[ad_1]

This article is an on-site version of our Trade Secrets newsletter. Sign up here to get the newsletter sent straight to your inbox every Monday to Thursday

Hello from Washington, where the cicadas have pretty much gone for another 17 years.

Our main piece today is on trade tensions with Canada, the sources of which might prove even more difficult to resolve than those with Europe over Boeing and Airbus.

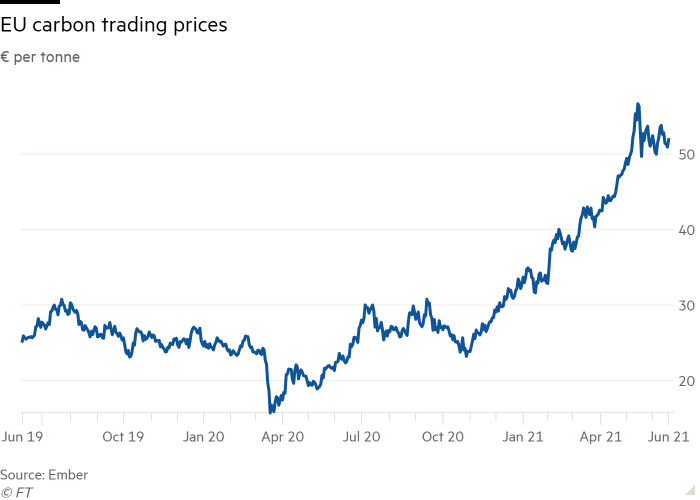

Charted waters, meanwhile, looks at the price of carbon emissions in the EU after shipping industry complaints that changes to the rules that would place a greater share of the burden on them could do more harm than good.

We want to hear from you. Send any thoughts to trade.secrets@ft.com or email me at aime.williams@ft.com

Easing tensions with Canada

Fresh off the plane from Brussels, and having vanquished one of the spectres of the transatlantic trade relationship by ending the tit-for-tat tariffs over Airbus-Boeing, US trade representative Katherine Tai can now focus on matters closer to home. Matters that include growing disgruntlement from Washington’s neighbour just north of the border.

It was widely expected that with Donald Trump and his trusted lieutenants banished to the wilds of Florida, frosty relations between Ottawa and Washington would thaw. To an extent they have. Canadian premier Justin Trudeau took the coveted prize of being the first foreign dignitary to be called on the phone by the newly minted Joe Biden (although this is traditional), and the two are aligned on big ticket issues such as combating climate change (although Biden caused tensions in some quarters by cancelling the permit for the Keystone XL pipeline).

But in the trade sphere all is not well. We’re noticing growing friction, even with the new US-Canada-Mexico trade deal in place. Arguments now range from dairy to softwood lumber, solar panels, digital taxes and the perennially closed border (not strictly a trade issue, but it’s rumbling on).

Last week, Canada requested a panel be formed under the USCMA’s dispute settlement mechanism to address the 18 per cent tariff the US has in place on Canadian solar products. Canadian trade minister Mary Ng said the tariffs, which are Trump-era levies that the Biden administration has not removed, were “unwarranted†and damaged the “global competitiveness of our long-established, secure and deeply integrated supply chainsâ€.

For its part, the US has escalated a complaint over dairy-related tariff rate quotas, also requesting a dispute settlement panel. It says Canada has essentially set aside a part of the quota for processors, making it harder for artisan cheeses and the like to get into Canada with the low, preferential duties agreed as part of the deal.Â

Then there is the growing uneasiness in Washington over Canada’s flirtation with a digital services tax. Despite the progress made in the OECD talks on international taxation, Canadian deputy prime minister Chrystia Freeland is still keen on pressing ahead. Washington has threatened tariffs on other countries that have implemented this via its Section 301 probe process, though progress made in the international tax talks — notably among the G7 countries — has seen the threat held off for now. US trade officials have dodged our questions a couple of times on whether they’re considering launching a Section 301 against Canada, but official readouts show that Tai “expressed concern†about the potential tax in meetings with Ng.

And then there’s the perennial thorn of Canadian softwood lumber, the Airbus-Boeing of US-Canada relations. Although, as one Hill staffer put it, while a permanent solution to the aircraft subsidies fight is — after 17 years of wrangling — imaginable, one on softwood lumber is harder to see. The US essentially thinks Canada is subsidising its lumber industry by not charging it enough to grow trees on public lands. Late last month, the Department of Commerce released a report announcing that it would look at doubling existing anti-dumping tariffs on Canadian lumber, from 9 per cent to more than 18 per cent.

“There’s very little coming out of the US that suggests there’s a special relationship with Canada,†said Edward Alden, of the DC-based Council on Foreign Relations. There is, he suggests, a lot of “underlying tensionâ€. This is surprising — Canada is almost joint with Mexico as the US’s largest trading partner in goods, partly reflecting integrated supply chains.

Despite this gloomy list, we assume things are going to settle down. We know South Park has an eerie knack for predicting the future, but we don’t envisage war on Canada as a looming threat (for those of you who are not fans, here’s what we mean. Warning: it’s not for the easily offended). We don’t even envisage a renewed tariff war over cheese. And generally, the direction of travel seems to be towards resolving tariff wars, not starting new ones. Fights with allies just end up burning US political capital, as seen when Tai got grilled by lawmakers over the random array of Airbus-Boeing tariffs that hit businesses in their constituencies. The list of trade irritants is bigger than we expected though. We’ll be watching this space.

Charted waters

The EU’s proposed update to its rules on carbon emissions, which aim at cutting emissions by 55 per cent by 2030, could be at risk of doing more harm than good when it comes to shipping.

In an interview with the Financial Times out yesterday, Soren Toft, chief executive of the Mediterranean Shipping Company, said the measures would have the reverse effect of their intentions unless low carbon fuels were readily available. According to him, the lack of green fuels available to the industry would mean operators would be forced to slow down their vessels to meet the demand for cuts, creating the need for more new ships to maintain service levels. The issue, of course, being that building those new vessels (probably in Asia) would have the effect of emitting more carbon.

There’s scepticism in some quarters about how accurate these claims are — we’d be interested in readers’ own thoughts on this. In the meantime, here’s what has been happening to the price of carbon emissions ahead of a decision on the degree to which the rules will apply to the shipping industry. Claire Jones

Trade links

Paul Krugman has tackled the big macro question of the moment: is the Federal Reserve right to view the current inflationary spike as transitory? The Fed’s view has been that many of the spikes we’ve seen — some of which relate to supply chain logjams — will soon simmer down. Our own Robert Armstrong looks at whether globalisation’s time as a deflationary force is spent in his excellent Unhedged newsletter.

More on China-US relations.

After months of talking tough, Joe Biden now wants to sit down with Beijing, with the US president pushing for meetings with high-level officials. What’s mooted so far is a meeting between Antony Blinken, secretary of state, and Chinese foreign minister Wang Yi at a G20 gathering in Italy next week. The Biden administration has also told Beijing it would like to send Wendy Sherman, deputy secretary of state, to China over the summer, and is considering a call with President Xi Jinping, its second engagement with him.

We’ve been keeping a close eye on the semiconductor story, a key element of which is of course the US’s desire to reduce its reliance on Taiwanese-made chips. With that in mind, Nikkei reports ($) that US semiconductor giant GlobalFoundries will invest more than $4bn to expand its Singapore wafer plant and ramp up capacity. This, it is hoped, will also alleviate the short-term supply pressures we’re still seeing in industries such as automotives. Aime Williams and Claire Jones

[ad_2]

Source link