owner.Â

An heir’s fight to stay atop his family’s empire

If you needed more proof that a truly baroque corporate battle was under way at France’s Lagardère, here’s your sign.

Arnaud Lagardère, the heir who has been battling an activist investor and two billionaires to keep control over the French media and retail group his father founded, made a big concession but sought to spin it as a victory.

He has agreed to give up the group’s legal status as a société en commandite that gave him near-total control and veto power over any takeover bid, despite only owning a 7 per cent stake.Â

In exchange, writes the FT’s Leila Abboud from Paris, he’ll get an additional 10m shares in Lagardère (about another 7 per cent), three board seats and a contract to serve as chair and chief executive for six years.Â

“I am very happy about this change, which I wanted, and I have no regrets,†he said on an analyst call. But in reality what has been negotiated isn’t so favourable to the heir.Â

Vivendi, which is controlled by feared corporate raider Vincent Bolloré, will also get three board seats and after dilution will hold 27 per cent of the shares, just under the threshold to trigger a full takeover offer.Â

Additionally, Arnaud’s longtime nemesis, the hedge fund Amber Capital, will also get a seat to go along with its 18 per cent stake, as will his supposed ally LVMH billionaire Bernard Arnault (who himself owns a 7 per cent stake.)

Crucially, there’s no standstill agreement between any of these parties. And without the commandite, the company is subject to a takeover whether Arnaud Lagardère likes it or not.Â

That has set tongues wagging in Paris, where the saga has captivated the business world for a year. Will Bolloré launch a full takeover offer or be content to more softly influence Lagardère? What does Arnault really want?

One éminence grise of French business told Leila that the LVMH boss had been outplayed and “humiliated†by Bolloré, who has become the real power at Lagardère given that he has allied himself with Amber and has the option to buy out its stake.Â

Few think that the truce Lagardère claims to have negotiated will last.

The obscure accountant that signed off on Sanjeev Gupta’s books

DD readers will be familiar with the unconventional financing behind the teetering steel and commodities empire of Sanjeev Gupta and his GFG Alliance.Â

The 49-year-old industrialist’s links to Australian financier Lex Greensill mean his operations’ struggles have been bound up in the public outcry over allegations of political sleaze at the heart of British politics.Â

But away from the glare of diplomacy, the accounts of more than 60 GFG companies in the UK have been signed off by a small accountant on London’s Regent Street.Â

King & King, whose motto is “our client’s interests always come firstâ€, audited the most recent accounts of GFG entities with combined revenues of nearly £2.5bn, an FT analysis found.

The two-office firm, whose other base is in the shadow of Wembley Stadium, is a far cry from the large accountants normally hired to audit the financial statements of multibillion-pound corporate groups.

One person who has set foot in King & King’s offices described them as “small†and “darkâ€. “It smells of the 1950s,†he said. “Everything is at least 30 years old, with dark wooden tables and shabby furniture. It’s full of boxes with yellowing bits of paper spilling out.â€

There have been calls to break the dominance of the Big Four accounting firms for as long as DD can remember, but we’re not sure King & King was exactly the candidate critics had in mind to shake up the long-running oligopoly.Â

The accounts of at least 19 GFG companies, 17 of which were most recently audited by King & King, are currently overdue, according to Companies House records.

Read the full deep-dive into the little-known audit firm by the FT’s Michael O’Dwyer and Cynthia O’Murchu and DD’s Rob Smith here.

Job moves

-

Former Paul Weiss attorney Alex Oh has resigned as director of the division of enforcement at the US Securities and Exchange Commission less than a week after her appointment was announced, citing “personal reasonsâ€. Melissa Hodgman will return as acting director.

-

Mary O’Connor, the first woman to lead a Big Four accountant in the UK, is to leave KPMG after being passed over for appointment as the firm’s permanent chief.

-

Justin Zhu, chief executive of marketing start-up Iterable, was dismissed over violations of company policy, including taking LSD before a meeting in 2019. Zhu told Bloomberg he was experimenting with microdosing, a practice gaining acceptance in certain Silicon Valley circles.

Smart reads

Musk vs USA Tesla and SpaceX’s illustrious founder has built an empire atop shattered status quos. His next frontier: the US regulatory landscape. (WSJ)

The new sheriff in town Gary Gensler, the new chair of the US Securities and Exchange Commission, made a name for himself cleaning up the post-2008 mess. This time, he’s scouring markets for bubbles before they burst in the first place. (FT)

Good luck in there António Horta-Osório is accustomed to fighting fires, which he did for years at Lloyds. But tackling the twin disasters of Greensill and Archegos as Credit Suisse’s new chair will be a challenge unlike any other. (FT)

News round-up

Saudi Aramco and India’s Reliance discuss cash and share stake deal (FT)

UK woos sovereign wealth funds over green investments (FT)

LSE rebuked by investors over chief’s pay package (FT)

GSK chief defends against accusations of flat performance (FT)

Indian food delivery group Zomato looks to raise $1.1bn in IPO (FT)

The bold GB News ​bet on a Fox Nation business model (FT Opinion)

[ad_2]

Source link