[ad_1]

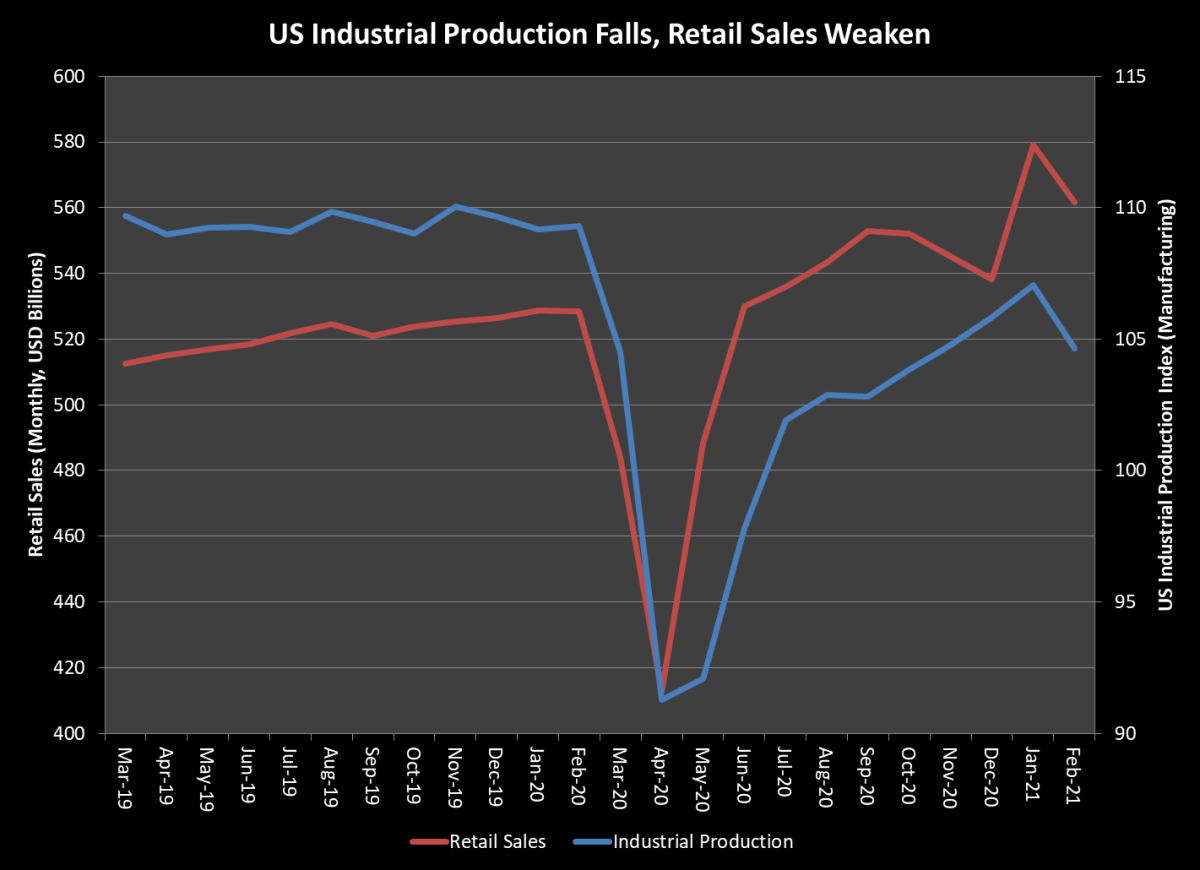

Just after Wall Street strategists revised up their forecasts for US economic activity, the government reported unexpected dips in industrial production and retail sales in February. A combination of post-pandemic reopening and anticipation of the Biden Administration’s $1.9 trillion in helicopter money was supposed to send consumers to the shopping malls or the Shopify website. The opposite occurred.

Excluding autos, February retail sales dipped by 2.7%, when the consensus forecast called for a slight increase following on a strong January. The economists blamed the weather, about which they had complete information when they made their forecast.

Weather and supply-chain constraints – for example, a shortage of semiconductors required by the auto industry –were blamed for a 3.1% drop in manufacturing production. (The consensus forecast had expected a 0.5% increase.)

Plainly, American consumers aren’t as confident as the Wall Street consensus thought, and US manufacturing has numerous weak spots, including supply chain as well as the availability of skilled labor. The US economy won’t collapse in 2021 but neither will it boom in a Pavlovian response to yet another fiscal stimulus.

Medium-term bond yields plummeted on the news, especially the bellwether 5-year inflation-indexed Treasury. After all the talk about rising bond yields in the face of a strong economy, this benchmark bond yields negative 1.89%, a hair’s breadth above its all-time low yield of negative 1.93%.

Stocks first rose because bond yields fell, but then the stock market ha a Wile E. Coyote moment: It did a double-take at the economic data, and fell along with it.

[ad_2]

Source link