[ad_1]

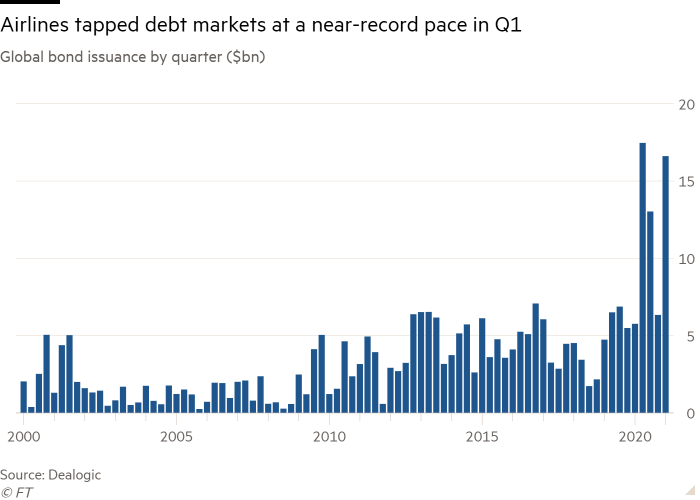

Airlines tapped a wave of investor enthusiasm to raise more than $16bn from bond markets in the first quarter, shoring up their finances as travel disruption stretches into a second year.

The figures highlight how the world’s biggest carriers have been able to raise a wall of money to help them through a period of unprecedented turmoil, with a third of the world’s fleet of commercial aircraft still in storage as passenger numbers collapse.

They also underline investor confidence in the long-term prospects of the strongest companies in the sector, as Covid-19 vaccines offer a way to reopen travel once curbs on movement are eased in major economies.

Airlines raised $16.6bn in the first quarter of this year, according to data provider Dealogic, just short of the record $17.5bn set in the second quarter of 2020 as companies dashed for cash during the initial, frantic stages of the pandemic. Overall, airlines raised $42.6bn in the debt markets in 2020, the most on record.

The activity has proven a boon for investment banks, which made more than $200m in fees from airlines, a first-quarter record, Dealogic said.

Investors have been willing to lend to strong airlines that are expected to emerge from the crisis relatively unscathed, but benign market conditions have also helped carriers, said Josef Pospisil, head of utilities and transport at Fitch Ratings.

“I am not sure it would be exactly the same if it wasn’t for the stimulus across the board,†he added.

In Europe, British Airways owner IAG and lower-cost rival easyJet raised €1.2bn each in separate bond issues that were oversubscribed.

The cash will help carriers to fortify their balance sheets at a time when there is still uncertainty over whether mass travel will be possible this summer.

“The simple answer is they are raising cash because they need it,†said Alex Paterson, an analyst at Peel Hunt.

Carriers have cut costs where they can over the past year, but are still left with significant staffing, leasing and maintenance overheads, and the global industry is forecast to burn through up to $95bn this year, according to the International Air Transport Association.

The near-term prospects for the industry look brightest in the US, where carriers have been bolstered by billions in taxpayer funds and a larger domestic market than in Europe. The US Transportation Security Administration reports that passenger numbers have exceeded 1m most days in March — half the roughly 2m travelling daily in 2019, but an improvement over January and February, let alone last year’s nadir below 100,000.

American Airlines launched an industry-record $10bn debt deal in March, which was made up of $6.5bn worth of junk bonds and $3.5bn in loans. Analysts calculate that the deal will give American, which estimates it will burn $30m in cash a day in the first quarter, about a year and a half of liquidity.

Investors have also moved into airline stocks.

MSCI’s global airlines index has risen 44 per cent since vaccine breakthroughs in November, although it is still down by a quarter since the end of 2019.

As well as hopes for the industry’s long-term recovery, companies have benefited from the “reopening tradeâ€, as investors move into parts of the stock market that suffered during the pandemic’s immediate impact.

Short-haul and low-cost flying is expected to lead the industry’s revival, and investors have poured money into carriers such as Ryanair and Southwest Airlines, which are both approaching all-time highs.

Other players, such as IAG, Lufthansa and United Airlines, are expected to recover more slowly because they are reliant on business and long-haul trips.

[ad_2]

Source link