[ad_1]

BlackRock chief executive Larry Fink has warned that the US should brace itself for a period of higher inflation, as the world’s largest asset manager handed the majority of its employees an 8 per cent pay rise.

The forecast came a day after figures showed the US consumer price index rose in June at the fastest pace in more than a decade, fanning concerns the economy may be overheating.

“We have been accustomed to sub-2 per cent inflation,†said Fink, who did not rule out inflation staying above 3 per cent thanks to a mix of higher energy costs, global supply chain disruptions and the Federal Reserve’s focus on job growth.

“In conversations with business leaders, they are seeing higher commodity prices and some are raising their prices and wages,†Fink told the Financial Times.

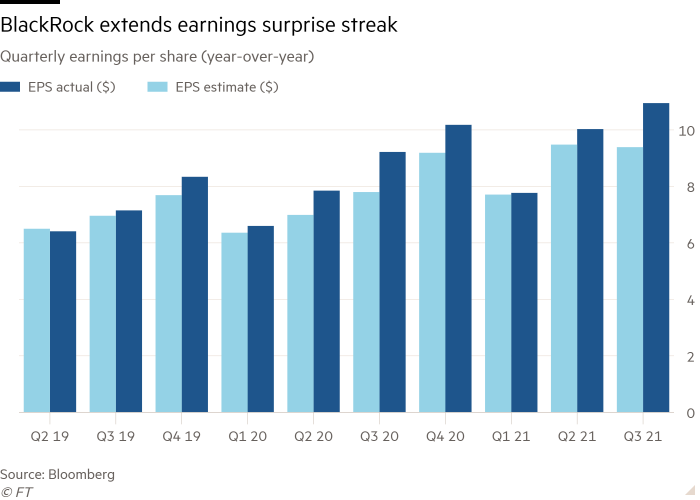

BlackRock announced the increase in base salary for all employees up to and including director level alongside second-quarter earnings that comfortably beat analysts’ expectations.

Riding the rebound in equity markets, BlackRock’s assets under management surged to a record $9.5tn. Revenues climbed 32 per cent to $4.8bn, exceeding expectations of $4.6bn, thanks to strong organic growth and higher performance fees.

Net income climbed 14 per cent to $1.38bn, while adjusted earnings per share came in at $10.03, exceeding the $9.48 Wall Street expected.

Fink said the decision to increase the base pay for almost 95 per cent of its 16,500 employees reflected a desire to share the benefits of the group’s growth, rather than a reaction to the wider inflationary pressures staff may be confronting. The increase will come into effect in September.

The boom BlackRock is enjoying was underlined by its operating margin, which climbed to 40.1 per cent in the quarter from 38.5 per cent a year ago.

Although assets under management set a new record, net inflows of $81bn for the three months to the end of June ended a streak of four quarters in which they had topped $100bn.

Long-term investment flows, a metric that excludes cash management, came in at $60bn, shy of the $94bn analysts expected. A US pension fund client pulled $58bn from an equity index mandate during the quarter.

“While the pension client loss weighed on the overall flow figure, underlying trends were solid,†said Kyle Sanders, analyst at Edward Jones.

Wall Street remains bullish about BlackRock’s long-term growth prospects given the substantial lead it has over rivals in ETFs and technology services through its Aladdin platform. Like competitors, the group is also targeting the boom in environment, social and governance investing.

Assets in BlackRock’s iShares franchise rose beyond $3tn for the first time in May. Net inflows for the quarter touched $75bn, up from $51bn a year ago. The asset manager told investors in June that it expects the current $9tn global ETF market will balloon to $15tn by 2025.

China remains another important area of long-term growth for the group, as Beijing opens the country to foreign fund managers.

BlackRock gained approval for operating as a wealth manager, in a joint venture with China Construction Bank and Singapore’s state fund Temasek during the quarter. Last month it became the first foreign asset manager to win approval to launch a wholly-owned mutual fund business in China.Â

“BlackRock has invested in the region and spent time building relationships that will help them become a major asset manager in China,†said Craig Siegenthaler, analyst at Credit Suisse.

Shares in BlackRock, which closed at a record high this week, fell 4 per cent in New York trading. The stock has climbed 21 per cent this year, outpacing the S&P 500’s 16.7 per cent gain.

[ad_2]

Source link