[ad_1]

Spain has set up an €11bn programme to help companies hard hit by the coronavirus pandemic stave off insolvency after mounting concern that previous loans to aid businesses risk swamping them in debt.

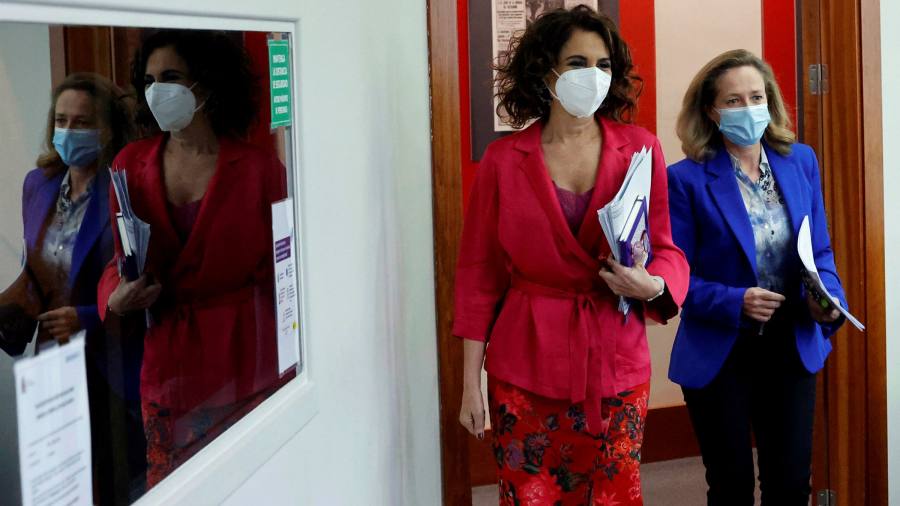

Nadia Calviño, the country’s deputy prime minister for the economy, said the package would provide a total of €7bn in direct non-reimbursable aid for companies and self-employed people struggling to pay their bills; €3bn to help restructure state-backed loans to businesses, including, as a last resort, debt cancellation for small and medium enterprises; and €1bn for “capitalisationâ€, which could include the state taking temporary stakes in some groups.

“We need to take measures to prevent possible solvency problems . . . to avoid a higher cost in the future,†she said at a press conference.

Among the programme’s priorities she listed: “stopping Covid from having a structural impact on our economyâ€, “protecting and supporting fundamentally viable businesses and sectors that are most affected by the pandemic†and “preventing over-indebtedness from wounding the recoveryâ€.

During the pandemic the state has underwritten around €120bn of loans to companies, including €51bn to groups in the commerce, transport and hospitality sectors and €24bn to manufacturing businesses.Â

In a letter to the European Parliament this month, Margrethe Vestager, EU competition commissioner, noted that “in relative terms Spain has disbursed the most [aid of all EU states between March and December last year]†at 7.3 per cent of gross domestic product.

Spain’s economy has also suffered exceptionally because of the Covid crisis, shrinking 11 per cent last year, with the tourism sector particularly badly hit. OECD estimates this week predicted that, despite growth this year, the country would remain one of the worst affected in Europe at the end of 2021, with GDP remaining more than 6 per cent below pre-pandemic predictions.

Calviño said the new government package — which provides particular help for the heavily tourism-dependent Canary and Balearic Islands — would require companies to remain operating until June 2022, and to forbear from paying dividends or increasing executive pay for a period of two years.

The government has also approved an extension from this month until the end of the year of a moratorium on bankruptcy proceedings for companies, while seeking to modernise the process for the future.

Officials in the CEOE, Spain’s main employers federation, reacted positively to the package but cautioned that it was important to get the aid quickly to companies in need. As a government decree, the package has the immediate force of law, but it will take time for it to be administered by the country’s 17 regions.

In an indication of the scale of the problem, the Bank of Spain warned last month that the 2020 income of 40 per cent of Spanish businesses was not enough to cover their financial costs, a figure that rose to 75 per cent for the hospitality industry. It has also estimated that 14 to 18 per cent of Spanish groups ran the risk of becoming insolvent.Â

Pablo Hernández de Cos, the Bank of Spain’s governor, has repeatedly warned of the knock-on effects of such business failures.Â

“Should such solvency problems materialise, this would not only lead to destruction [in] the productive system and employment, but would also eventually affect the resilience of the banking sector,†he said in a speech this month. He called for fiscal measures to “alleviate problems of over-indebtedness for firms considered to be viable, thus helping them to survive†and to “avoid a potentially significant deterioration in the banking sector’s financial position.â€

[ad_2]

Source link