[ad_1]

London’s once-unquestioned dominance of European financial markets is being tested as trading spills beyond the UK’s borders following the end of the Brexit transition.

Data released this week revealed the speed at which the UK can lose its grip on key parts of Europe’s financial services industry.

Trading in stocks and derivatives — markets where London has long taken a leading role — has flowed out of London in the six weeks since the Brexit transition period expired. Amsterdam, Paris and New York have all gobbled up market share, according to data released in recent days.

With financial services omitted from the UK’s trade deal with the EU just before Christmas, banks, brokers and fund managers have swiftly grown accustomed to far more basic and inefficient terms for cross-border trade.

Some executives and bankers worry that the patterns established in recent weeks are beginning to set the parameters for the relationship between London and Brussels over the longer term.

Steven Maijoor, outgoing chair of the European Securities and Markets Authority, said at a Financial Times conference this week that he suspected the share trading shifts were “going to be a permanent changeâ€.

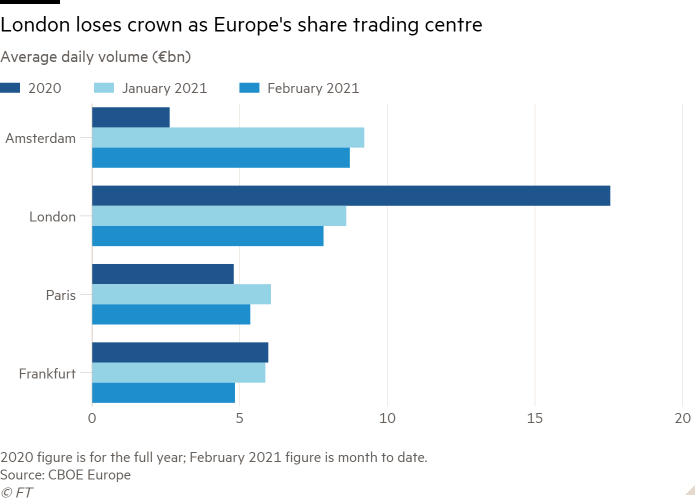

In one of the most symbolic changes in leadership to date, Amsterdam supplanted London last month as Europe’s main share trading hub, after dealing in EU companies moved back to the bloc.

So far in February there has been an average €8.7bn a day traded in the Dutch city, compared with €7.8bn on venues in London, CBOE Europe data show. Last year London traded an average of €17.6bn shares a day and Amsterdam languished behind Paris, Frankfurt and Zurich, with just €2.6bn.

Trading in euro-denominated swaps, a $1.6tn-a-day global market that was a City mainstay, also began leaving in the run-up to the UK’s departure from the single market as EU banks dealing derivatives in London were caught in a stand-off between London and Brussels over greater oversight of their activities.

New York has swept up the majority of business with $4tn of deals moving out of Europe to US marketplaces in the four weeks, according to Clarus FT, a data provider. Intercontinental Exchange said on Monday it will transfer the EU’s €1bn-a-day carbon emissions trading market from London to the Netherlands, although clearing will remain in the UK capital.

While the move in trading away from London has been rapid for some securities, many UK bankers and asset managers are sanguine.

“I’m not a ‘declinist’ about London’s future,†said Paul Marshall, a supporter of Brexit and co-founder of London-based Marshall Wace, one of the world’s biggest hedge funds.

“Irrespective of where trades are booked — and there is bound to be some shift due to the protectionist attitude of the EU — most of the money should continue to be managed from London,†he said. Sir Paul added he expected issues facing the City to be “looked after†by the government in due course.

The impact of Brexit on London’s large fund management and hedge fund industries has been muted so far.

While some managers have had to set up offices or use the services of a third-party company in the EU, very few have left the UK.

While Esma, one of the EU’s main financial watchdogs, has recommended tightening rules that allow UK managers to run EU-based funds, few executives see this as a major threat because such restrictions would also hit US and Japanese fund managers.

Bankers also said the move in trading would have only a subtle effect, at least initially, since modern day trading is mostly done on computers. “The euro share and derivative trading that has moved elsewhere is a tiny sliver of the global pie. Tiny. None of my people are moving to Amsterdam from Londonâ€, one bank executive in the UK said.

The trading moves “are significant but they are not the harbinger of doom for the City of London,†added William Wright, head of think-tank New Financial.

In most other areas of the City the effect is “not black and whiteâ€, he said. “I don’t think we can read too much from these two examples to the longer-term impact of Brexit on the City,†he added, referring to share and derivative trading.

For the UK, better terms of access to the vast single market relies on Brussels judging the UK’s regulation and supervision to be as good as its own, under a system known as equivalence. Granting a range of permits would make it far easier for brokers to conduct cross-border business and sell services to EU customers.

The City is holding out little hope that coming discussions on financial services between Brussels and London will yield much of substance. The two sides have committed to trying to find an accord by the end of March. Some firms have decided not to wait: investment bank Numis announced this week that it would open an EU office within 12 months.

Brussels is keen to assert its own financial independence from London and is wary of the extent of UK plans to deviate from EU laws. Andrew Bailey, governor of the Bank of England, weighed in this week, arguing that “now is not the time to have a regional argument.â€

But the current flow of business to the EU may energise the bloc’s policymakers to extend their current stance. Leonard Ng, a partner at law firm Sidley Austin in London, said banks and fund managers may wait only a short period before moving on.

“If equivalence isn’t granted in the next three-six months, things will get settled and then banks won’t want to change back,†he said.

He added that the UK could strike out on its own path without equivalence. “But there’s no point in having better infrastructure if you don’t have clients,†he said.

Some bankers warn that the early shifts should not be underestimated over the longer-term. “The European Central Bank over time will insist on banks creating holding companies inside the EU, just as the US has done,†said the chief executive of one UK bank.

“One can imagine that in 10 years London will be a subsidiary of Paris, not the other way around. Banks will want to locate as much as they can of central costs in the holding company to take advantage of economies of scale. I am not being pessimistic, I am being realistic,†he said.

[ad_2]

Source link