[ad_1]

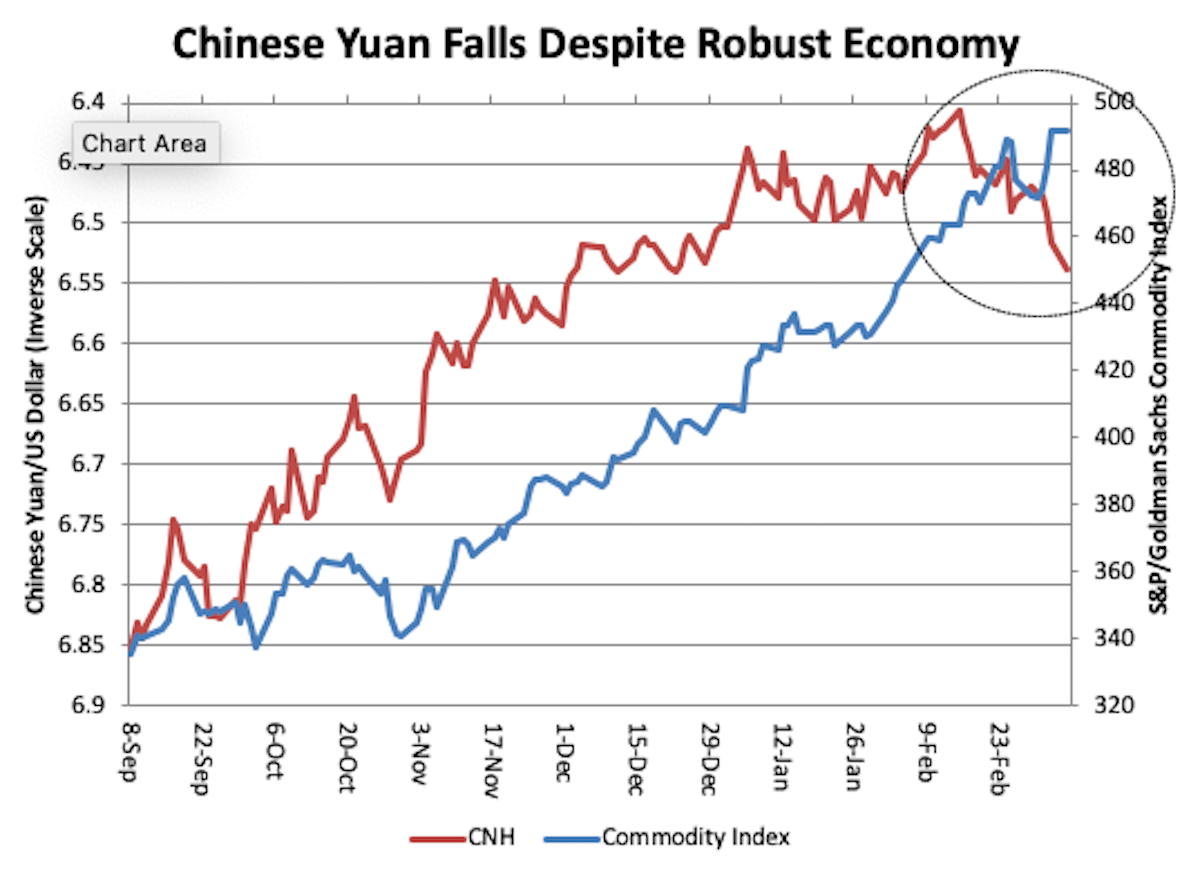

China’s currency has lost about 2.4% against the US dollar since mid-February, when it briefly touched the 6.4 mark. Most forecasts put the yuan at 6.25 to the dollar by mid-year. The yuan’s turnaround is all the more perplexing given the economic context.

For the past six months, it has tracked the major commodity indices fairly closely, because Chinese demand has provided the main impetus for world commodity prices. Commodity prices continue to rise, reflecting a buoyant Chinese economy, but the yuan has weakened noticeably.

Political tension with the new Biden administration is to blame. Most observers (including this newspaper) anticipated negotiations to wind down the complex of tariffs and tech barriers set up by the Trump administration and at least limited cooperation with China on public health and other issues.

Biden’s team, though, seems determined to show that it isn’t soft on China. As M K Bhadrakumar noted March 7, “the Biden presidency is struggling to show ‘America is back’ on the world stage,†and belatedly pushed for a strengthened Quad alliance against China to demonstrate its toughness with respect to what Secretary of State Tony Blinken called “the biggest geopolitical test of the 21st century.â€

A report by the National Security Council on artificial intelligence (AI) curated by former Google CEO Eric Schmidt and Barack Obama’s former deputy defense secretary Robert Work last week called on the US to maintain a technological blockade against China’s semiconductor industry.

China regards this as a serious threat; the costs of compensating for American restrictions on chip and chip manufacturing technology to China might cost China as much as two percentage points of GDP in 2021.

China meanwhile fears that the Biden administration will “cross red lines†in relations with Taiwan, as Foreign Minister Wang Yi told a news conference March 7 during the National People’s Congress in Beijing.

For its part, Washington fears retaliation by China against its technology controls. The US has alleged that state-backed Chinese hackers were responsible for compromising tens of thousands of Microsoft Exchange servers over the past week. If that is true, it would be one of history’s most dramatic examples of covert cyberwar.

China has warned whoever will listen during the past several months that it will respond to American tech restrictions.

The Trump administration asserted a novel kind of extraterritorial control over American equipment and intellectual property when it banned Taiwanese exports of high-end computer chips to Huawei, ZTE and other Chinese companies.

From China’s standpoint, the US is interfering in trade between a Chinese province and the Chinese mainland. If Beijing and Washington choose to escalate, the results could be disruptive as well as dangerous.

[ad_2]

Source link