[ad_1]

In the centre of Florence, near the Uffizi gallery and Cathedral of Santa Maria in Fiore, Pasquale Naccari has serious doubts about whether the seafood and pizza restaurant his family has run for more than 50 years can survive much longer.

“We are in a desperate situation,†said Mr Naccari. “My bank account balance is almost zero for the first time in years and my business is on the verge of collapse; state funding is inadequate, badly distributed and delayed.â€

The plight of the Il Vecchio e il Mare restaurant epitomises the existential crisis facing thousands of Europe’s small and medium-sized companies that have had much of their income wiped out by the coronavirus pandemic and the curbs to contain it.Â

The eurozone economy fell into a double-dip contraction in the final quarter of last year, shrinking 0.7 per cent from the previous three months, data published this week showed, resulting in a record postwar contraction of 6.8 per cent over the whole of 2020.

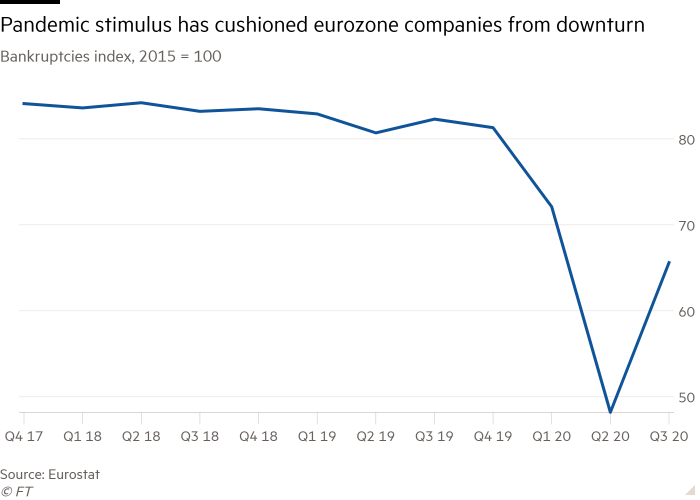

However, there is almost no trace of this painful situation in the latest data on the number of businesses filing for insolvency in the eurozone, which fell sharply after the pandemic hit the region last March and stayed lower for the rest of the year.

Experimental data published by Eurostat this week showed a one-fifth drop in businesses filing for insolvency in the eurozone in the third quarter of 2020 from a year earlier. That followed a 41 per cent year-on-year drop in corporate insolvencies in the second quarter.Â

The main reason is that governments have spent huge sums to shield their economies from the pandemic.

The bloc’s four biggest economies, Germany, France, Italy and Spain, committed to spend an extra $3.1tn — a third of their combined gross domestic product — including vast loan guarantees, subsidies for millions of people’s wages and bailing out scores of companies, according to the IMF.Â

But Mr Naccari said government aid, including subsidised wages for furloughed employees, had often been delayed and was nowhere near enough to offset a 60 per cent drop in his restaurant’s revenues.Â

“We cannot cover fixed costs such as electricity, water and gas,†he added. “Some people lack the cash flow to pay the rents of their houses and do their shopping. Those who survive today do so only to fail tomorrow.â€Â

In response, some Italian restaurant and café owners have started disobeying an order to close at 6pm. In Hungary, restaurant owners promised a similar show of civil disobedience during protests in Budapest last weekend.

Even in Germany, where the government has spent more on its pandemic response as a share of GDP than most European countries, there are signs that the second lockdown in force since late last year is taking its toll.Â

An Instagram video posted by Bianka Bergler, who was forced to close her hairdressing salon in Dortmund in December, has gone viral with 2.2m views of her appeal for the government to speed up its payments.

“Every day I look at the account with fear,†she said, explaining that she was overdrawn and could not pay her five staff. “No bridging aid has yet arrived.â€Â

Her video touched a nerve: German business groups have been complaining for weeks about delays and difficulties in applying for state aid. Helge Braun, chief of staff for German chancellor Angela Merkel, this week called Ms Bergler’s video “startling and impressive†and promised to “ensure that the aid is paid out quicklyâ€.

Berlin recently extended until April a waiver exempting over-indebted companies from having to file for insolvency. But German corporate bankruptcies still broke a long run of monthly declines by rising in both November and December. Several hotels have gone bust in recent months, including Sofitel Berlin, Nordport Plaza in Hamburg and a chain of 10 Holiday Inn Express and Crowne Plaza hotels.

Dehoga, the German hotel and restaurant association, estimates turnover in these sectors fell 47 per cent last year and a recent survey found a quarter of its members were considering giving up. “Many companies are still waiting for the November aid promised on October 28,†said Ingrid Hartges, general manager of Dehoga. “These companies have their backs to the wall.â€

Part of the problem is that companies are hitting EU limits on state aid. Ministers from Denmark, Austria and the Czech Republic called in the FT last week for the EU to raise its €800,000 cap on direct grants and €3m ceiling for uncovered fixed cost compensation.

Euler Hermes, the trade credit insurer, estimates eurozone business insolvencies will rise 29 per cent this year after falling 17 per cent last year, with the biggest increase of 73 per cent expected in Italy.

“One in four companies in Europe will be cash constrained this year,†said Maxime Lemerle, head of sector and insolvency research at Euler Hermes. “These zombified companies in hospitality, retail, transport, leisure and events could go bust very quickly even if the support measures are wound down quite slowly.â€

In France, a third fewer businesses filed for bankruptcy in the year to November than in the previous year — helped by a temporary waiver on companies being declared insolvent that expired in August, according to the Banque de France.

But the French government still worries that some companies may collapse and last week finance minister Bruno Le Maire said Paris may convert some of its €130bn of loan guarantees into grants.

While most European governments have extended support programmes to this year, some business leaders and officials worry about what will happen when the aid dries up.Â

In Greece, banks have granted moratoria to suspend payments on a fifth of their performing loan books.

Yannis Stournaras, governor of the Greek central bank, said: “You never know what is going to happen when this assistance ends — either the moratoria of the private sector banks or the public sector support — and that is the key test. Much will depend on how much growth we have.â€

[ad_2]

Source link