[ad_1]

Confidence among large US employers has surged in the past three months, as an accelerating vaccine rollout and Joe Biden’s $1.9tn stimulus package combine to boost companies’ willingness to hire and invest.Â

A quarterly poll of chief executives by the Business Roundtable, Washington’s leading big-business lobby group, reported a 21 point jump in its economic outlook index since December. The index’s new reading of 107 is far above both the 50-point level that indicates growth and the historical average of 82.Â

The rebound was “among the sharpest and quickest recoveries in optimism in the history of our surveyâ€, said Josh Bolten, the BRT’s chief executive, noting that it had taken eight quarters from the trough during the 2008-2009 financial crisis for the index to get back to a similar level of optimism.Â

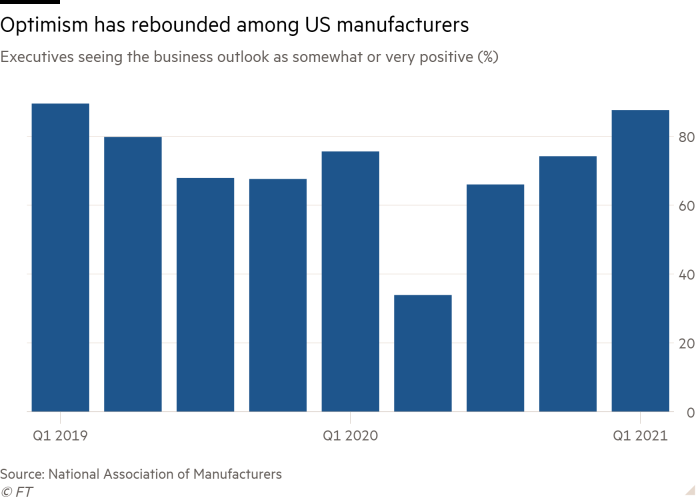

The advance in the BRT survey came on the heels of other reports showing confidence rising across US industry. The National Association of Manufacturers reported on Tuesday that optimism among its members had jumped in the past quarter from 74 per cent to 88 per cent — its highest rate in two years.

The readings suggest an early vote of confidence in the Biden administration despite continuing impatience for infrastructure spending and concerns about the prospect for higher corporate taxes and tougher regulation.

Bolten said BRT members had been encouraged by their early dealings with the new administration. “The communication with the business community is good and the tone is good,†he said. But he warned that advances in business investment and employment over recent years would be “jeopardised†if reversing the 2017 corporate tax cuts made the US uncompetitive with other OECD countries.Â

Bolten expressed disappointment that the $1.9tn American Rescue plan had not drawn bipartisan support but voiced optimism that an infrastructure bill would attract backing from both parties in Congress.Â

“We believe Congress and this administration can get it done,†echoed Brendan Bechtel, chief executive of the eponymous engineering company, who said this was “a once in a generation opportunity†to pass big infrastructure legislation.

The survey showed investments in traditional infrastructure and broadband networks ranked as chief executives’ priorities for Covid-19 recovery legislation. The BRT is pressing for a combination of federal investment in transportation, broadband and green infrastructure; a more streamlined permissions process; and measures to unlock private financing including “user pays†models.

The increase in the BRT’s index was driven by a 30-point advance in the measure of companies hiring plans for the next six months, signalling renewed optimism about the employment outlook at big companies.Â

More than one-third of the chief executives it polled said conditions for their companies had already recovered, while a further 38 per cent expected a full recovery by the end of 2021.

The NAM’s survey contained notes of caution, pointing to higher raw material costs and the inability to attract and retain talent as the biggest challenges now facing manufacturers. NAM members expect raw material costs to increase by 6.2 per cent over the next 12 months — a record for the survey.

[ad_2]

Source link