[ad_1]

FTSE Russell has launched an internal review into the annual rebalancing frequency of its family of US stock indices followed by about $9tn of investors’ money, on concerns that the rejigs cause unhealthy concentrations of trading.

Nasdaq said a record 2.37bn shares listed on its exchange, with a combined value of $80.9bn, traded in just 1.97 seconds on June 25 as it executed the closing cross for this year’s Russell reconstitution, up from 1.57bn shares worth $56.7bn last year.

Factoring in shares listed on the New York Stock Exchange, FTSE Russell said $186bn of stock changed hands in this year’s rebalancing, a figure that first passed the $100bn mark about five years ago.

Wesley Wynn, director of US and global benchmark products at FTSE Russell, said some investment managers had requested quarterly or semi-annual rebalancings to spread trading out through the year.

“We have highly experienced [market] practitioners that we meet with on a regular basis to make sure we have our pulse on how they are seeing the market, and they give insights into areas we may wish to reform,†Wynn said.

“Our [index] committee has said we should look at increasing the regularity of our review,†he added, with the issue of “style drift†also on the agenda.

The annual rebalancing is an outlier within FTSE Russell and a legacy issue predating the takeover of Russell Indexes by the London Stock Exchange Group, FTSE’s parent, in 2014.

The FTSE 100 and the rest of the group’s UK indices rebalance quarterly, while FTSE Russell’s global index series does so on a semi-annual basis.

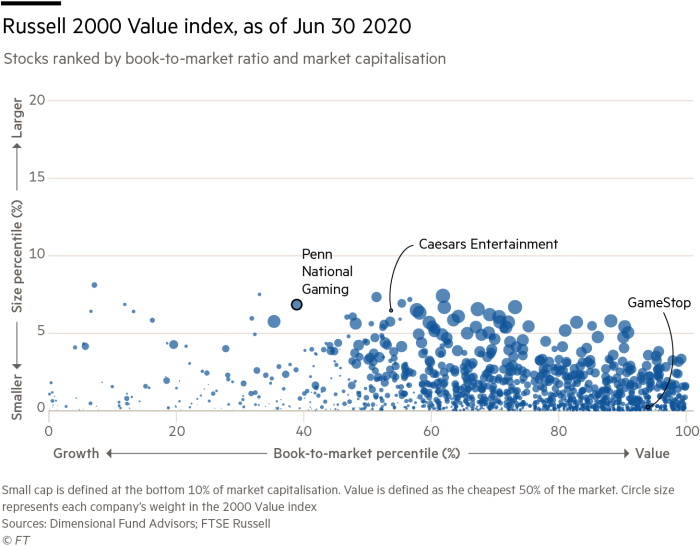

Some investors argue a yearly rebalance leaves the indices at the mercy of style drift where, for instance, some companies in the US small-cap Russell 2000 Value index cease to be either small or value in the months leading up to the revamp after enjoying strong share price rallies, particularly in an era of “meme†stocks.

Analysis by Dimensional Fund Advisors highlighted the drift in the Russell Value 2000 index in the period up to May 31, shortly before its annual rebalancing.

This small-cap value index was dramatically reshaped by the surge in meme stocks such as GameStop and AMC Entertainment, which were no longer remotely small-cap or value by this point.

It found that in May, 15 per cent of the index’s weight was in large-cap stocks, led by Caesars Entertainment, with a market capitalisation of $22.4bn, and GameStop, at $16.5bn.

Some element of style drift is inevitable, and even beneficial to investors if the drift is a result of stocks rallying strongly.

However, Wes Crill, head of investment strategists at Dimensional, argued that the accentuated style drift permitted by infrequent rebalancing was detrimental to investors seeking to profit from the small-cap and value premia historically found in markets.

“Infrequent style rebalancing, a process that leads to style drift, leads to a reduced ability to manage the premia,†Crill argued.

Todd Rosenbluth, head of ETF and mutual fund research at CFRA Research, was also in favour of more frequent rebalancing.

“There would be higher turnover perhaps, but it would be spread throughout the year as opposed to one day in the summer,†he said.

“The schedule predates the development of ETFs tracking these benchmarks. They were reference points for active management, now billions of dollars of ETFs are tied to them.â€

[ad_2]

Source link