[ad_1]

Dear readers,

Big Tech’s billionaire philanthropists face a dilemma. How to dispose of vast fortunes tied up in stock without tanking their company’s valuations?

For Facebook’s Mark Zuckerberg, founder of the world’s biggest social media company, the answer is by donating shares without relinquishing power.

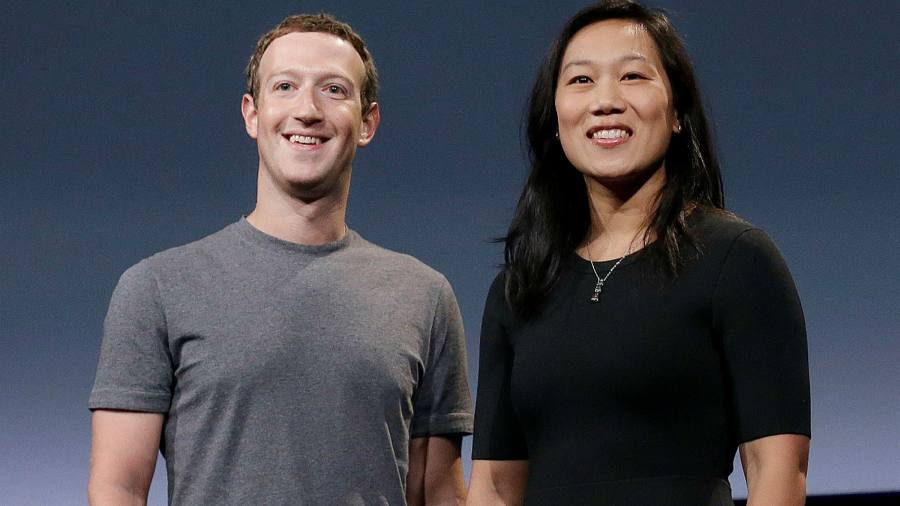

Like Microsoft’s Bill Gates before him, Zuckerberg has made the admirable pledge to give away the majority of his fortune in his lifetime. At the end of 2015, he unexpectedly said he would give away 99 per cent of his Facebook shares — then valued at $45bn — “to further the mission of advancing human potentialâ€. It was a feel-good plan written in a public letter to his baby daughter and drew widespread and justifiable praise. Zuckerberg and his wife, Priscilla Chan, created the Chan Zuckerberg Initiative for their endeavour.Â

Feelgood moments have been in short supply for Facebook and Zuckerberg since then. Still, regulatory filings show that the Facebook chief has kept to his promise. The way he has gone about it, however, is worth examining.

Like Google and Snap, Facebook’s shares come in different classes, with unequal voting power. Zuckerberg and a small group of investors own class B shares, which carry 10 votes per share. Public investors own 1 vote per share class A stock. Remember the shareholder rebellion in 2019? Back then investors called for Zuckerberg to no longer hold both chief executive and chairman positions. That revolt was easily squashed: the only person with the power to fire Zuckerberg was Zuckerberg.

Class B shares convert to class A when sold. But not when donated. As of this week, Zuckerberg held just 5.5m supervoting class B shares out of a total of more than 440m. That looks puny until you realise the Chan Zuckerberg Initiative Foundation holds 1.9m and CZI Holdings holds almost 354m. Zuckerberg is sole trustee of CZI Holdings and has sole voting power over its securities. He has therefore retained majority voting rights for his company.

Over his lifetime, Zuckerberg plans to whittle down these shares via pre-ordered sales. If he wants to keep his voting power, he has to do so carefully. Sales may be automated but they are not consistent. In 2018, Zuckerberg halted sales when the combined force of a market sell-off and the Cambridge Analytica data scandal weighed on Facebook’s share price.

Regular sales restarted this year. You can monitor these yourself here. Happily for Zuckerberg, the huge jump in Facebook’s share price means he can raise large sums with smaller share sales. In late 2015, Facebook shares traded at just over $100 each. They now change hands for $269.Â

How to put these vast sums of money to work? In 2010, Zuckerberg donated $100m to Newark Public Schools in New Jersey — a sum expected to transform their fortunes. Yet the gift apparently became tangled in competing aims, recriminations and bureaucracy, according to Dale Russakoff’s book The Prize: Who’s in Charge of America’s Schools?

Zuckerberg and Chan last year declared that they were donating $400m to civic organizations that support voting infrastructure — a plan that attracted eye-rolling from Facebook critics who think the platform should have done more to prevent the spread of political misinformation.

None of that will deter Zuckerberg and Chan. Philanthropy is a balm for those whose conscience is pricked by their vast wealth. In 2019, a Wall Street Journal reporter called Deepa Seetharaman tweeted Zuckerberg’s weekly Q&A session with employees in which he was asked whether billionaires should exist. His response was to talk about the Chan Zuckerberg Initiative. While Facebook’s market capitalisation keeps rising, Zuckerberg’s share disposal programme will keep expanding.

Enjoy the rest of your week,

Elaine Moore

Deputy head of Lex

[ad_2]

Source link