[ad_1]

The writer is Bank of America’s head of global thematic research

The US and China have been at the forefront of the key trends this century: trade wars, technology frontiers, economic growth and beyond. Meanwhile, Europe has spent the past 20 years languishing with inferior progress, relatively unloved by investors.

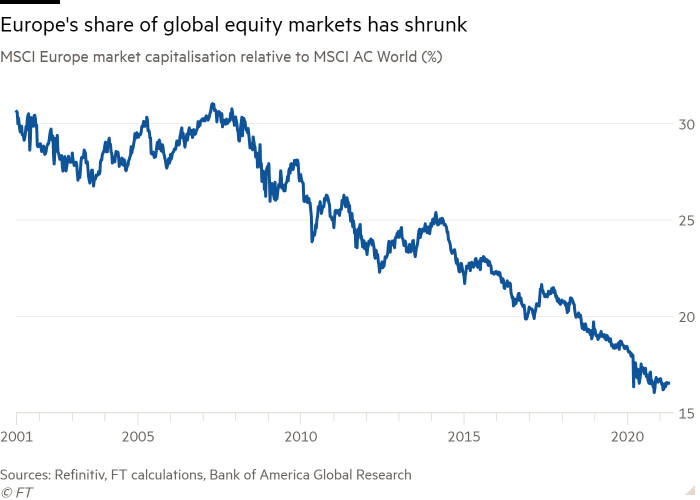

Global gross domestic product has grown 160 per cent over two decades while the continent has suffered lacklustre growth with GDP rising only 90 per cent. Meanwhile, Europe’s share in the value of global equity markets has almost halved over the past 20 years.

Part of this decline has resulted from an overexposure to legacy industries such as tobacco, banks and energy as investors increasingly shifted away from traditional sector allocation. Investors have focused more on technology, thematic investing and issues related to environmental, social and corporate governance.

Looking ahead, three factors will determine whether Europe will once again be relegated to third place behind the US and China: people, technology and climate action.

On the first, Europe’s ageing population will only become more challenging. Europe is the first and only continent to have more over-65s than under-15s and has the lowest global fertility rate at 1.6 children per woman — well below the replacement threshold for developed countries of 2.1.

On the second factor, technology, Europe is not faring much better. Its chronic stagnation has been hindered by under-investment in research and development.

In 2000, the EU invested almost 1.7 per cent of its GDP in technological research and development, while China invested about half of this at 0.9 per cent. Since then, China has almost tripled its investments while the EU’s has increased to only about 2 per cent in 2019.

It will all then hinge on the final factor of climate action. Here, at least, Europe has a clear advantage over the US. However, the renewed US focus by the Biden administration and China’s use of the green agenda to assert economic dominance will pose new tests.

Yet, in the face of these challenges, Europe has undergone a dramatic market transformation over the past five years that we believe has been underestimated by investors. Europe’s legacy industries have dramatically lost market share or transformed and emerged reborn as new industries.

Particularly noticeable has been the fall of the European financial industry. The rise of global payment platforms, regulatory burdens and declining interest rates have all contributed to banks nearly halving their weighting in market indices in five years to just 7.1 per cent of equity markets at the end of 2020.

The move has been so radical that in 2020 just three payment companies, PayPal, Square and Adyen, together had a greater market cap than the entire EU banks sector in the Stoxx 600 index.

Examples of European legacy industries’ diminishing influence are numerous. One is that Cisco’s market cap has overtaken that of the leading telecom service providers in the UK, France, Spain, Italy and Switzerland combined.

In contrast, new areas of future growth and prosperity have emerged in other old industries. Much of this relates to Europe’s leading role in climate action.

In 2020, Europe became the first major economic bloc to adopt targets for net zero carbon emissions and with those goals, funding, companies, technology and regulation have followed. Europe accounts for nearly 70 per cent of all ESG mutual fund assets, already derived 57 per cent of its energy from renewable sources in 2020, and eight of the top 10 clean energy companies by market cap are located in the continent.

The transition is so developed that in 2020 the top five European fossil energy companies’ combined market cap was smaller than the five largest European renewable companies. Regulation will further boost Europe’s presence in this area. Policies on batteries should spur local capacity growth of nearly 30-fold by 2025, while ambitious hydrogen policies are driving the legacy chemicals industry’s transformation as well.

Europe has also seen growth in other areas. Take for, example, Ocado, which now has a market value five times larger than bricks-and-mortar retailer Marks and Spencer, while food delivery start-ups such as Delivery Hero have outgrown in market capitalisation large players, such as Telefónica, in previously dominant industries.

From the land of autos, fossil fuels and tobacco has emerged a new series of high-growth companies and industries defined by tech — specifically healthtech, fintech, foodtech, medtech and, of course, cleantech.

[ad_2]

Source link