[ad_1]

Coupang, South Korea’s largest ecommerce group, revealed it had almost doubled its revenues in the past year, and narrowed its losses, ahead of what is likely to be the largest initial public offering by a foreign company in the US since Alibaba’s debut in 2014.

The online retailer saw its net revenue rise 91 per cent in 2020, to $12bn, and booked a $527m operating loss. It lost $643m in 2019 and more than $1bn in 2018, the filing shows.Â

Coupang is hoping for a market valuation of more than $50bn following its listing on the New York Stock Exchange, said one person briefed on the company’s thinking. SoftBank’s Vision Fund is one of its largest investors, buying a $2bn slice of the company in 2018 at a $9bn valuation, including the invested capital.

The listing would be the latest in a string of high-profile IPOs for companies backed by the Vision Fund, spurring a rebound in the fund’s fortunes following the property group WeWork’s failed public listing.Â

Coupang’s listing would be one of the largest for an international company on US exchanges in recent years. China’s Alibaba reached a market value of more than $230bn after its first day of trading.Â

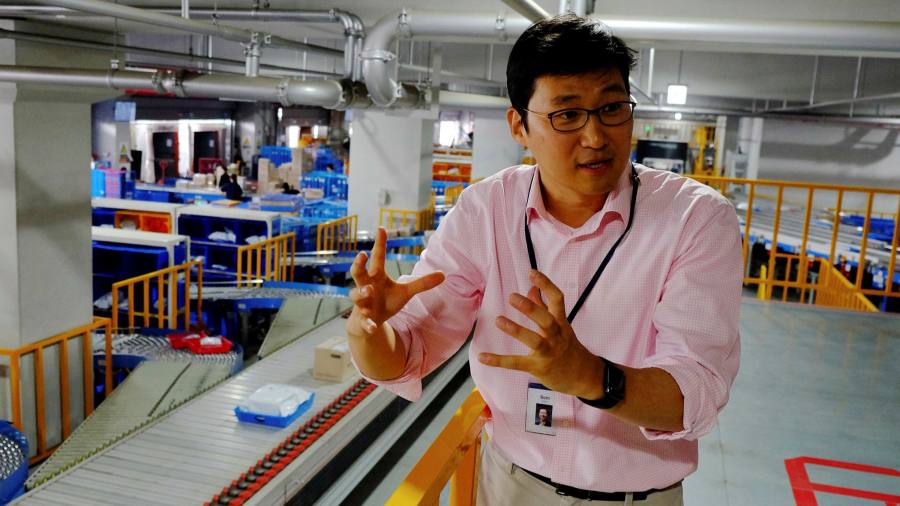

Eleven-year-old Coupang is now South Korea’s dominant online retailer, and has quadrupled its revenues since 2018. It promises one-day delivery on almost all of its products, and can deliver several million of its products within just a few hours.

South Korea is one of the world’s biggest ecommerce markets, but profitability remains elusive in an overcrowded sector. While Coupang is dominant, it faces fierce competition including from Naver, eBay’s Gmarket subsidiary, the messaging app Kakao and from Baemin, the country’s most popular food delivery app, which has recently been bought by Delivery Hero.

In a letter to potential investors, Coupang’s founder Bom Suk Kim wrote that his firm’s mission was to “create a world where customers wonder ‘How did I ever live without Coupang?’â€Â

Kim also noted that his company doubled its workforce in 2020 by adding 25,000 employees, with plans to hire another 50,000 in Korea by 2025.

Following the sharp increase in demands for delivery services during the coronavirus pandemic, concern has been rising from workers’ advocates over the ecommerce sector’s treatment of drivers and warehouse staff.Â

Goldman Sachs, Allen & Company and JPMorgan are serving as lead underwriters on Coupang’s listing.

[ad_2]

Source link