[ad_1]

This article is an on-site version of our Unhedged newsletter. Sign up here to get the newsletter sent straight to your inbox every weekday

Good morning. Commenting on a single day’s market action exposes finance writers to professional risk. Markets go down sometimes, and the most fun thing one can write in the wake of those days is that EVERYTHING IS DIFFERENT NOW or, in the case of congenital pessimists like myself, AT LAST, ALL MY BIASES HAVE BEEN CONFIRMED. But the boring fact is that if the sun rises this morning on calm markets, I won’t be surprised. Still, Monday was ugly, and some features of the day are deserving of comment. Email me: robert.armstrong@ft.com

Everything sells off

What I thought was remarkable about Mr Market’s very bad day yesterday was that it replicated some market patterns we have seen in recent weeks — in particular, falling yields in the bond market and growth/tech outperforming cyclical/value stocks — but in a harsher form. Yields didn’t drift down, they plummeted. The techy Nasdaq Composite index outperformed the cyclical Russell 2000, but was itself down more than 1 per cent.

Here’s a rundown:

-

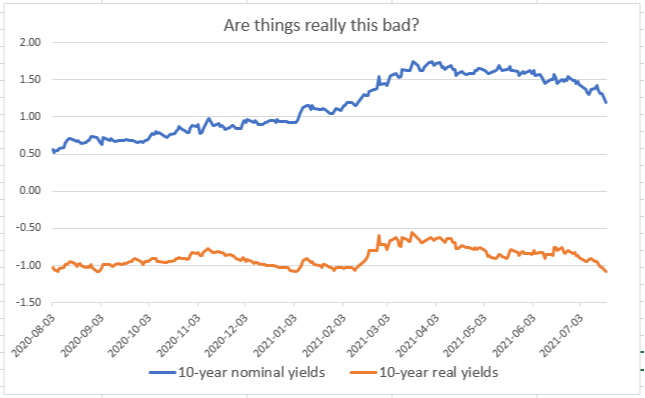

10-year yields fell a whole lot. A 12 basis point decline, the biggest move down in many months. The move was driven by both falling inflation expectations and falling real yields. Amazingly, the latter are now below the levels of last summer. Can this be an accurate expression of rational growth expectations — after kazillions on monetary and fiscal stimulus, and the introduction of highly effective vaccines?

-

In stock markets, the fall was very widespread. Only 60 members of the S&P 500 were up on the day. The leader was the supermarkets operator Kroger. Among the big losers: energy, retail, office and retail real estate investment trusts, airlines, cruise lines and the most rate-sensitive banks. This looked a lot like a general flight from risk with a strong Covid-ain’t-over overlay.

-

Big Tech was only a relative safe haven. Over recent months, Big Tech has pretty reliably outperformed when yields and growth hopes have sagged. Here is the performance six companies I consider the “true†Faangs (Facebook, Apple, Alphabet, Netflix, Google owner Alphabet and Microsoft) relative to the other 494 companies in the S&P 500, plotted against inverted 10-year yields:

Today, however, the consolations of technology were modest. The average decline of the big six was 1.4 per cent, just a hair ahead of the broad market.

-

The decline comes against the backdrop of very positive market sentiment. The crucial thing to keep in mind after a disappointing day was the market was extremely well set-up for disappointment. Sentiment remains very high. Strategas Research points out, for example, that the ratio of puts to calls has not been lower since the technology bubble:

What is more, analysts been busy revising up their estimates for earnings as companies share lots of good news:

Here is Citi’s panic/euphoria model, which wraps in everything from short interest to margin debt to survey data. It has fallen some, but is still well at the euphoric end of the spectrum:

Now, there are two ways to read the combination of high sentiment, markets at or near all-time highs, and falling growth expectations. One way is optimistic. We may have to trim our growth hopes a bit, but the outlook is still strong relative to history (this is the “first derivative†view). The second interpretation holds that bull markets end not when the future suddenly looks dark, but rather when the future looks just the teensiest bit less bright than it did the day before (this is the “second derivative†view). I’ll let you choose for yourself.

If vaccinations don’t accelerate, the bad news will

Whichever view you take, there is no longer much debating over the source of the diminished hopes for economic growth. It is about the Covid-19 Delta variant, which has cases rising fast even in the relatively well-vaccinated US. In the context of the US, however, the Delta variant alone is not the frightening thing; it is the combination of the variant and unvaccinated populations that is so terribly alarming, given the wide availability of vaccines.

Without wanting to play epidemiologist, what I want to know is simple: at the current rate of vaccinations, when is it realistic to expect that a powerful majority of Americans will be fully vaccinated? Will we ever get there?

I know there is big variation among states, so I took figures from Our World In Data about the 20 biggest states (by economic output), which represent almost 80 per cent of the US economy. Specifically, I looked at how many additional people had reached fully-vaccinated status in each state over the most recent 30 days.

I compared that figure with the number of unvaccinated people remaining in each state, to get a first-cut estimate of how many months, at the current rate of vaccination, it would take to get 80 per cent of each state vaccinated (the 80 per cent figure is not some magical herd immunity figure. I simply think you cannot get more than eight in 10 Americans to do anything).

Here is what I found. It’s a little complicated but bear with me:

Column G shows how long, in months, it will take each state to reach an 80 per cent full vaccination level, if they keep vaccinating the same number of people they did in the month that just ended. For the states as a group, it will take nine months. That’s not a model, but it’s a crude first guess.

But here is the sting in the tail: I also looked at the number of people the states vaccinated in the month that ended one month ago, and those numbers were way higher. That is to say, the new vaccination rate is falling really fast — by 50 per cent in the past 30 days compared to the 30 days before that. Unless something changes, we are a lot longer than nine months away from home free.

Now, all of this is very rough and simple-minded, a finance hack’s attempt to contextualise the some numbers. But it looks to me as if US vaccination is not just stalled but collapsing, and if that is true, it seems to me that markets can look forward to a steady diet of fairly nasty news for the rest of the year.

Am I missing something? Am I misreading the numbers? Any epidemiologists out there?

One good read

On the Fed Guy blog, Joseph Wang has a nice accounting explanation of how the Federal Reserve’s reverse repo operations work, an important topic when liquidity is on everyone’s mind.

[ad_2]

Source link