[ad_1]

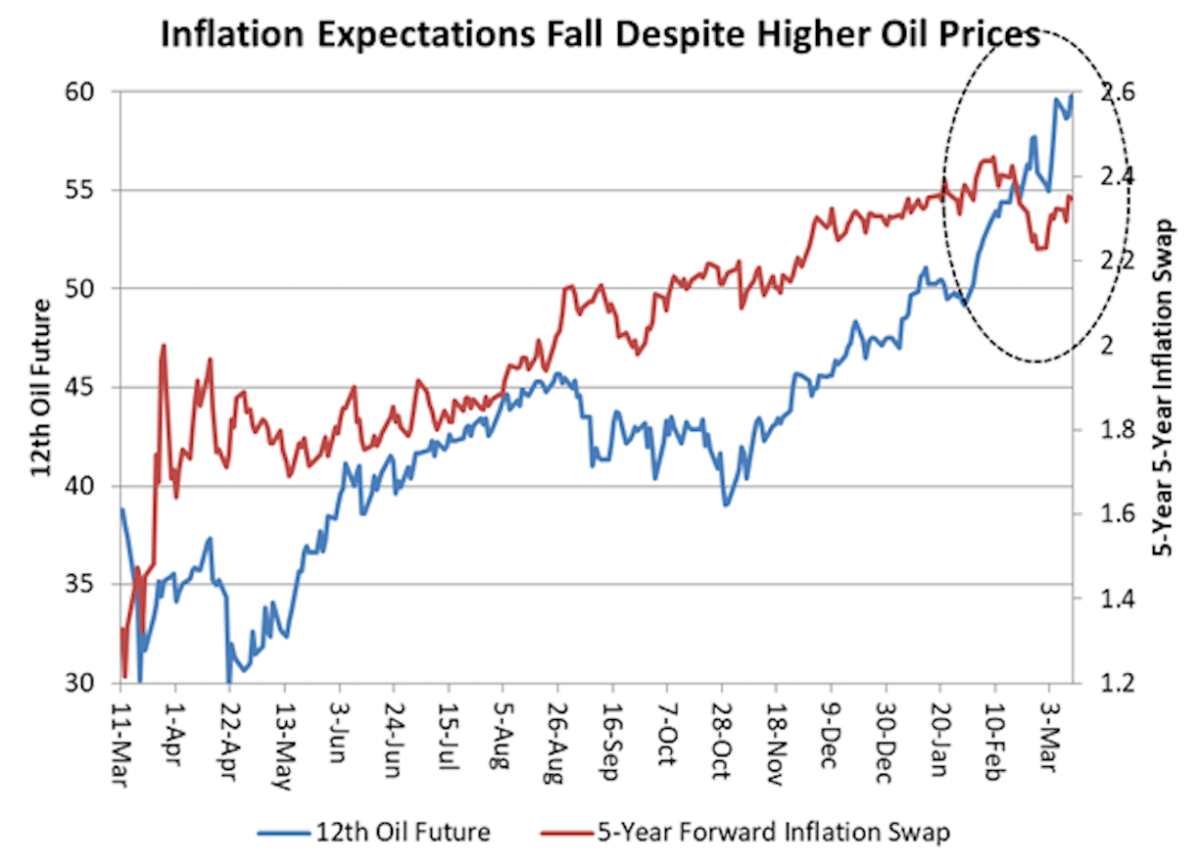

The cleanest measure of long-term inflation, the expected 5-year inflation rate 5 years forward, fell noticeably during the past week, despite a continued surge in oil prices. That’s unusual, because the expected inflation rate priced into inflation-indexed securities usually tracks the oil price.

During most of 2020, long-term inflation expectations rose despite falling oil prices (the market clearly thought the price drop was temporary). But now we have seen a fall in inflation expectations while oil prices are rising.

We call attention to this anomaly in order to beat our favorite dead horse, namely the widespread idea that a return of inflation will force the Federal Reserve to raise interest rates (or at least “taper†its enormous purchases of US Treasury securities), provoking a sharp reduction in stock market valuations.

As we showed in yesterday’s Chart of the Day, falling rents in the wake of the Covid-19 pandemic stem from high and persistent unemployment, and that’s the biggest item in family budgets. Medium-term inflation-protected bond yields have been falling for the past week, and stock prices have been recovering.

US tech stocks have come off the bottom, and Chinese tech stocks have bounced – less because of reduced worries about the Fed in the case of Chinese tech, and more because of de-escalation of the US-China tech war. The yield on the 5-year Treasury Inflation Protected Security is down to negative 1.81%, about 20 basis points below the February 25 peak at the worst of the Fed scare.

The tiger that the Fed has by the tail isn’t inflation. It’s a federal borrowing requirement in the range of $4.2 trillion, or a staggering one-fifth of US GDP.

The last thing the Fed wants is for the market to believe that yields are going to rise, because no-one would buy US Treasury securities, except, of course, for the Fed itself, which has been financing the US budget deficit for the past year on its ballooning balance sheet.

So the Fed will do whatever it takes to keep short- and medium-term yields low. And the stock market will bubble for some time before it (inevitably) hits trouble.

[ad_2]

Source link