[ad_1]

Cryptocurrency markets swung in chaotic trading and related stocks were hit after Chinese regulators signalled a crackdown on the use of digital coins, which have soared in price this year.

Bitcoin tumbled as much as 30 per cent to a low of $30,101, before clawing back its losses to less than 8 per cent. Other digital coins were also hit by heavy selling, with ethereum, one of the best-performing cryptocurrencies in the past month, losing a quarter of its value before moderating to losses a little over 20 per cent.

More than $8.6bn of positions have been liquidated over the past 24 hours, according to data from bybt.com, a cryptocurrency data provider.

For more markets news sign up to our new email Unhedged.

Coronavirus digest

-

The EU member states have provisionally agreed to allow entry to tourists who have been fully vaccinated against Covid-19.

-

One of Taiwan’s few remaining allies has warned that it may be forced to switch diplomatic allegiance from Taipei to Beijing to gain access to Chinese coronavirus vaccines.

-

Boris Johnson said there was “increasing confidence†that coronavirus vaccines were effective against all variants, including a strain first identified in India.

-

India reported more than 4,500 Covid-19 deaths on Tuesday, the highest known single-day tally of any country during the pandemic.

Follow the latest on our live blog and sign up for our Coronavirus Business Update newsletter.

In the news

Firm founded by son of China’s finance tsar invests in tech A fund founded by the son of China’s vice-premier Liu He has invested heavily in tech companies, including units of leading internet groups Tencent and JD.com. The firm, which has $1.6bn of assets under management, was established in late 2016, according to corporate records seen by the Financial Times.

Fed officials discussed tapering asset purchases Some Federal Reserve officials argued that the US central bank should chart a path towards curtailing some of its vast monetary support to the economy if the recovery accelerates further.

Biden urges Netanyahu to end assault on Gaza In a White House readout from a call on Wednesday morning, Joe Biden told his Israeli counterpart that he “expected a significant de-escalation today on the path to a ceasefireâ€. Hours after Biden’s statement, Benjamin Netanyahu said he was “determined to continue this operation until its aim is metâ€.

SoftBank marks retreat from global solar ambitions The renewables arm of Indian tycoon Gautam Adani’s conglomerate said it planned to acquire SoftBank’s energy unit at a valuation of $3.5bn, marking a significant retreat for Masayoshi Son’s global solar ambitions. Meanwhile, Xinjiang’s solar industry has launched a charm offensive as sanctions loom.

Pelosi urges diplomatic boycott of Beijing Olympic Games Nancy Pelosi, Speaker of the US House of Representatives, has become the highest-ranking American politician to call for a diplomatic boycott of the 2022 Beijing Winter Olympic Games over China’s human rights abuses in Xinjiang.

New York opens criminal investigation into Trump Organization The legal threats to Donald Trump and his business empire have escalated after the New York attorney-general indicated that a long-running investigation of those entities was leading to possible criminal — and not just civil — misconduct.

Silicon Valley veteran warns of ‘very frothy’ markets Sandy Robertson is worried about what’s happening in the markets these days, and that matters. Few people in the financial world have seen more than he has. Best known for helping to start two investment banks that dominated technology underwriting in the 1990s, Robertson told the Financial Times he sees “a lot of junk†among Spacs.

Thank you to those who took our poll yesterday. Sixty-two per cent of respondents said they feel overworked at their job.

The day ahead

New Zealand Budget announcement MÄori housing and child poverty programmes are expected to be in the spotlight at Thursday’s budget announcement. Climate change is also expected to be a priority. (New Zealand Herald)

Japan trade data The country’s exports are expected to have grown more than 30 per cent year-on-year in April, the most in more than a decade, according to a Reuters poll. Trade data figures are set to be announced today. (Reuters)

Over two days the Business of Luxury Summit will host creatives, executives and analysts from across the globe to talk about how they are navigating the impact of Covid-19. Gain critical insight by registering here.

What else we’re reading

Dream of united space will prove elusive Consolidation makes sense in an industry that requires billions in capital investment. But the satellite industry is struggling to become less fragmented ahead of disruption from Elon Musk and Jeff Bezos, writes Peggy Hollinger.

Why the IEA is ‘calling time’ on the fossil fuel industry Just as global governments and corporations are under pressure to tackle climate change, the world’s most influential energy body, too, has had to overhaul itself. The IEA’s bombshell report on how to reach net zero emissions by 2050 marks a drastic turnround since the group’s formation in the early 1970s.Â

Huarong’s woes are a warning to lazy investors Irreverent overseas analysts have dubbed it “Hua-wrongâ€. But the problems besetting China Huarong Asset Management, the country’s largest distressed debt investor, are deadly serious. Beijing may be tempted to shunt all or most losses on to overseas investors, writes Brooke Masters.

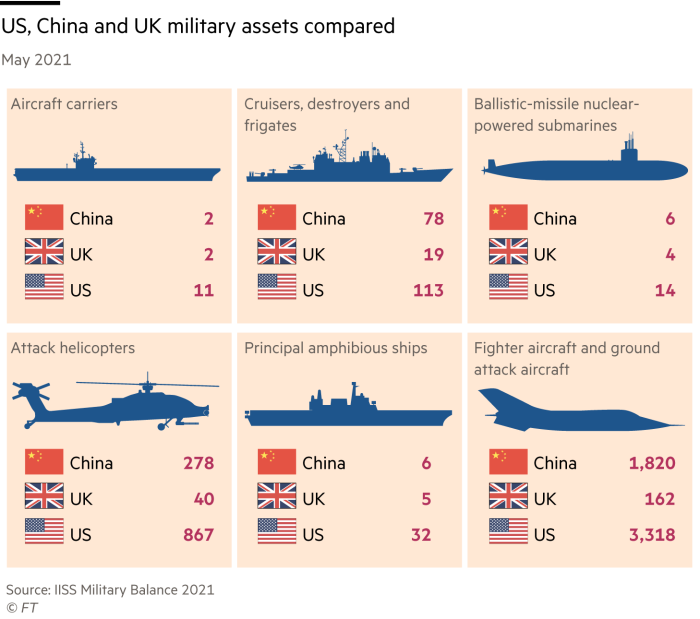

Challenging China: Britain after Brexit In the aftermath of the 2016 referendum, UK ministers talked optimistically about negotiating a trade deal with Beijing. But newly free from Brussels, Downing Street is keen to reinforce political and military ties with the US as Washington girds itself for what analysts have described as a new cold war with Beijing.

US telecoms decide focusing on pipes isn’t so dumb after all AT&T’s chief executive was crowing last month about the success of Godzilla vs Kong at both the box office and in driving audiences to the HBO Max streaming platform, the group’s attempt to challenge Netflix. This week, he sounded more like a traditional telecoms executive after unveiling plans to spin out and merge WarnerMedia.

The 50 greatest food stores in the world Where to find the best produce on the planet, from classic New York delis and Indian spice emporiums to German sausage shops, How To Spend It has a comprehensive guide. As restaurants in countries with declining Covid cases begin to resume normal operations, diners are remembering the random thrill of seeing other people. (FT, NYT)

Video of the day

Tod’s chief executive Diego Della Valle plans for the future The founder and chief executive of Tod’s tells FT editor Roula Khalaf at the Business of Luxury Summit that he would only ever consider a sale of the Italian luxury goods maker to LVMH.

Thank you for reading. Please send your recommendations and feedback to firstft@ft.com

[ad_2]

Source link