[ad_1]

Greetings from Colorado, where the Aspen Institute took a bold leap into post-pandemic existence this week by staging part of its annual Ideas Festival “IRL†— In Real Life. A top theme at this year’s event was racial diversity and sustainability, and Chip Bergh, chief executive officer of Levi Strauss, issued a rousing call to arms. “If we as CEOs fail to take action on structural racism and inequities . . . as leaders [we] are complicit in structural racism,†he declared, noting that the Black Lives Matter protests in 2020 had sparked a personal “reckoning†for him, showing “what white privilege is aboutâ€.Â

But how can CEOs navigate the boundaries of shifting social norms? Bergh admits this is difficult because the definition of sustainability keeps shifting — and ESG demands difficult trade-offs. “The job of the CEO has become so much harder in the last couple of years,†he said.

Today’s newsletter demonstrates this: take a look at how antitrust is converging with ESG as global regulators step up scrutiny — and how companies are engaging in new restructuring strategies in response. (Gillian Tett)

‘Right to repair’ — where ESG and antitrust converge

The “right to repair†— the freedom to fix one’s broken cars and electronics rather than buy new items — has become an increasingly popular issue in the US and Europe, and now has new relevance to the ESG world.

On June 24, As You Sow, a non-profit that is one of the biggest filers of ESG shareholder proposals, unveiled a petition at Microsoft, calling on the company to analyse the environmental and social benefits of making its devices more easily repairable. It is believed to be the first right-to-repair shareholder proposal filed at a US company.

“Microsoft positions itself as a leader on climate and the environment, yet facilitates premature landfilling of its devices by restricting consumer access to device reparability,†said Kelly McBee, the waste programme co-ordinator at As You Sow.

Part of the impetus for filing the proposal was a recent US Federal Trade Commission report on the right to repair, McBee said. The May report said that “there is scant evidence to support manufacturers’ justifications for repair restrictionsâ€, and that the agency “will consider reinvigorated regulatory and law enforcement options†for the right-to-repair issue.

Microsoft already publishes a device sustainability report in addition to its overall sustainability disclosure. “Microsoft provides consumers with safe, effective, and high-quality repair services that safeguard their privacy, security and protect them from injury,†a company spokesman said in a statement. “We are committed to designing our products to deliver what customers need and want in a premium device, and that includes increasing repairability and durability.â€

As an unprecedented shareholder proposal, it remains to be seen how Microsoft shareholders will react to the right-to-repair petition. The company is highly ranked on ESG and sustainability, and investors might be inclined to give it a pass. But if the right-to-repair issue becomes a legitimate antitrust threat, then Microsoft investors will need to view it as a more serious business risk. (Patrick Temple-West)

Sunak unveils £15bn of green bonds

The UK Treasury has announced that it will follow through on its pledge to issue green bonds, saying this week that it will do at least two deals totalling a minimum of £15bn.

In his annual Mansion House speech on Thursday, chancellor Rishi Sunak re-upped the UK’s plans to require companies, pensions and investment products to make sustainability disclosures. The Treasury also said it would introduce sustainability disclosure requirements that would bring together and streamline existing climate reporting requirements before the UN COP26 summit in Glasgow in November.

But as Boris Johnson’s government promotes its green aspirations, it is facing fury from environmentalists over North Sea oil projects. The Guardian has reported that environmentalists uncovered a loophole that will allow more than 1bn barrels of oil to avoid climate compatibility checks. The government had previously said it would allow oil drillers to keep exploring in the North Sea as long as they pass the climate compatibility test. (Patrick Temple-West)

Global securities regulators set up scrutiny of ESG

Last year, the International Organization of Securities Commissions (Iosco) announced that it would analyse the ESG investing space to determine where disclosures could be harmonised and where investors might be misled.

On Wednesday, Iosco, the global umbrella body for securities regulators, published its recommendations for the ESG asset management sector.

As assets under management in ESG funds have boomed, concerns have emerged “about the consistency and comparability of sustainability-related information and greenwashingâ€, said Ashley Alder, head of Hong Kong’s securities regulator and Iosco’s chair. “This report sets out Iosco’s view of the regulatory and supervisory expectations needed to support asset managers in addressing these challenges,†he added.

Iosco recommended securities regulators step up oversight of the sustainable investing market. Enforcement tools can help prevent greenwashing, and as a starting point, securities regulators should look at the rules they have on the books already to pursue potential wrongdoing. For example, marketing materials and website disclosures must be consistent with regulatory documents, Iosco said.

The report noted that the US Securities and Exchange Commission this year formed a team in its enforcement division to hunt for ESG misconduct. In Europe, the Danish Financial Supervisory Authority has set up a team dedicated to sustainability issues.

“ESG sells, [and] greenwashing, whether intentional or not, can be seen as a way to piggyback this growing trend and attract more investors who have an interest in environmental and climate issues,†said Hortense Bioy, global director of sustainability research at Morningstar. (Patrick Temple-West)

Gen Z isn’t ready to pay up for sustainable fashion

Adding a $7 dress to her digital basket, my friend shifted a glance my way saying, that if it doesn’t fit, the loss is “practically negligibleâ€, noting she could always opt to resell or donate it.

Shein, the fast-fashion retailer known for its rock-bottom prices, has rapidly garnered the attention of Gen Z shoppers. In May, the ecommerce site overtook Amazon as the most downloaded app in the US and is estimated to be valued at $15bn, according to Pitchbook.

Shein’s popularity stands in contradiction to polls that tout young adults as being sustainably minded in their purchasing decisions.

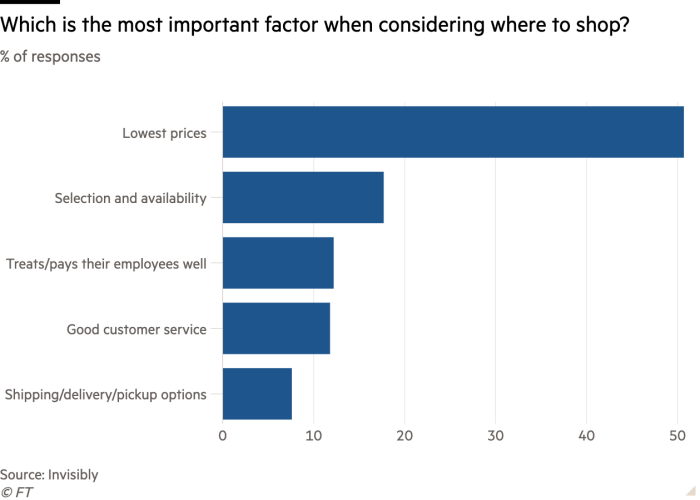

“Price and availability are still the leading driving factors for most purchase decisions,†Don Vaughn, head of product at Invisibly, a personal data company, told Moral Money.

Good On You, an ethical and sustainable brand rating site, ranks Shein as “very poorâ€, its lowest score. Despite trademark disputes and low sustainability ratings, investors have flocked towards the Chinese company.

To assume that Gen Z consumers are dramatically different consumers than their elders may be naive, even if they’re willing to answer a questionnaire claiming otherwise. (Kristen Talman)

Can corporate spin-offs accelerate a low-carbon future?

Heavy industry has had a long-time relationship with carbon, but a break-up might leave both sides better off.

Russian aluminium giant Rusal is planning to spin off a handful of old smelters, refineries and mines to focus on carbon-lite production methods.

The split appears to be more than just a fee-generating furniture rearrangement by investment bankers. Recent comments from Rusal America’s chief executive caught our eye as a major indication that clean commodity production is being driven by consumer demand.

Speaking to S&P Global Platts last month, Rusal America chief Brian Hesse said the home improvement company Lowe’s had started asking for the carbon content in ladders. It is striking that consumers appear to care about the sustainability of simple products such as ladders — especially considering the popularity of fast-fashion retailers such as Shein, as Kristen touched on above.

In June, South African energy company Anglo American mimicked Rusal’s spin-off with a float of its coal business Thungela Resources. It was seen as a test of investor appetite for the high-polluting resource.

While Rusal and Anglo spun off dirty assets, other companies are looking to spin off renewables businesses into the hot, hot market for clean energy.

Italian energy company Eni is looking to sell its renewable power business either in a public offering or in a minority stake. The spin-off makes sense as government net-zero commitments are driving investors to seek new green opportunities.

“Further decarbonisation of heating, transport and industrial sectors — driven by economy-wide net-zero carbon targets set by both national governments and corporations — offer a significant upside potential to the growth of renewables,†according to IHS Markit. (Patrick Temple-West)

Chart of the day

With a review of the EU’s climate legislation scheduled for later this month, ministers from countries including Finland, Estonia and Sweden asked for “all forms†of bioenergy currently labelled as renewable to also qualify as sustainable investments. It was a none too subtle reminder that if the status of biomass is changed it may be almost impossible for the EU to meet its target for renewables to provide a third of all energy usage across the region by 2030. Please read Camilla Hodgson’s big read on biomass here.

Smart read

-

The shipping industry, which contributes close to 3 per cent of global emissions, is in for a decarbonisation awakening, the FT’s Peggy Hollinger writes. Previously exempt from the Kyoto protocol 25 years ago, the EU is planning to layout guidelines for the maritime industry in the carbon cap and trade system (EU-ETS) in two weeks’ time.

Further reading

-

Insurance industry feels the heat on cover for fossil fuels (FT)

-

BlackRock, State Street Defend ESG Policy After Republican Slam (Bloomberg)

-

Credit Suisse CEO says sustainable investing no longer means lower returns (CNBC)

-

Firms Scrub Dirty Bonds Off Books in Quest for ESG Credentials (Bloomberg)

-

Regulators to tighten scrutiny of asset managers to stop ‘greenwashing’ (Reuters)

[ad_2]

Source link