[ad_1]

Tech stocks have declined for a second day on concerns that rising long-term interest rates could stall the equity rally in high-growth companies.

The technology-focused Nasdaq Composite is down 1.5 per cent currently. On Monday, it had its worst day of the month, falling 2.5 per cent, while Tesla was down more than 8 per cent and Apple 3 per cent. European tech shares also sold off on Tuesday, with the regional Stoxx 600 tech index sliding 1.6 per cent.

Tesla is 3 per cent lower today at $692 and is now down for the year, having started 2021 at $730. Its shares have been mirroring bitcoin movements of late and Elon Musk’s weekend tweet that the cryptocurrency did “seem high†has sent it down below $50,000.

The only Big Tech stock in positive territory today is Facebook, after it reached a settlement with the Australian government to restore news on its platform. Amendments to a proposed law that would have forced it to license news content have given it more flexibility on negotiating deals with media businesses. Lex says other countries including Canada, the UK and the EU that are considering Australia-style laws should take note of what has been achieved.

The Internet of (Five) Things

1. Lucid to go public in biggest Spac merger

California-based electric vehicle start-up Lucid Motors has agreed to go public in a $24bn deal with a blank cheque company controlled by veteran dealmaker Michael Klein, in the largest such reverse merger to date. The deal had been widely rumoured and investor excitement had sent shares in the Spac up almost 500 per cent so far this year — but they fell by more than a quarter in after-hours trading as financial details were revealed on Monday. Lex says the biggest winner is Lucid’s largest current shareholder, Saudi Arabia’s Public Investment Fund.Â

Daily newsletter

#techFT brings you news, comment and analysis on the big companies, technologies and issues shaping this fastest moving of sectors from specialists based around the world. Click here to get #techFT in your inbox.

2. WeWork co-founder set to benefit from Spac deal

WeWork co-founder Adam Neumann could reap almost $500m in cash from his holdings and emerge with a stake in a public company, less than 18 months after the failure of WeWork’s IPO cost him his job as chief executive. SoftBank is in advanced talks with him to try to settle a legal battle in order to clear the path for WeWork to be bought by a special purpose acquisition company and finally achieve a public listing.

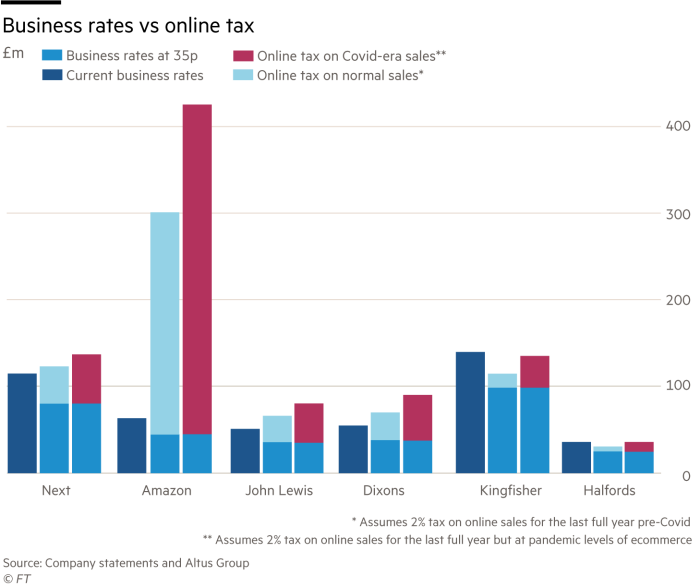

3. Bricks retailers could pay more with clicks tax

Some leading UK high street retailers face potentially higher taxes if the government imposes a charge on online sales to fund a reduction in business rates, Financial Times calculations have shown. Fashion retailer Next, electricals group Dixons Carphone, cycle retailer Halfords and department store chain John Lewis could end up paying more if a tax on ecommerce were implemented.

4. Genomics boss calls for global ‘Bio Force’

The chief executive of the world’s largest genomic sequencing tech company has called for global co-operation to track new virus variants. Francis De Souza, who leads the Californian company Illumina, said governments and companies should create a “global surveillance network†to monitor and share information on the virus, just as many have tried to do with threats from computer viruses.Â

5. Sony PS5 supplies should increase

Sony’s gaming chief Jim Ryan said he expected the continuing PlayStation 5 supply limitations to “ease incrementally throughout 2021†but he refused to guarantee that there would be enough to meet demand by the next holiday sales season. He was speaking as Sony revealed plans to launch a new virtual reality headset to connect to the PS5.

Tech tools — Huawei Mate X2

Huawei’s latest folding phone looks impressive, but may not be seen outside China and still lacks key Google apps and services. Unveiled on Monday, it goes on sale in China this week at a basic price of 18,000 yuan or around $2,785. The Mate X2 follows last year’s XS and the original X in 2019.

The Verge says: “The new phone has received a radical redesign compared to the original device, with a large screen that unfolds from the inside of the device rather than around the outside. For using the phone while folded, the Huawei Mate X2 has a second screen on its outside, similar to Samsung’s approach with the Galaxy Fold series.†Its cameras, with Leica lenses, include four on the rear: a 50-megapixel wide-angle, a 16-megapixel ultrawide, a 12-megapixel telephoto with a 3x optical zoom, and an 8-megapixel “SuperZoom†camera with a 10x optical zoom.

[ad_2]

Source link