[ad_1]

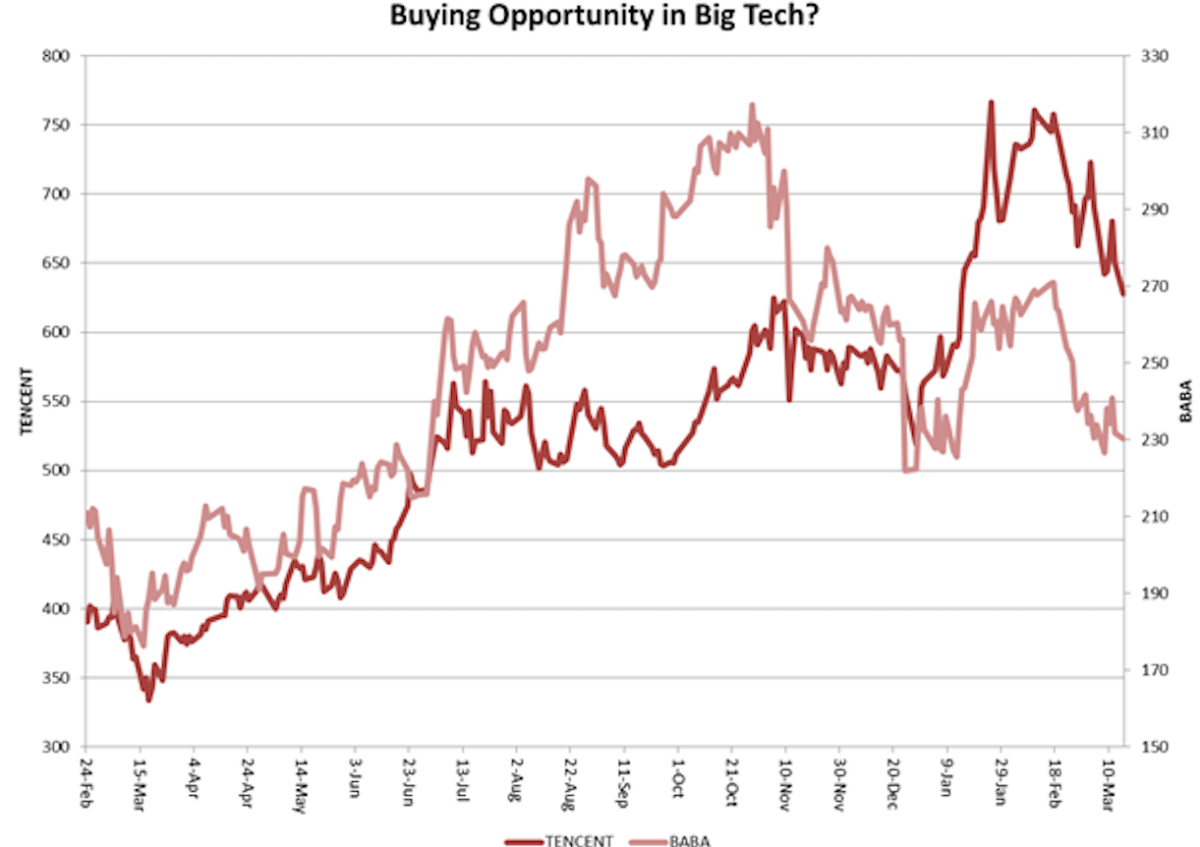

China’s two tech giants, Tencent and Alibaba, trade at double their year-ago pandemic price, but have dropped respectively 18% and 27% from their recent highs. Alibaba has been floundering since Chinese regulators clipped the wings of Ant Financial, the innovative but extremely leveraged fintech enterprise controlled by Alibaba founder Jack Ma. Anti-monopoly measures against Tencent meanwhile knocked $60 billion off its market capitalization during the past several weeks.

It looks like a buying opportunity to us. Alibaba now trades at just 22 times its estimated 2021 earnings, a comparative bargain considering that Amazon—with much slower growth than its closest Chinese counterpart—trades at 50 times expected earnings. Chinese regulators acted reasonably when they required Ant Financial to reduce its leverage. Their anti-trust actions against Big Tech responded to real abuses, for example, forcing merchants to use the Alibaba platform exclusively. China needs Big Tech to disseminate new technologies, including Fintech. It’s not going to cripple its most successful entrepreneurs, but it will make sure that they don’t write their own rules.

[ad_2]

Source link