[ad_1]

This article is an on-site version of our #techFT newsletter. Sign up here to get the complete newsletter sent straight to your inbox every weekday

Britain has now joined the US and China as a country expressing dubious concerns about a national security threat from foreign technology.

It was always hard to understand the Trump administration’s obsessions, for example with how ByteDance’s TikTok video app might undermine America’s defences. Beijing’s alarm this past week over the Chinese ride-hailing app Didi’s data being of vital interest to foreign powers also seems overblown.

Obviously, there is more at play here, in terms of trade issues, tech supremacy, dominance in financial markets and plain old geopolitical tensions.

However, the UK government’s probe on national security grounds, into the Chinese-backed takeover of the country’s largest silicon wafer manufacturer, is a bit of a headscratcher.

As Louise Lucas points out, Newport Wafer Fab is small fries as chip factories go: it produces less cost-efficient 200mm wafers and has no cutting-edge technology compared to the Intel, Samsung and TSMCs of this world.

Back on the Didi front, this FT scoop reveals China’s internet regulator requested multiple changes to the mapping function of Didi’s app before its US listing, fearing it could reveal sensitive government locations.

In the US, a Chinese fitness app, a podcasting platform and a medtech company have all pulled their New York IPOs as regulators back home turn up the pressure to list locally. Lex says Beijing has signalled it would prefer companies to list on mainland exchanges such as Shanghai’s Star Market and there is even concern that it could pull the rug from under businesses such as Alibaba by curbing or closing an offshore ownership loophole.

Shanghai may be the future, but today, Hong Kong was suffering — a drop in the share prices of Chinese tech stocks dragged the city’s Hang Seng index to its lowest level this year, as investors digested the fallout from the regulatory crackdown.

The Internet of (Five) Things

1. Circle in Diamond deal

Circle, the US fintech behind the USD Coin stablecoin, is to list on Wall Street through a deal with a blank-cheque company chaired by former Barclays chief Bob Diamond. Circle said the deal would give it an enterprise value of $4.5bn. The founder of BuzzFeed, Jonah Peretti, has pledged to adopt more financial discipline as he laid out his plans to the FT to consolidate the digital media industry once he has taken his company public via a Spac.

Daily newsletter

#techFT brings you news, comment and analysis on the big companies, technologies and issues shaping this fastest moving of sectors from specialists based around the world. Click here to get #techFT in your inbox.

2. Food glorious food

Food delivery group Deliveroo has upgraded its sales growth forecasts but warned that margins will be at the lower end of its earlier guidance for the year, as it prepares for Covid-19 restrictions to end in the UK. In India, Zomato announced it would launch its $1.25bn initial public offering next week as it sought to capitalise on the surge in food order demand. In the US, the founder of grocery app Instacart is stepping aside to become executive chair and will be replaced as CEO by Facebook executive Fidji Simo.

3. Google does not play nice — US states

US antitrust enforcers have mounted their first challenge to a mobile app store, accusing Google of overcharging developers who sell through its Play store. The complaint, filed in federal court in San Francisco, is led by Utah and includes 35 other US states and the District of Columbia. It accuses Google of “unlawfully restraining trade and maintaining monopoliesâ€.

4. Unicorns stampede in Q2

The number of start-ups valued above $1bn grew rapidly in the second quarter, as venture capitalists increased the size and pace of their investments following several blockbuster public listings in the US. Private investors assigned billion-dollar valuations to a record 136 start-ups globally between April and June, according to CB Insights, more than the total for all of last year. Richard Waters comments that a new private finance system has emerged from the old VC model.

5. When Big Dating leaves you standing

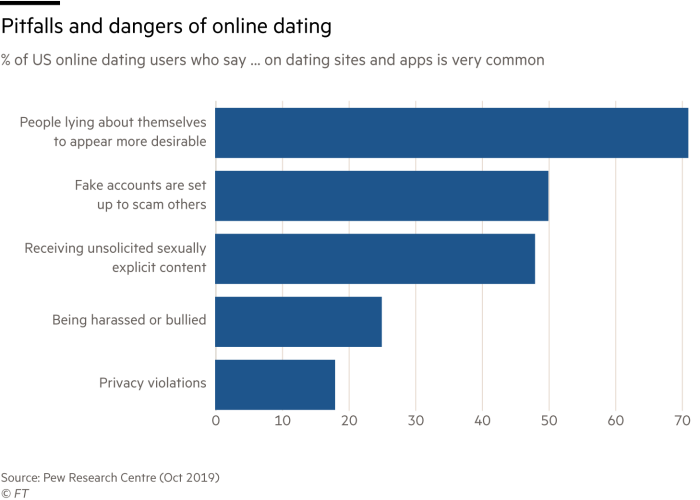

Dating apps mean that it has never been easier to meet new people, but they also appear to have bred a culture of harassment and disrespect, writes Elaine Moore in her review of two new books on the online dating game.

Forwarded from Sifted — the European start-up week

Nikolay Storonsky, founder and CEO of Revolut, is one of the most recognisable faces in European tech. He’s built a $5.5bn fintech, which boasts 15m customers across 30+ countries, and is even slowly edging towards profitability. But Storonsky hasn’t built Revolut alone over the past 6 years. Amid his 2,000 employees, there is a small team of trusted individuals who Storonsky has entrusted to help scale the business. Who is the power behind the throne at Revolut?

In other European start-up news, Gopuff, the US delivery app, is in late-stage talks to acquire Dija, the London-based 10-minute grocery delivery start-up, according to two people close to the talks. It would be another big deal in the now-fashionable fast grocery sector. Elsewhere, London fintech Wise has broken new ground with an £8bn direct listing; some European SPACs are valued more highly than Tesla, and the French government is rolling out yet another initiative in its quest to become Europe’s most start-up-friendly country.

Tech tools — Brickit Lego app

Brickit helps you get more out of your Lego and build things you had probably never imagined. The free iOS app works by scanning the bricks you have laid out and generating ideas for objects to construct from your inventory. It also provides instructions on how to build them. It’s not an official Lego app, but one created by and for fans, as the photos of their creations on its gallery suggest.

[ad_2]

Source link