[ad_1]

For all the criticism Brazil has endured over its stewardship of the Amazon, it can still boast of its climate credentials in the field of clean energy.

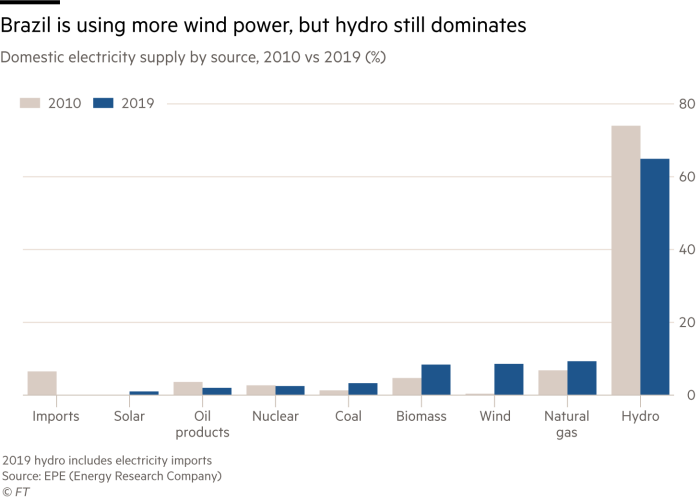

Hydropower has long provided most of the country’s electricity, thanks to the construction of large-scale dams and reservoirs, in particular under the ruling military dictatorship of the 1960s.

And while coal, gas, nuclear and oil play a role in the power generation mix, in addition to burning sugarcane and wood biomass, the past decade has also seen a push to harness the potential of wind and solar energy.

Among those investing is AES Brasil, an arm of US power group AES. The electricity generator, whose shares trade on São Paulo’s B3 stock exchange, is enlarging its 4GW of entirely renewable assets through new-build “greenfield†projects and acquisitions.

Formerly known as AES Tietê, the company recently increased its budget for maintenance, modernisation and expansion to R$2.4bn ($440m) until 2025 and its chief executive sees another R$7bn worth of greenfield opportunities.

“We‌ ‌are‌ ‌in‌ ‌a‌ ‌special‌ ‌moment‌ ‌for‌ ‌the‌ ‌market, ‌ ‌with‌ ‌many‌ ‌changes‌ . . . ‌in‌ ‌the‌ ‌electricity‌ ‌sector,†says Clarissa Sadock, who has spent 16 years at the business and took the reins in December. “Today‌, ‌two-thirds‌ ‌or‌ ‌66‌ ‌per‌ ‌cent‌ ‌of‌ ‌our‌ ‌portfolio‌ ‌is‌ ‌hydro. ‌ ‌Our goal‌ is‌ to diversifyâ€.

As well as balancing out the intermittent availability of many types of renewable energy, the idea is to be able to offer customers a “24/7 renewable product†from sites around the country, she adds.

“There’s a correlation between the different sources,†Sadock notes. “When it rains a lot, there is less wind.â€

Hedging hydro

In addition, experts warn that variations in rainfall due to climate change could affect hydropower plants in future. So, finding alternative forms of generation is considered an important step in securing an electricity system that is reliable as well as sustainable.

Although AES Brasil operates solar farms, its priority for growth is wind projects, which it says offer the most competitive form of energy with the lowest price for customers. Wind power output in Brazil rose more than 20-fold in a decade to account for 9.4 per cent of national electricity production last year, according to statistics website Our World in Data.

Falling equipment prices and favourable weather patterns have made it the country’s cheapest source of electricity, according to Roberto Schaeffer, professor of energy economics at Coppe, Federal University of Rio de Janeiro.

“The size of the wind turbines [has] greatly increased over time, reducing the per MW cost, and probably more importantly there are exceptional wind conditions in the north-east and south of Brazil,†he says.

Founded in the late 1990s to operate a hydroelectric concession that runs until the next decade, AES Brasil was rather late to branch out. “Between 2015-16, there was a change in the company, where strategically it moved from being a hydro cash cow to investing and participating in the growth of renewables in Brazil,†explains Antonio Junqueira, head of Latin America utilities research at financial services company Citi.

Cautious approach

Now, a test of the self-discipline of Brazil’s wind and solar developers is looming as the government looks to cut subsidies. With new projects requiring registration by next March to qualify for support, a rush of applications is expected before the deadline.

“I believe prices over three to five years will come down [due to] an overcapacity build, which is good news for consumers but in another way it might affect the generators,†Junqueira says.

By seeking to obtain power purchase agreements from customers before building new facilities, AES Brasil is taking a cautious approach.

Sadock says it is focusing on the segment of the market where power generators sell directly to industrial users, rather than to the grid, and has interest from commercial customers pursuing green agendas.

Construction work began this year on one of AES Brasil’s flagship projects: the Tucano wind farm in the state of Bahia — a joint venture with a chemicals producer. Together with a second phase that will supply miner Anglo American for 15 years, the complex will have capacity of at least 322MW.

Alongside wind, Brazil has strong prospects for further growth in solar, Schaeffer says. The most promising locations are in the states of Bahia, Minas Gerais, São Paulo and Paraná.

He points out, however, that upgrades will be needed to grid infrastructure that was designed to serve big hydro stations in single locations.

“In order for solar to become more popular in Brazil, it’s not only an issue of cheap plants but also preparing the power system, transmission lines and distribution to deal with this more dispersed character.â€

[ad_2]

Source link