[ad_1]

Matthew Moulding, the UK billionaire and founder of ecommerce group THG, is clear who calls the shots at SoftBank.

“Anyone who knows SoftBank will know that Masa [founder Masayoshi Son] has the final say,†Moulding told reporters on Tuesday, hours after Manchester-based THG announced a $730m investment from the Japanese group.

The investment was one of a series of deals that THG and SoftBank revealed after the London stock market closed on Monday. SoftBank’s $730m injection made it the cornerstone investor in a $1bn capital raise by THG, which went public to considerable fanfare in London last September.

It also marks the first major foray into a London-listed company by SoftBank, the sprawling Japanese investment group that in recent years has become one of the world’s most powerful tech investors. It was dubbed the “Nasdaq whale†last year for its outsized bets on a handful of high-profile technology stocks.

While SoftBank’s billionaire founder Son would have signed off on the investment, Moulding said he negotiated the deal with Akshay Naheta and his team. Naheta runs SB Northstar, a unit of SoftBank that Son set up last year to manage its investments in public equities.

The introduction between THG and SoftBank came via Goldman Sachs, according to one person familiar with the matter.Â

Naheta, who is based in Abu Dhabi, is the architect of some of SoftBank’s most complex and controversial trades, including the Nasdaq whale and one tied to the now disgraced German payments company Wirecard.

A former Deutsche Bank trader, the 39-year-old has forged an expertise in structuring transactions with derivatives at their heart. As the London stock market opened on Tuesday, it was not the $730m investment that was enthusing investors.

Instead, it was an agreement struck between THG and SoftBank that gives the Japanese group the option, but no obligation, to buy a 19.9 per cent stake in a division of the UK ecommerce company called THG Ingenuity.

THG Ingenuity, which provides ecommerce and logistics services for third parties, has been seen by analysts as one of the UK group’s more attractive units, particularly as ever more consumers shop online. Its sales, however, only hit £137m last year.

Under the terms of the unconventional deal, SoftBank would have to spend $1.6bn to acquire the stake in THG Ingenuity, a price tag that values the division at about $6bn.

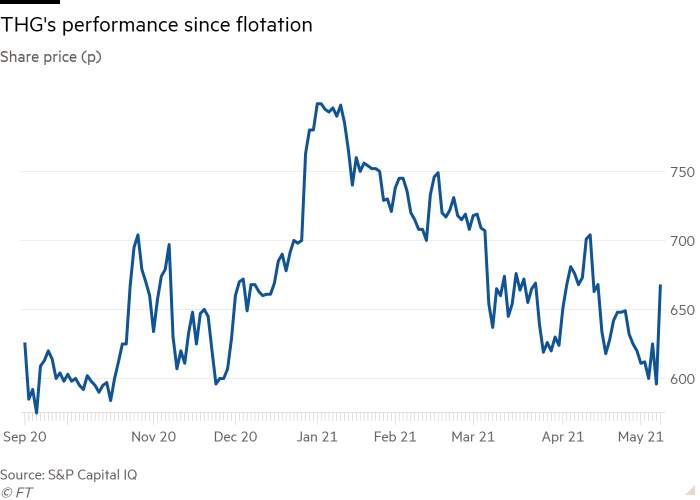

The dizzying multiple attached to Ingenuity, whose customers include Nestlé and UK DIY retailer Homebase, sent THG shares up 13 per cent on Tuesday. They gave up some of those gains early on Wednesday to trade at 639p, giving THG a market capitalisation of £6.2bn.

Wayne Brown, an analyst at Liberum, said the Ingenuity deal not only highlighted “the significant conglomerate discount THG is on, but it leaves huge upside especially when one considers the commercial benefits that will accrue when working with SoftBank’s portfolioâ€.

Not everyone was euphoric. Clive Black at Shore Capital said there was an element of “smoke and mirrors†over the transaction given the lack of detail around the option and the circumstances under which it can be exercised.

Moulding told analysts the deal had been structured as an option because THG Ingenuity is not currently a separate entity ringfenced from the rest of the company. However, he acknowledged that the company had no specific uses in mind for the potential $1.6bn injection from SoftBank, which would dwarf Ingenuity’s recent capital spend of about $100m a year.

Beyond doubt is that the option arrangement helped hand SoftBank an instant gain on its $730m investment, made at 596p a share, on a day when THG stock might have fallen given existing shareholders were being diluted by the $1bn equity raise.

SoftBank and Naheta declined to comment.

While shares in THG, which changed its name from The Hut Group when it floated, remain comfortably above their 500p IPO price, they had sunk 25 per cent from a record high of almost £8 in January.

Naheta is no stranger to London’s capital markets. He was recruited in 2017 by Rajeev Misra, a former Deutsche Bank colleague, for a role at SoftBank Investment Advisers, the London-based unit that manages the group’s $100bn Vision Fund.

Sandwiched between Deutsche Bank and SoftBank, Naheta spent five years managing his own hedge fund in London called Knight Assets. In 2015, the company took an activist stake in New York-listed Bollywood film producer Eros International, which at the time counted Misra as a board member.

His stint at SBIA is arguably best known for a 2019 bet on Wirecard, a trade that helped shore up confidence in the payments group before it collapsed last summer in one of Germany’s largest corporate frauds.

Although it was run out of SBIA, it was later revealed instead of SoftBank making the initial investment, the trade was funded entirely by Abu Dhabi’s sovereign wealth fund Mubadala and a handful of the SoftBank executives, including Misra and Naheta.

Naheta left SBIA last year for an executive role at SoftBank itself, managing a new internal hedge fund called SB Northstar. The fund was briefly the most talked about on Wall Street when the Financial Times revealed it as the Nasdaq whale, which had used outsized options bets to drive a breathless rally in stocks such as Facebook and Amazon.

These trades ended up being largely unprofitable, however, with Northstar booking big losses later that year and eventually exiting them. SB Northstar reported derivative losses of $300m for the first quarter of the year, bringing total losses to $5.6bn since September, SoftBank said on Wednesday.

But in a sign of his growing influence within the company — and emergence from Misra’s shadow — Naheta has also played a major role as SoftBank morphed from a conglomerate that aimed to run the companies it owned into an investment group.

Despite the tech trades, “Akshay’s stock has risen quite a lotâ€, said a person familiar with the matter, adding that he speaks frequently to Son.

SB Northstar itself has since pivoted to buying newly issued equity in public companies, such as the stake it snapped up in Norwegian educational software company Kahoot last October.

Naheta has been involved in UK companies before. He had a key role in structuring the sale of Arm Holdings, the UK chip designer SoftBank acquired in 2016, to US-based Nvidia.

But the deal struck with THG, touted by some as a rare UK ecommerce success, means his first major push into the London market will be watched closely.

[ad_2]

Source link