[ad_1]

There’s only one place to kick things off today and that is in Texas, where freezing temperatures have wreaked havoc this week.

The Arctic blast that has swept through the state since Saturday has left millions without power as the local grid faltered under soaring demand.

The Energy Source team has been following developments in Texas closely over the past few days. For the first item in today’s newsletter, Justin Jacobs breaks down what happened and why.

In our second item, David Sheppard delves into the prospects of a fresh supercycle in oil and asks what we should read into Warren Buffett taking a stake in oil major Chevron.

Elsewhere we look at the nuclear industry’s calls for more funding as it carves out its niche in America’s clean energy future and Total boss Patrick Pouyanné weighs in on the chances of an oil supply crunch.

Thanks for reading. Please get in touch at energy.source@ft.com. You can sign up for the newsletter here. — Myles

What zapped Texas’ power supply?

America’s largest energy producer and second-largest economy has been paralysed this week by a blast of Arctic weather that knocked out much of the state’s power grid and forced millions of people to face subfreezing temperatures without power and heat.

As we reported, the managers of Texas’ electric grid anticipated record demand as the winter storm approached. What they did not predict was that so much of the state’s power generation capacity would buckle under the cold weather. As of late Wednesday, the Electric Reliability Council of Texas (Ercot) said that roughly 46GW of generation capacity remained offline days after planned blackouts were instituted in order to ration power.

The sudden loss of generation capacity as temperatures plummeted on Monday night forced the grid manager to sharply curtail demand, plunging millions into the dark, or else risk catastrophic damage to the state’s power grid.

Was it renewables’ fault?

No. Republican politicians were quick to point fingers at frozen wind turbines, but this is not the sole cause of the blackouts. While a full postmortem of went has gone wrong will take weeks, all early indications show that this was a wide-ranging failure of the Texas energy system.

It’s true that some wind turbines did seize up in the freezing temperatures because they were not equipped with the sort of heating equipment that keeps turbines spinning in typically cold climates like Scandinavia and Canada. But a larger problem appeared to be a massive loss of natural gas supply as wells, pipelines and other equipment froze over. A number of power plants also saw equipment fail in the cold.

So what needs to change?

Republican Governor Greg Abbott has called for an investigation into Ercot’s handling of the blackout and a broader look at what went wrong. That investigation will no doubt explore what role renewables’ intermittency played in the blackouts, in addition to other factors in the crisis.

But the state power grid’s shortcomings in unusually cold winter-weather should not have come as a surprise. A similar investigation into a cold weather-related power disruption in 2011 focused on the need to better harden power plants and other energy infrastructure against freezing temperatures. However, regulation-shy Texas never put any teeth behind those recommendations.

Some of the Texas grid’s unique features will also come under scrutiny. Texas is the only state that has not connected its grid to others, which it has done to avoid federal regulations. But that also means it was not able to import power from other states as generation failed and demand surged. Plus, Texas is unique in that it does not pay generators to maintain spare capacity that can be drawn on in times of peak demand, a so-called “energy only†market design that will be closely examined.

What does this mean for Joe Biden’s renewables push?

Abbott appeared on rightwing commentator Sean Hannity’s Fox News show on Tuesday night where he said, “this shows the Green New Deal would be a deadly deal,†laying out in no uncertain terms how the fiasco will feed into the national climate change conversation.

Biden still has control over the levers of government needed to institute many of his clean energy priorities, but there will undoubtedly be pushback from Republicans such as Abbott who will point to frozen wind turbines in west Texas as evidence of renewable energy’s unreliability.

What Abbott failed to mention, however, is that as climate change fuels more extreme weather patterns, frigid winters in normally balmy Texas will only become more common.

(Justin Jacobs)

Andy Hall and Warren Buffett: smoking up the supercycle

In the history of oil trading there are few bigger figures than Andy Hall.Â

From Saddam Hussein’s invasion of Kuwait in 1990 through to the last oil “supercycle†in 2003-2014 when the lasting surge in prices propelled crude upwards of $100-a-barrel, few (if any) traders made more money by getting the big calls in crude right.

So as talk of a new supercycle in oil starts to circulate, with banks like JPMorgan and Goldman Sachs pushing the idea of a supply gap just over the horizon, we thought it was wise to seek out Hall’s view. We quoted an excerpt of his less-than-stellar endorsement in Tuesday’s supercycle story, but here are the full comments exclusively for Energy Source readers:

“Count me as a sceptic. Perhaps this dead cat can bounce a few more times, but would that be a supercycle? When Chevron and ExxonMobil are talking about merging, when GM is planning to stop making oil-powered cars, when the US government is aggressively embracing renewable energy, then for me the writing is on the wall. Plus the Covid experience is likely to have some enduring consequences: significantly less travel whether for business or for pleasure which creates another headwind,†Hall said.

“I continue to think the oil and gas industry is in terminal decline — and so it should be. The trajectory won’t be linear and there could well be some dramatic death rattles along the way that will create some short term excitement. But as an investment opportunity, this is what Warren Buffett would call a cigar butt with a few last puffs.â€

Hall’s scepticism is not a huge surprise. He closed down his hedge fund a few years ago and while he still keeps one eye on the oil market it’s hardly his burning passion compared to his new career as an art collector and gallery owner.

But his reference to Buffett might be prescient. It came just a few days before it was revealed that Berkshire Hathaway had built a stake worth $4.1bn in Chevron at the end of 2020.

Is The Sage of Omaha making a trademark value play by buying into one of the world’s biggest oil companies?Â

Based on his well-publicised investment philosophy, that would imply he sees a good business that — crucially — has the macro winds behind it. In other words, a tacit endorsement of a higher-for-longer oil price emerging from the ashes of last year’s crash, despite fears about peak demand.Â

Those less confident in oil’s long-term future might prefer to see it as a bottom-scraping “cigar butt†investment, which Buffett has admitted to indulging in earlier in his career.

“If you buy a stock at a sufficiently low price, there will usually be some hiccup in the fortunes of the business that gives you a chance to unload at a decent profit, even though the long-term performance of the business may be terrible . . . A cigar butt found on the street that has only one puff left in it may not offer much of a smoke, but the ‘bargain purchase’ will make that puff all profit.â€

Given Buffett denounced this investment approach as “foolish†more than 30 years ago, it’s tempting to conclude that — whisper it — Buffett is an oil bull. Backing Chevron is one way to express that view. Chevron’s shares were up 1.5 per cent on Wednesday, following the Berkshire announcement, while rivals like ExxonMobil were broadly flat.

But given the uncertainty the industry faces — as articulated by Hall — it’s fair to say there’s still some room for doubt over Buffett’s motives for getting long Big Oil. Many believe any spike in oil prices really would be the industry’s last hurrah, as it would expedite the energy transition. The oil bulls probably shouldn’t reach for the cigars just yet.

(David Sheppard)

Data Drill

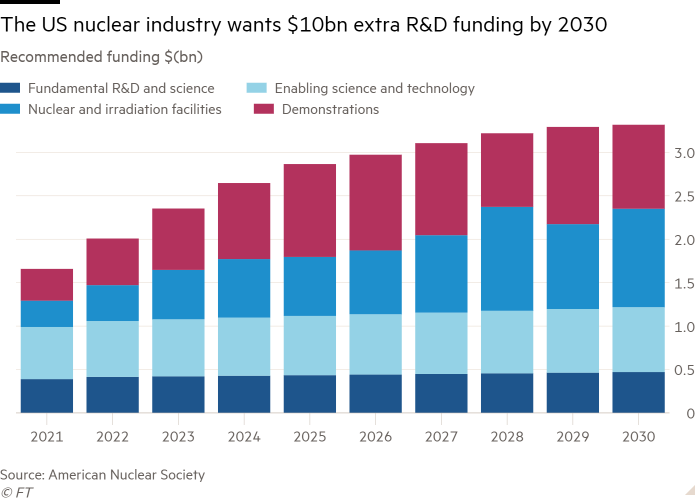

As policymakers piece together their visions for America’s low-carbon future, the nuclear industry is adamant it has a key role to play in providing reliable, dispatchable power alongside intermittent renewables.

But for this to happen, federal investment in nuclear research and development will be “critical†in slashing costs and speeding up the commercialisation of advanced nuclear technology.

That is the case made by the American Nuclear Society, an industry group, in a new report launched this week.

An additional $10.3bn will be needed over the next decade, according to the ANS — a small ask, it says, when set against the Biden administration’s $1.7tn climate spending ambitions.

Power Points

Endnote

Oil company stock prices have benefited from an uptick since the end of last year as traders became more optimistic after the rollout of vaccines. But there is a big question now if the world will see another price spike as coronavirus-linked pullbacks in new oil projects hit supply.

“High prices are perfectly possible,†said Patrick Pouyanné, Total’s chief executive, in a wide-ranging interview.

While Pouyanné said he could see the potential for another swing upwards and “a possible supply crunchâ€, he said how Opec countries and non-Opec allies swing their production is worth paying attention to.

Oil rich nations, he said, have learnt their lesson on allowing crude prices to escalate. “Producing countries realise that if prices go too high this will damage, forever, their market share.†Like the rest of the energy world, they too see that “today we have alternative energies.â€

“There is a fear today that all of their resource will not be consumed . . . [so they] don’t have an interest to push prices too high,†he added.

(Anjli Raval)

Energy Source is a twice-weekly energy newsletter from the Financial Times. It is written and edited by Derek Brower, Myles McCormick, Justin Jacobs and Emily Goldberg.

[ad_2]

Source link