[ad_1]

This article is an on-site version of our Unhedged newsletter. Sign up here to get the newsletter sent straight to your inbox every weekday

Welcome back. The housing cycle is the economic cycle, or so I’ve been told, so we’re back on to that topic. I bought my house just before the pandemic hit, so it has made me feel like both an idiot and a genius and I’ve only owned it for a year and a half. Good times. Email me: robert.armstrong@ft.com

Is the Fed inflating a housing bubble?

An important Federal Reserve person is worried about house prices. From the Financial Times yesterday:

“It’s very important for us to get back to our 2 per cent inflation target but the goal is for that to be sustainable,†Eric Rosengren, the president of the Boston Fed, told the Financial Times. “And for that to be sustainable, we can’t have a boom and bust cycle in something like real estate.Â

“I’m not predicting that we’ll necessarily have a bust. But I do think it’s worth paying close attention to what’s happening in the housing market.â€

This is sensible. One side-effect of the Fed’s asset-buying programme is higher asset prices. If the Fed was only buying $80bn in Treasuries a month, that itself would push rates of all sorts down, making it cheaper to finance house purchases, and driving house prices up. But the Fed also buys $40bn a month in mortgage-backed securities, or MBS, which affect housing finance more directly.Â

Whatever the cause, asset prices that are very high by historical standards are not generally very stable, and house prices are very high. If house prices do crack, that could make a lot of people feel poorer, a lot more people than, say, a fall in share prices would. Such a negative wealth effect could crush economic growth and inflation (can you remember a time when that happened? I can).

Rosengren has an idea: he thinks that the Fed should wind down its MBS purchases at the same rate as its Treasury purchases, despite the fact that it bought Treasuries twice as quickly, implying “that we would stop purchasing MBS well before we stopped purchasing Treasury securitiesâ€.Â

He is not the first important Fed person to worry about house prices. A few weeks ago Dallas Fed chief Robert Kaplan said this, which I have quoted before:Â

“I’m hearing more and more widespread reports of private investors entering the single-family housing market, competing with families, often making bids sight unseen above the asking price and requesting that the house remain furnished. So, we’re in a position where single families are being crowded out . . . This is an example of an excess, maybe an unintended consequence, a side effect of these extraordinary [Fed] actions.â€

Here are the prices that are causing all the fuss, from the National Association of Realtors:Â

That is a pretty lively acceleration in May. Still, not everyone at the Fed thinks that house prices are a problem, or if they are a problem, that they are the Fed’s fault. Here is New York Fed president John Williams, as quoted in The Wall Street Journal:

“My view is that the monetary accommodation that we’re providing, both in terms of the very low fed-funds rate and also our asset purchases, is supporting overall financial conditions,†Williams said. He added that the support isn’t “specifically targeted to the housing marketâ€.

“My best guess estimate is that we are having a de minimis effect on mortgage interest rates with our mortgage-backed securities purchases.â€

This is not a completely insane view, for reasons that Matt Klein explained on FT Alphaville a few years ago. Mortgage borrowers always have a put option, so they refinance when rates fall. This means mortgage bonds’ duration risk goes up when rates rise. Investors who buy mortgage bonds try to balance out this added duration by selling Treasuries (or related instruments) when rates rise and buying them when rates fall. This is procyclical hedging (rates and yields go in the opposite direction as prices). When interest rates are falling, and Treasury bond prices are rising, mortgage hedgers buy more Treasuries, pushing rates down further. The opposite applies when rates rise.

But the Fed does not hedge, so when it buys mortgage bonds it “takes interest rate risk out of the market . . . [which] reduces the volatility of yields and reduces the risk premium embedded into longer-term interest rates†— that is, Fed MBS buying loosens Williams’ “overall financial conditionsâ€.Â

But putting that important effect aside, the Fed is influencing house prices. How much is not clear. Just at present, though, the Fed might not have to worry too much, because there is reason to think that housing prices cool on their own.

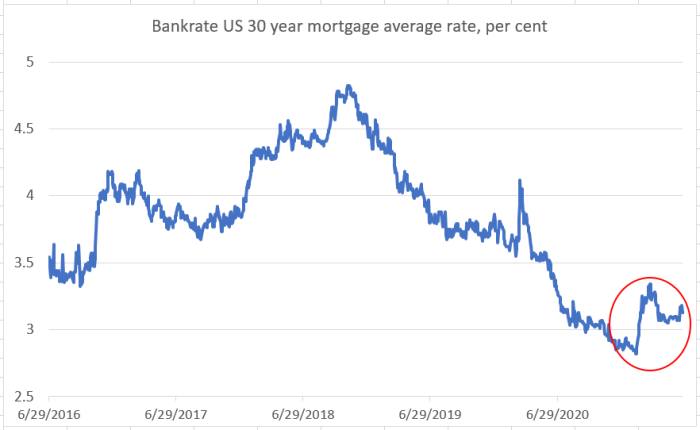

Most importantly, the rate environment is responding to inflation worries. Mortgage rates are off of their lows (this and the next two charts use Bloomberg data):

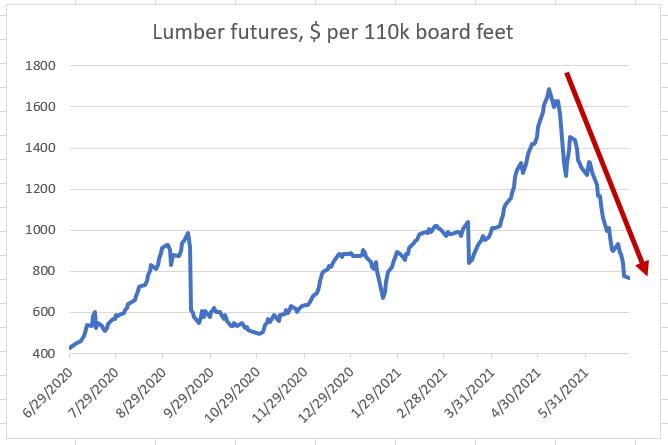

Lumber prices, which had added ten of thousands of dollars to new house prices, are plummeting:

High house prices are turning off buyers. Transaction volumes have turned south:

Finally, as post-lockdown consumers have other things to spend money on, less of them are touring new homes, according to homebuilder surveys (chart from Strategas Research, who are great on housing):

If this sort of data are, in fact, pointing to an orderly slowing of housing prices in the months to come, it does not mean that the Fed’s monetary policy does not inflate dangerous bubbles, especially in housing. It means Fed officials will have dodged the bubble-popping bullet this time, if they manage to taper and tighten without incident. But my view continues to be that the Fed needs to worry about markets’ effect on financial stability. Specifically, it should worry when policy is very loose and asset prices are very high. As Rosengren and Kaplan rightly acknowledge, that combination has direct implications for the central bank’s growth and inflation mandates.

ESG responses

On Monday I wrote about environmental, social and governance investing. I argued that the mechanism by which ESG investing makes the world a better place is cost of capital. ESG investors lower the cost of capital for “green†companies and increase it for “brown†ones, ensuring that more green projects and less brown ones are completed (I use “green†and “brown†to stand for ESG-positive and ESG-negative, rather than in any strictly environmental sense). But a lower cost of capital must mean lower expected returns for investors, all else equal.

Readers’ objections to this argument were almost all the same. They said that ESG-positive companies are less risky, and their premium prices (that is, their lower expected returns) reflect that, and so ESG investments’ risk-adjusted returns are not below the market’s.

Remember my point was conditional, though: if ESG investing makes the world better, then it does so by lowering expected returns.

It may be that ESG investing doesn’t make the world better, or to put it more clearly, that it doesn’t do anything that greed does not. It could, in theory, be that ESG investing is just good investing, and we don’t need to care about the environment or the social good. We all just have to seek the highest risk-adjusted returns and more money will go to ESG companies. Our values, what we think constitutes a better world, don’t matter one bit in this view.

I don’t think superior returns and sustainability are likely to align on the average investor’s horizon, and that we should be prepared to accept lower returns for ESG reasons, but that is a debatable point. What is not a debatable point is that the ESG industry goes to market under the banner of “doing well by doing good†or “investing with your valuesâ€. But on the view that ESG offers superior risk-adjusted long-term returns, values are irrelevant. They change nothing. Only selfishness matters, as the shareholder capitalism model insisted all along.

One good read

This better be a tax haven department: surely a €10m apartment aboard a superyacht is the least appealing imaginable luxury good?

[ad_2]

Source link