[ad_1]

Three years after SoftBank’s Vision Fund became Uber’s largest shareholder, it is finally seeing a handsome return on its investment in the ride-hailing app.Â

In January, the Vision Fund sold just over 17 per cent of its Uber shares for about $2bn, and the rest of its stake is currently worth around $10.5bn, leaving the technology-focused investment fund with a near $5bn profit on paper.Â

The reversal, after long periods of paper losses on its investment, reflects a wider change in the Vision Fund’s fortunes, which will feature prominently as the Japanese technology conglomerate presents its latest results on Monday.

Originally intended to be the first in a string of funds run by SoftBank’s investment arm, the $100bn Saudi Arabia and Abu Dhabi-backed Vision Fund has been one of the most disruptive forces in venture capital and private investing since it launched in 2017.

But its reputation was severely dented by its ‘wild-west’ culture and after some of its high-profile bets, including on office-sharing group WeWork, imploded.

Things got worse last March, as a global markets sell-off disproportionately hurt SoftBank and many of the Vision Fund’s holdings. The fund’s performance helped sink SoftBank to its worst annual loss on record.

But a sharp recovery in investor sentiment towards risky, high-growth technology companies over the past several months has swung parts of the Vision Fund portfolio back into favour. That is especially true for its holdings in sectors such as food delivery, ecommerce, life sciences and online car resale platforms.Â

“The past 12 months have changed the landscape. The world is substantially different to January 2020 and that behaviour change will not go back to normal,†said Rajeev Misra, who runs the Vision Fund, at a Goldman Sachs conference last month. “The pace of disruption has covered three years of ground. Evidence continues to mount that the pandemic has catalysed once-in-a-generation shifts across all demographics.â€

Along with selling down its Uber stake, the Vision Fund exited its position in OSIsoft, the industrial software company that was acquired for $5bn, and returned close to $18bn to its investors by the end of last year, according to Financial Times calculations and people with knowledge of the matter. That is up from the $13.4bn it reported in its previous quarter.

A major SoftBank shareholder said: “The narrative before was that SoftBank had done a bunch of bad investments and all these guys are stabbing each other in the back. They’ve managed to keep a lid on the latter, if it is still going on. And now the perception of the companies they have invested in has changed a lot.â€

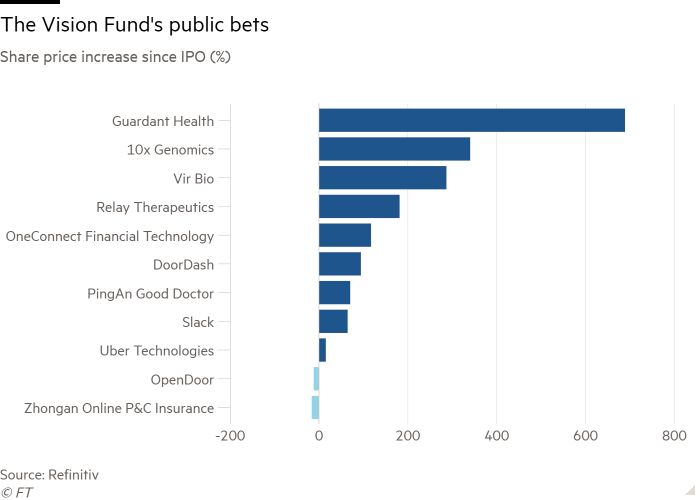

Equally important to the Vision Fund’s recovery has been the vibrant US market for initial public offerings that turned SoftBank’s $680m investment in DoorDash into an $11bn stake after the food delivery group went public in December.

In the same month, Opendoor, an online real estate start-up that has received $450m in backing from the Vision Fund, went public after completing a $4.8bn merger with a blank-cheque company run by former Facebook executive Chamath Palihapitiya.Â

Shares in Auto1, a German online car dealer, were listed on Thursday, reaching a market value of more than €11bn, tripling the value of SoftBank’s 20 per cent stake from €460m in 2018. Its $300m investment in oncology drug developer Relay Therapeutics is now worth $1.4bn following its IPO last summer.

Several other IPOs are around the corner, with South Korean ecommerce group Coupang and the US real estate brokerage Compass aiming to go public in the coming months. The Chinese ride-hailing company Didi Chuxing, one of the fund’s largest bets, is in talks with bankers about a public listing that could come as soon as the second half of this year, according to a person close to the company.

“The bigger picture is, with close to zero interests rates and with the central banks buying assets and the liquidity in the market, the multiples that growth companies have achieved in the public markets have gone through the roof,†said Misra at the conference.

But not all Vision Fund investments have benefited from the recovery. Laggards in the portfolio include struggling investments in Oyo, the Indian hotel rentals group; Katerra, a US construction start-up; and Greensill Capital, a UK-based firm that specialises in supply-chain finance, according to one insider.Â

Silicon Valley start-up founders and investors also remain wary of the Vision Fund and its influence on the market for fast-growing companies. SoftBank’s approach has encouraged competitors to raise larger funds and flood young businesses with large amounts of capital, a strategy that has had mixed success.

The Japanese group also frustrated Silicon Valley insiders after it pulled back from a series of proposed deals as it attempted to raise capital for a second Vision Fund. The sequel fund has still not attracted outside investors and is only investing with SoftBank’s own money.Â

Still, some company founders view SoftBank as one of the few investors willing to place large bets on emerging technologies.

“The only question was whether they were still writing cheques, because founders have continued to want SoftBank to invest in them,†said Roy Bahat, head of Bloomberg Beta, a venture fund backed by the financial data company. “Two founders asked us about SoftBank just last month.â€

Finally, there continues to be turmoil inside the Vision Fund, which has been marked by a steady string of departures among its executives, and which last year laid off 15 per cent of its 500-person staff.Â

The most serious of those departures is the planned exit of Jeff Housenbold, who led SoftBank’s investments in Compass, DoorDash and Opendoor, along with at least one high-profile blunder: the dog-walking app Wag. The Vision Fund was preparing to hire a new partner in the San Francisco area, two people familiar with the plans said.

And even though the Vision Fund is expected to report its best performance next week, investors are far from optimistic. Citigroup analyst Mitsunobu Tsuruo said both investors and SoftBank know that current stock price increases are driven by ultra-low interest rates and excess liquidity in the market. Once the US Federal Reserve starts removing, or “taperingâ€, support by reducing the scale of its asset purchases, markets along with tech shares could go the other way.

“People are aware of what needs to be done when the music stops. SoftBank knows it as well, so that’s why they are doing a massive sale of assets and reducing its debt,†Tsuruo said. “The Vision Fund overcame the March crisis, but the next stress test will come when the tapering begins.â€

Additional reporting by Ryan McMorrow and Christian Shepherd in Beijing

[ad_2]

Source link