[ad_1]

One thing to start: The US and Germany yesterday struck a deal to resolve their long running dispute over the Nord Stream 2 pipeline. It did not go down well in Ukraine.

Europe is where today’s newsletter kicks off, as the EU redoubles its push to slash emissions. Our first item is a guest column from Christian Zinglersen, director of the EU Agency for the Cooperation of Energy Regulators (ACER), who argues the integration of European energy markets will be critical to the bloc’s transition efforts.

And as earnings season cranks into gear, our second item lays out the key areas to watch as US oil and gas companies report: will surging crude profits ease green pressure, and can the shale patch’s newfound discipline hold?

Elsewhere, we chart the Olympic Games’ poor track record on sustainability and a new report suggests the climate commitments of many US energy companies are more bark than bite.

And we kick off a new Energy Source video series with a look at Joe Biden’s plans for an American net zero revolution.

As ever, thanks for reading.

This article is an on-site version of our Energy Source newsletter. Sign up here to get the newsletter sent straight to your inbox every Tuesday and Thursday

The unsung hero of Europe’s energy transition

This January, Europe’s energy grid split in two, risking power outages across the continent.

Six months later — just as Brussels lays out sweeping plans to clamp down on greenhouse gas emissions — an investigative report into that “power system separation†reveals a crucial lesson for the continent’s energy transition: as the bloc intensifies its efforts to go green, energy market integration will be key.

The January 8 electricity system separation in Europe was significant, having the potential to create serious damage, had it not been managed.

The facts about what happened during the incident reveal something fundamental about Europe’s energy market integration efforts: an ambitious energy transition trajectory, underpinned by the ‘Fit-for-55’ package, (policies adopted last week to slash emissions by at least 55 per cent by 2030), is likely to rely on further integration of energy markets across Europe, not less, making energy market integration the unsung hero of Europe’s transition efforts.

What happened on January 8?

Europe’s power grid split in two, with the trigger originating from a substation in Croatia. Subsequent contributing factors led to a cascade of tripped power lines from the Romania-Ukraine border down to the Adriatic Sea within 20 seconds.

To mitigate this, fast and co-ordinated activation of stabilising measures across countries meant the situation was automatically steadied and then further helped by manual measures to bring the grid back to the frequency necessary for system stability. In total, the split lasted approximately an hour.

Such events are rare in Europe, but if they occur EU rules require an investigation. The Expert Panel’s final report, just released, identifies the causes and consequences, and makes more than 20 recommendations for grid operators, showing where there is room for further improvement.

The value of ‘being in it together’

The January incident took place within a European energy market that has never been more interconnected and interdependent.

Energy interdependency brings benefits. Put simply, meeting different energy needs across the EU member states in a co-ordinated way maintains security of supply at a lower cost.

Climate Capital

Where climate change meets business, markets and politics. Explore the FT’s coverage here.

Are you curious about the FT’s environmental sustainability commitments? Find out more about our science-based targets here

This will likely prove even more prevalent going forward. As underlined by the ‘Fit-for-55’ package, Europe needs to scale up renewables and rely on electrification pathways to decarbonise significant parts of the economy. Hence, the importance of a vastly integrated power grid across Europe operated efficiently and securely.

Looking at the January incident from this perspective provides comfort. It shows that in times of emergency, our integrated energy system can actually help each country cope with sudden changes given the ability to draw on its neighbours’ stabilising measures. This enhances security of supply across Europe.

But, being heavily integrated also exposes one’s grid to risks further away. Hence, the need to back up such interdependence with vigilantly enforced rules and strong oversight.

Dispelling a few myths

Some commentators were quick to pin the blame for the January incident on renewables. The facts now show renewables played no role. Period.

This is not to suggest that as Europe’s power system draws more on intermittent wind and solar and less on large-scale thermal generation, we can sit back. No, we need to update our approaches, be it from sharing balancing resources across countries to the demand patterns of vehicles or buildings becoming more responsive to wider system needs.

Another myth is that self-sufficiency is attractive for countries to maintain secure supply. Here, the ‘Fit-for-55’ package illustrates the challenges ahead. For Europe’s energy transition to succeed, we will need to draw more on the respective energy endowments of member states, facilitated by free-flowing energy trade and backed by interconnections used to their fullest.

The split in January showed that the sharing of resources across countries significantly enhanced security of supply, rather than lowered it.Â

This is another, more political, lesson to draw then. Modern security of supply is something we ensure together — as opposed to leaving it for each to tackle. And precisely because of the extensive system of rules and oversight we have in Europe, not only can we enlist our integrated energy markets to decarbonise our economies, we can also use this model to keep the lights on at a lower cost as we transition.

Christian Zinglersen is director of the EU Agency for the Cooperation of Energy Regulators (ACER)

US earnings season: 3 things to watch

It’s earnings season again, and for American oil executives there is more cause for optimism than there has been in quite a while, especially compared with this time last year when many were still fighting for their companies’ survival.

Oil prices are hovering around $70 a barrel, and look to have stabilised after a sharp drop earlier this week. Oil demand is surging back from pandemic lows. Share prices have rallied on the year, though dropped more recently.

Baker Hughes and Halliburton, two of the largest oilfield services firms, were first out of the gate this week and set a strikingly buoyant tone.

Lorenzo Simonelli, Baker Hughes’ chief executive, expects industry activity to “gain momentum†through the year, saying he does not expect the emergence of the highly contagious Delta variant of the coronavirus to derail the recovery.

Here are three big questions we’ll be tracking for you:

1. Will a surge in crude profits ease mounting green pressure?

Executives, under huge pressure from shareholders, have largely resisted the urge to throw money at new drilling as oil prices have risen, setting themselves up for a bumper quarter.

Investors will want to see those profits turned into “cash in shareholders pocketsâ€, either through dividends or share buybacks, analysts at the energy investment bank Tudor, Pickering & Holt wrote in a note this week. That is key to convincing investors that have abandoned the sector that a new shareholder-focused business model is taking root.

But a surge of crude profits will not wash away the sector’s green problems, another barrier to winning back the market. Oil companies will remain under pressure to do more to tackle methane pollution, reduce carbon emissions and find other ways to significantly improve their environmental performance, with an eye on a net-zero future.

2. Eyes turn to 2022: can shale’s restraint hold?

Nobody seems completely convinced yet by the sector’s newfound spending restraint, with many still worried growth-minded executives will open up the taps again next year if prices stay high.

Analysts at Credit Suisse, a bank, say investors will be keenly focused on gauging the sector’s “propensity to resume growth (and at what level) next yearâ€.

Consensus is that companies will signal oil output growth in the mid-single digits — far below the 15 per cent to 20 per cent seen during the boom years — but will not yet lay out specific plans.

We’ll be watching to see if companies hold the line — or if any step out to test the market’s appetite for higher growth given a relatively rosy crude price and demand outlook.

3. More deals in the pipeline?

Dealmaking in the shale patch has been brisk, with $85bn in mergers and acquisitions having been done over the past year as the sector is reshaped by the pandemic and new demands from shareholders.

The transformation is not done yet.

“We expect consolidation and a heightened rate of asset level [mergers and acquisitions] to continue,†analysts at Morgan Stanley said in a note this week. The bank says it expects bigger public companies to turn their acquisitive attention to the smaller private producers, often private-equity backed or family-owned, that still hold large swaths of the shale patch.

(Justin Jacobs)

Video: President Biden’s net zero revolution

Data Drill

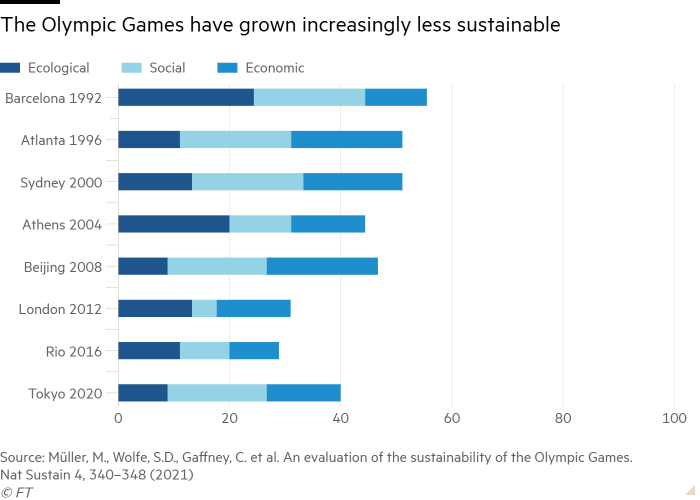

Tomorrow marks the kick-off of the highly anticipated Tokyo Olympics. Environmental advocates are concerned about the event’s sustainability.

A recent report in Nature found that the Games’ sustainability has declined over recent decades, with no recent summer Olympics more sustainable than Barcelona in 1992.

The report looked into the ecological, social and economic sustainability of the past 16 games, including factors like event size, public approval, and financial exposure in their evaluation and assigned each games a score.

The deterioration in sustainability comes despite the International Olympic Committee’s efforts to reduce the event’s environmental impact. Tokyo 2020 medals are made from donated electronics, the podiums are recycled plastic, and 65 per cent of waste will be reused or recycled. The games have also pledged net-zero carbon emissions and launched a carbon offsetting programme.

(Amanda Chu)

Power Points

-

Gabon is pricing its natural capital to become Africa’s green superpower

-

John Kerry pressures China to reduce emissions

-

What will scorching weather mean for the Olympics? (Forbes)Â

-

How voting restrictions hurt the climate agenda (Politico)

-

Opinion: Joe Manchin is holding back the Democrat agenda on climate change. He also invests millions in fossil fuels. (The Guardian)

Endnote

Energy companies have become increasingly vocal about their climate commitments. But in many cases, this is being undermined by their political activities.

A recent Ceres report found that 92 per cent of S&P 100 companies plan to set emission targets, and nearly all energy and utility companies on the index recognise climate change as a risk in their financial filings.

When it comes to political action, company intentions are less clear. While most of the S&P 100 energy and utility companies have made statements supporting the need for ambitious climate policies, nearly all have lobbied against them in Congress.

Energy Source is a twice-weekly energy newsletter from the Financial Times. It is written and edited by Derek Brower, Myles McCormick, Justin Jacobs and Emily Goldberg.

Recommended newsletters for you

Moral Money — Our unmissable newsletter on socially responsible business, sustainable finance and more. Sign up here

Trade Secrets — A must-read on the changing face of international trade and globalisation. Sign up here

[ad_2]

Source link