[ad_1]

Official statements of corporate values are often a maddening mix of hokum and gibberish. When the Financial Times’ former parent company adopted “efficacy†as one of its top goals, the sceptical newsroom made fun of the decision for days.

A new survey of 525 of the world’s largest public companies by the AMO advisory network confirms that my former bosses are not alone in their enthusiasm for vague principles.

Integrity, innovation, respect, responsibility and sustainability topped the list of popular buzzwords, as stated in annual reports from the past two years. Some companies even opted for joy.

I suspect their popularity lies in the fact that they are extremely hard to measure. Integrity suggests a company plans to stick by its principles without actually specifying what those principles are. Respect and responsibility beg the question of “for who and whatâ€. And defining sustainability has been so fraught that the EU recently passed a new regulation setting up an official classification system.

It’s hard not to wince at some of the more idiosyncratic choices: proximity, proactivity and “legally safeâ€. And the contrast is pretty stark between PepsiCo’s chosen mission to “Create More Smiles†and the workers striking over punishing 12-hour shifts at its Frito-Lay plant in Topeka, Kansas.

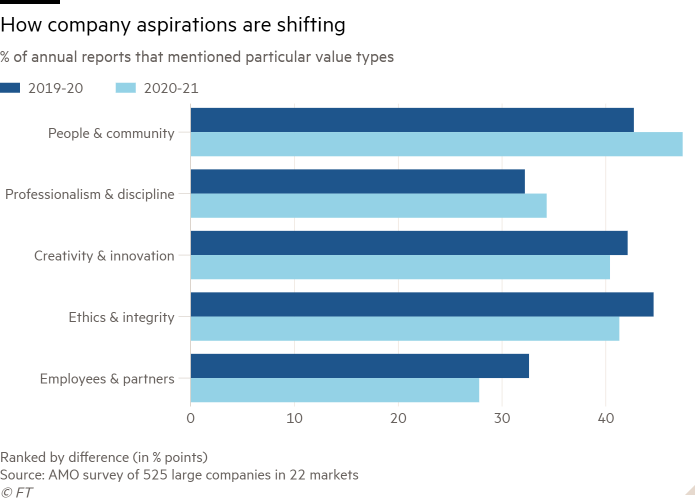

Beyond the buzzwords, the survey reveals that Covid-19 and last summer’s protests over racial inequality have had an impact. AMO sorted roughly 2,300 individual values into categories and found a change in emphasis. “People and community†now tops the list, while “ethics and integrity†and “creativity and innovation†have fallen back.

“We’re rediscovering the meaning of society,†says Charles Fleming, who ran the research. “It’s a shift away from the more specific and self-centred — my company, my employees, my customers — to a more global, aspirational view.â€

Or to be more cynical, that’s what corporate leaders think their customers, employees and investors want to hear. It puts me in mind of the quote usually attributed to Groucho Marx: “Those are my principles, and if you don’t like them . . . well, I have others.â€

Though US companies have recently felt pressure to address discrimination after the Black Lives Matter protests, shifting values were not just an American phenomenon. The AMO survey found that at least one of the top five principles changed ranks in almost every market and sector that it examined. A notable exception was Germany, where the top five values remained unchanged, with responsibility and sustainability on top.

That inconsistency is a problem. “Values are more important if they are consistent over time,†notes André Spicer, a professor of organisational behaviour who is also helping develop a values statement for Cass Business School. “Good values are founded on what the company actually does, what does it reward, what does it punish.â€

Research led by MIT’s Donald Sull last year found virtually no correlation between official values and how well US companies live up to those principles in the eyes of their employees.

However, Amelia Miazad, a University of California, Berkeley, law professor, argues that scepticism over mission statements is misplaced. She has studied stakeholder capitalism for six years and has found that corporate value statements affect behaviour over time.

“They are a first step. When companies make statements, stakeholders and investors hold them accountable for those statements,†she says. Investors may push to tie executive pay to performance on values or, as in the case of Coca-Cola and Delta Air Lines, customers may demand that the companies voice an opinion on voting rights.

This spring, SOC Investment Group, which works with union pension funds, asked 10 US companies to follow up their fine words on diversity with independent audits of their performance on racial equity. BlackRock and Morgan Stanley agreed. The other eight refused, so SOC demanded shareholder votes that won 44 per cent support at Amazon and 40 per cent at JPMorgan, where chief executive Jamie Dimon had dramatically “taken a knee†amid last year’s protests over the killing of George Floyd by police.

“There are going to be real tests for companies,†says Dieter Waizenegger, the group’s executive director. “These words actually have meaning for your customers and shareholders.†SOC plans to demand audits again next year, and it hopes to secure more support from investors like BlackRock.

Just imagine how corporate principles would change if companies knew they had to live up to them.

[ad_2]

Source link