[ad_1]

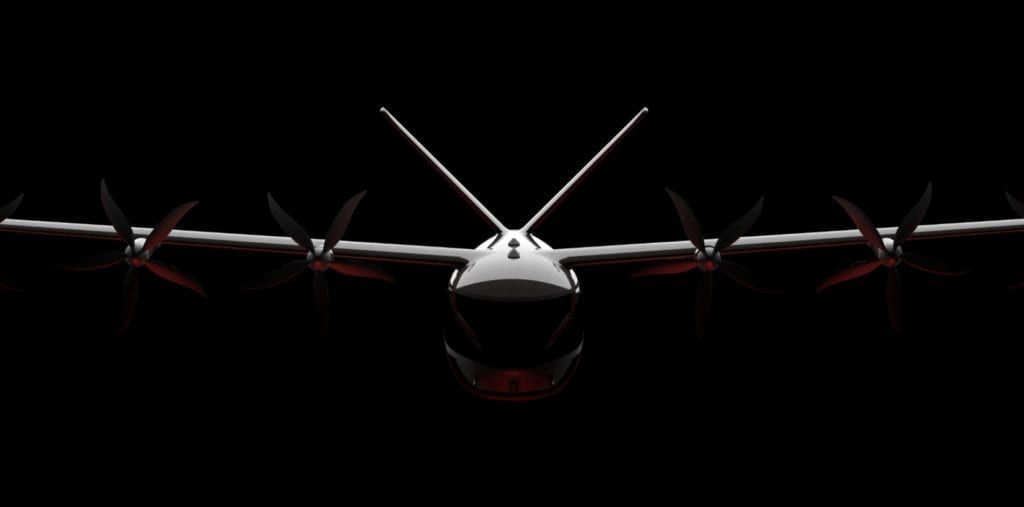

Top range of Archer’s electric plane can fly 60 miles at a speed of 150 mph. Archer

Last year, a record 248 companies went public through reverse mergers with SPACs, or special-purpose acquisition companies, an unconventional way of going public without going through the complex (and expensive) IPO process led by investment banks. The trend shows no sign of slowing down in 2021, either. In January alone, 116 companies went down that path with an average valuation of $3 billion, according to SPAC Data.

The boom continues to be fueled by electric vehicle companies across all subcategories, from battery makers to hydrogen fuel cell truck makers to (unsurprisingly) flying cars. And many of them are pursuing these deals quietly.

On Friday, Bloomberg reported that hydrogen fuel cell startup Hyzon Motors has agreed to go public via a merger with Decarbonization Plus, a private equity-backed SPAC, in a deal that would value Hyzon at $2 billion. Decarbonization Plus raised $226 million in an IPO last October and has been looking for a reverse merger target “whose principal effort is developing and advancing a platform that decarbonizes the most carbon-intensive sectors.â€

Hyzon was spun off from Singapore-based Horizon Fuel Cell Technologies, which develops fuel-cell technology for commercial applications. The startup is headquartered at a former General Motors facility in Honeoye Falls, New York. It says there are already more than 400 commercial vehicles on the road using its fuel cell technology. Hyzon aims to deliver about 5,000 fuel cell-powered trucks and buses by 2023.

On the West Coast, Silicon Valley electric plane startup Archer Aviation is also planning to go public in a multibillion-dollar SPAC deal, people familiar with the transaction told IPO Edge on Friday. It’s unclear yet which SPAC firm Archer is merging with. The deal could be announced as soon as next week as investors finalize terms, the sources said.

Archer Aviation belongs to a special category of EV startups eyeing the promising urban air mobility market, which Morgan Stanley estimates to be worth $1.5 trillion by 2040. The company is building electric vertical-takeoff-and-landing (eVTOL) aircraft at a facility near Palo Alto Airport in California. A prototype with a maximum range of 60 miles at a speed of 150 mph is expected to be unveiled later this year and obtain FAA certification by 2024.

Archer is backed by Jet.com (the e-commerce site) founder Marc Lore and a number of undisclosed investors. Last month, the company entered a partnership with Fiat Chrysler to gain access to the automobile giant’s supply chain infrastructure, advanced composite material technology, and engineering and design expertise.

Hyzon and Archer are the latest examples of early-stage EV companies pursing multibillion-dollar public listings, following the footsteps of Nikola Motors, Lordstown, Los Angeles-based Fisker, Bill Gates-backed QuantumScape and other headline-making SPAC deals.

[ad_2]

Source link