[ad_1]

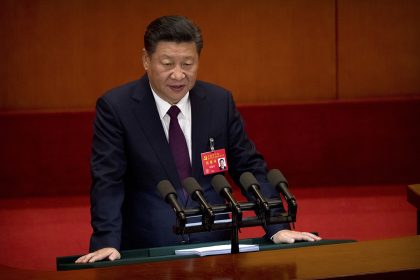

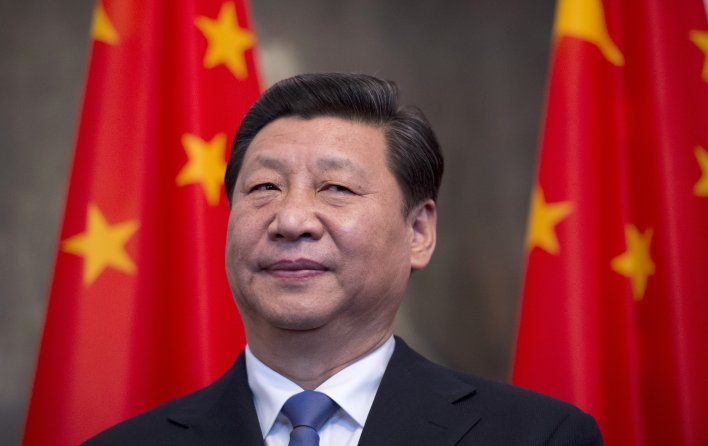

Jack Ma, as everyone knows, has had a serious falling-out with Chinese President Xi Jinping’s government. But global investors still can’t get enough of the billionaire founder of Alibaba Group Holdings.

Last week, Ma’s e-commerce juggernaut turned away more bids for a $5 billion bond sale than it could count. Fixed-income punters placed about $40 billion of orders. The vast majority went away empty-handed.

But the wild demand Ma’s empire garnered tosses a fresh wrinkle into Xi’s gathering campaign to bring tech titans like Ma to heel and to root out monopolistic behavior in the internet space. It suggests investor optimism that Ma’s Alibaba and financial arm Ant Group can navigate Xi’s clampdown and come out the other side whole.

Is that a reasonable bet? The problem, says internet analyst Robin Zhu at AB Bernstein, is that “we don’t know what will happen in terms of regulations.â€

Ma is, for better or worse, the global face of an industry that Xi was championing just a few months back. Not only because the “Amazon of China†is so dominant, but because fintech giant Ant is still angling to pull off history’s biggest-ever initial public offering (IPO).

The $37 billion IPO was supposed to hit markets in early November in what was to be a moment drenched with geopolitical significance.

In 2014, Alibaba had listed in New York, a signal China Inc had arrived. Last year, Ant was set to sell shares in Shanghai and Hong Kong, a signal that China’s markets had arrived.

But the listing got shelved and the disruptions from delaying Ant’s IPO continue to make headlines globally. One loser is Shanghai’s fledgling STAR Market, which had positioned Ant as its core attraction for luring other mainland tech unicorns to list there.

Xi’s regulators were reportedly miffed about Ma’s October 24 speech in which he called Beijing regulators too conservative and mainland banks “pawnshops.â€

Yet, they also welcomed a timeout to see wherever Ma’s ambitions were creating a titanically large entity that might be, depending on your disposition, too big to fail or too big to save.

Size, reach and power

In an age when the size, reach and power of tech firms is controversial in other jurisdictions, the Ant story is not one that is exclusive to China.

As Felix Salmon at Washington-based Axios puts it, Ant “is one of the most systemically important financial institutions in the world, and at the moment it’s barely regulated.â€

The trouble, Salmon says, is that “all banks are tech companies, but tech can break. It’s okay if a single computer crashes; it’s not okay if a country’s entire financial system goes down. If a technology company is also a systemically important financial institution, then it needs to be regulated just as assiduously as any other financial services giant.â€

At the moment, Salmon says of Ma, “it appears that he fumbled at the goal line.†But “Ma’s misstep,†he adds, “could ultimately be rewarded if Ant and Chinese regulators come to a meeting of the minds, and restructure the company in a way that ensures post-IPO compliance for decades to come.â€

Bottom line: If the Ant IPO delay helps clarify Ant’s future regulatory regime and the bureaucratic landscape for competitors to come, no long-term damage will have been done.

Done well, China could perhaps avoid the messy antitrust troubles Washington faces with Google, Facebook and Amazon as their monopolies rise and veer toward payments and other financial services, raising systemic risk in the US economy. Facebook, remember, still wants to float its own cybercurrency.

In this sense, Ant will be a tantalizing test case for Xi’s greatest balancing act: cultivating a vibrant innovation scene within the Communist Party-controlled system in which mainland innovators are in many ways trapped. And to ensure disruptors can thrive without putting the broader financial system at risk.

Ma’s big success in global debt markets last week highlights the risks of Xi’s team getting that balance wrong. Demand for Alibaba’s bonds suggests confidence that Ma’s corporate universe can deftly navigate Beijing’s antitrust inquisition.

That marked Hangzhou-based Alibaba’s first foray into global debt circles since a $7 billion sale in 2017. Heady demand allowed Ma’s platform to sell 10-, 20-, 30- and 40-year debt at lower yields than Alibaba had expected.

The deal won broad-based demand from sovereign wealth funds, asset managers across the US and Europe, and pension funds everywhere. And it reminded Xi’s team that investment of the kind flocking to Alibaba benefits the bigger goals of Chinese tech dominance, yuan internationalization and the global soft power Beijing craves.

In many ways, Ma’s market timing was impeccable. With central banks from Washington to Tokyo holding interest rates near or below zero, investors are hungry for higher yields.

Since Covid-19 hit 13 months ago, governments and companies alike have been selling longer-term debt at historically low yields. The 30-year debt Alibaba sold, for example, carries a 3.15% coupon, an attractive one given Alibaba’s broader performance.

Alibaba recently reported a 37% jump in revenue in the three months ended in December. Such growth amid a pandemic, coupled with improving top-line Chinese growth, explains why Alibaba’s bonds were rated a healthy “A1 stable†by Moody’s Investors Service and “A+ stable†by S&P Global.

For Ma, this is all a timely vote of confidence given the extreme uncertainty since November, when he effectively disappeared, and since December 24, when Xi’s antitrust watchdog began probing Ant’s business model and practices.

More recently, Ma – a global superstar and far-and-away China’s best-known businessman – was even dropped from the list of mainland entrepreneurial leaders compiled by state-run Shanghai Securities News. Clearly, a man once toasted as China’s richest is now out of favor.

The opacity thickens

Last week, Ant and Beijing regulators agreed on a plan to recalibrate the mechanics of the globe’s largest fintech operation. Only time will tell if Alibaba and its financial unit are sufficiently disentangled and whether a reimagined Ant will pass muster with watchdogs and investors.

Beijing’s new rules aim to curb monopolistic behavior by clamping down on the sharing of sensitive consumer data, making it harder to form alliances that marginalize smaller rivals, and policing subsidies that impede competition.

It all came with blistering speed. Previous antitrust tweaks took, in many cases, years to finalize. China’s fintech reforms took just three months. But where are the details?

Last week, Ant reportedly agreed to a restructuring plan whereby it becomes a financial holding company.

The scheme, according to media reports, would put businesses from payment processing to tech offerings in the blockchain and food delivery places under one corporate roof to increase oversight and compliance procedures.

There are still more questions than answers, though. Notably: Where’s the boss?

William Huston at California-based Bay Street Capital Holdings speaks for many when he says he invests in Alibaba because it bears Ma’s fingerprints and long-term vision.

And “just because he showed up,†Huston says of Ma, it “doesn’t necessarily explain what is going on.†At the same time, adds analyst Zhang Fushen of Shanghai PD Fortune Asset Management, “Alibaba is not out of the doghouse.â€

At this point, investors need three questions answered, says analyst Michael Araneta of IDC Financial Insights: 1.) how the orbit of subsidiaries under the holding company will be structured, 2.) how flexibly those subsidiaries can operate without flagging regulators anew, and 3.) how Ant can grow its business given any number of new constraints.

Bottom line, Araneta says, this will be “a long path to the ideal†model not just for Ant but for the next wave of “powerhouses in the platform world of technology.â€

This underscores the urgency of reining in tech giants. The haste, though, means this will remain a work in progress.

Reining in grey rhinos

Though Beijing’s Ant challenge is on a different scale, it’s had some experience with unruly national champions before. Case in point: the so-called “grey rhinos†that got in over their heads with global expansion moves.

The reference here is to obvious dangers that are often ignored until they start galloping away from regulators. Beijing’s biggest targets are globally-acquisitive giants like Anbang Insurance Group, Dalian Wanda Group, Fosun Group, HNA Group and Zhejiang Luosen Neili.

Over time, Beijing realized these giant, high-indebted and politically-connected companies serving as the vanguard of China Inc’s expansion were threatening financial stability at home.

HNA became a poster child of the problem. What started as a little-known airline operator morphed into a global colossus, making tens of billions of dollars of overseas acquisitions between 2016 and 2019.

Those debt-finance bets pushed HNA’s tentacles into financial services (Deutsche Bank), tourism (Hilton Hotels), logistics and even former president Donald Trump’s orbit.

In 2017, HNA moved to buy a hedge fund from one-time Trump adviser Anthony Scaramucci. The deal fell through but not before reminding Xi’s party of the tail wagging the dog dynamics these highly-leveraged giants were creating for Beijing.

This quandary will sound familiar to students of South Korea’s family-owned chaebol giants.

By cultivating, nurturing and enabling a handful of ambitious and overreaching monopolies at the center of your economy, anti-competitive behavior and financial risks can quickly surge over the heads of your regulators.

Xi’s tightrope

Beijing must tread carefully.

Its Hong Kong clampdown in 2020 did Beijing’s capitalist street cred no favors. For decades, observers thought China would welcome the city’s laissez-faire economic model on the mainland.

Instead, Xi is making “Chinafication†a reality. Fears Hong Kong’s transparency and trusted legal system are disappearing has multinational companies considering relocating to Singapore, Seoul and Taipei.

In many ways, the pressure is on to get the Ant-fintech model right as Xi pushes ahead with his “Greater Bay Area†vision for southern China. Even as investors and global CEOs fret at Hong Kong’s trajectory, they’re intrigued by how the city fits into Xi’s bold vision for a massive “Silicon Valley East.â€

Xi’s plan to group the city and Macau with Shenzhen and eight other municipalities all destined to become economic powers all their own — Guangzhou, Zhuhai, Foshan, Huizhou, Dongguan, Zhongshan, Jiangmen and Zhaoqing — could give Hong Kong new relevance as gateway to overseas capital flows.

The same is true, in a slightly different context, of Ant’s role in Xi’s “Made in China 2025†extravaganza.

Any push to make China the global tech leader is sure to create ever greater demand for fintech services, including the moment when Beijing begins floating a digital currency.

These all mean the stakes surrounding Ant could not be higher. As Ma learned from his October “pawnshop†crack, it’s dangerous to risk trespassing on the turf of China’s state banks.

For one, their political connections have made many party officials fantastically wealthy, a gravy train many in Beijing will protect at all costs.

Another is Xi’s party loves how behemoths like Industrial and Commercial Bank of China, China Construction Bank and Agricultural Bank of China have recently dwarfed Deutsche Bank, JPMorgan Chase and Mitsubishi UFJ Financial Group on the international league tables.

Xi’s inner circle was likely tickled to see Ant’s pre-IPO market capitalization leaving Goldman Sachs in the dust and how investors everywhere were clamoring for a piece of a listing that would turn Wall Street’s head like never before.

As such, Xi’s government would lose face in market circles if Ant doesn’t list in short order.

Ant could indeed pull off its IPO this year. But Xi’s team has to get this right at every turn to stay in the good graces of overseas investors who view Ma’s plight with trepidation.

[ad_2]