[ad_1]

This article is an on-site version of our #techFT newsletter. Sign up here to get the complete newsletter sent straight to your inbox every weekday

There was finally some good news for the auto industry today, with the world’s largest contract chipmaker saying the semiconductor shortage disrupting car production should ease in the current quarter.

Taiwan’s TSMC increased its output of microcontroller units, an important component in car electronics, by 30 per cent in the first half and MCU production is expected to be 60 per cent higher for the full year, compared to 2020.

“By taking such actions, we expect the shortage to be greatly reduced for TSMC customers starting this quarter,†said CC Wei, TSMC’s chief executive, as it predicted revenues would rise around 22 per cent in the current quarter.

JPMorgan analysts estimate production cuts by global carmakers related to the chip shortage would fall to 399,000 vehicles in the third quarter compared with 1.9m during the second quarter.

New-car shortages have pushed up prices in the second-hand market, where new ventures focused on selling used cars online have struck deals to raise almost $6bn so far this year, reports Tim Bradshaw.

Companies across Europe, Latin America and Asia are looking to replicate the success of Arizona-based trailblazer Carvana, which was founded in 2012 and is now worth more than $50bn.

Lex says TSMC’s margins are being affected by its big spending plans to increase capacity, but that could be good news for Japan, with its CEO revealing it was going through “due diligence†to build a fabrication plant there. This was timely, with former economy minister Akira Amari telling us that Japan risks falling irrevocably behind on semiconductor technology.

The Internet of (Five) Things

1. Kazakh bitcoin mining surge

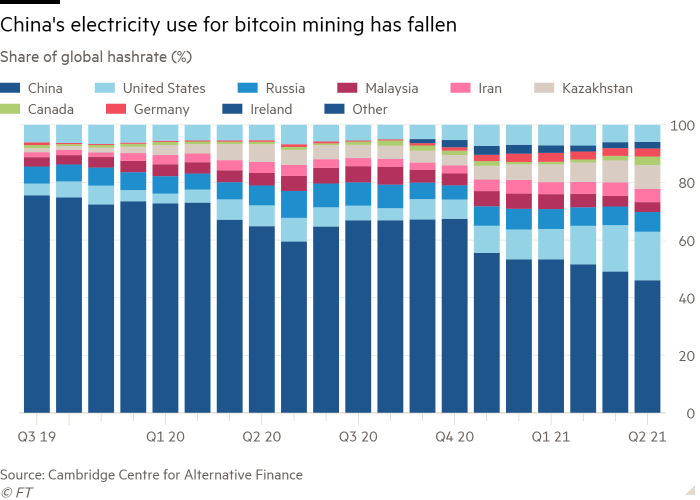

China’s share of global electricity usage for bitcoin mining fell to under half for the first time this April, while Kazakhstan has been catapulted to third place as its share of mining increased sixfold. Today’s Big Read looks at the world’s largest stablecoin tether and the former plastic surgeon who is now the CFO behind it.

2. Netflix gaming move

Netflix is accelerating its move into video games with the hiring of a 30-year veteran of the gaming industry, in its first significant expansion beyond TV and movies. Mike Verdu will join Netflix from Facebook, where he oversaw gaming on its Oculus virtual reality headsets.

Daily newsletter

#techFT brings you news, comment and analysis on the big companies, technologies and issues shaping this fastest moving of sectors from specialists based around the world. Click here to get #techFT in your inbox.

3. Revolut’s valuation revolutionised

Revolut, the London-based digital banking start-up, has raised $800m in a funding round that makes it the UK’s most valuable private tech company of all time. The deal, led by SoftBank’s Vision Fund 2 and Tiger Global Management, values the six-year-old company at $33bn (£23.9bn), six times more than at its last fundraising in early 2020. Lex says Revolut’s recent success has come from offering cryptocurrency services.

4. NortonLifeLock scans Avast for merger

Prague-based antivirus software provider Avast says it is in “advanced discussions†about a merger with NortonLifeLock. Avast floated in London in 2018 in one of the UK’s biggest tech listings at the time. The move by NortonLifeLock, formerly called Symantec, sent Avast shares 15 per cent higher, valuing the group at almost $9bn. Lex says a deal at that premium is unimpressive.Â

5. Darktrace ups revenue forecasts

Cyber security company Darktrace has upgraded its revenue growth expectations, in its first trading update since its UK float in April. The Cambridge-based company, which uses artificial intelligence to detect network break-ins, said it expects revenues to rise between 29 and 32 per cent for the full year. In other cybersec news, Lex says China’s cyber security industry has been given a golden opportunity by the Beijing authorities, and Facebook says it has blocked a “sophisticated†online cyber espionage campaign conducted by Iranian hackers.

Forwarded from Sifted — the European start-up week

Europe’s top digital banks are struggling to take off in the US, blocked by stiff competition from homegrown counterparts, according to new data.

Download rankings for the first half of this year show local US digital banking apps dominating the top 10 leaderboard. The only contender from Europe was Germany’s N26, polling in 10th place. In other fintech news, Klarna this week acquired ‘social shopping’ start-up Hero in a sign of the company’s ambitions to be more than just a buy-now-pay-later lender.

Elsewhere in European start-ups, French start-up Gourmey is now growing ethical foie gras in a lab in Paris while Sifted looks at Europe’s top health-tech start-ups to watch this year.

Tech tools — Twitter’s fleeting Fleets

Fleets, the Twitter feature that allows posts to disappear after 24 hours, is doing its own disappearing act. Only introduced last November, The Verge reports Fleets will be removed from August 3 as the Snapchat-like feature was little used. “We haven’t seen an increase in the number of new people joining the conversation with Fleets like we hoped,†said Twitter.

If you happen to be nostalgic about all the gadgets that have failed to capture the public’s imagination, check out deadstartuptoys.com, which sells limited-edition toy versions of unsuccessful products created by iconic failed start-ups, including Theranos, Juicero and Jibo.

[ad_2]

Source link