[ad_1]

This article is an on-site version of our #techAsia newsletter. Sign up here to get the newsletter sent straight to your inbox every Wednesday

Hi, it’s Kenji from Hong Kong here. Apple is going all-in on 5G, according to a scoop from Nikkei Asia’s Taipei team (The Big Story). Staying with 5G, Ericsson fears its sales in China could suffer from the Swedish government’s decision to bar Huawei and ZTE. Turning to India, billionaire Mukesh Ambani is teaming up with Google to convert millions of old phone users — some even on 2G networks — to smartphones (Mercedes’ top 10). Finally, from Japan, where the Olympic Games are about to start, we feature the president of top bicycle parts maker Shimano, who is apologetic even though the company’s profits are surging. Find out why in Spotlight. See you all next week!Â

The Big Story — Exclusive

All iPhones released next year will be 5G-capable, according to this exclusive in Nikkei Asia. The plan marks a big endorsement for 5G technology and a big departure for Apple, which has been a latecomer to the 5G race, launching its first 5G phones after rivals Samsung, Oppo, Xiaomi and Huawei had all done so.

Apple will not introduce any new 4G phones next year and will start selling a version of its cheapest handset — the popular iPhone SE — that is compatible with 5G, which provides for faster processing speeds and bigger traffic capacity.

Key developments: The budget 5G iPhone is set to hit the market as early as the first half of 2022, sources briefed on the matter said. It will be powered by Apple’s own A15 processor — the same chip that will go into this year’s premium iPhones — and its 5G connectivity will be enabled by Qualcomm’s X60 modem chip, they added.

Apple will not introduce an updated version of the iPhone mini next year after the premium smartphone with a smaller screen failed to catch on with consumers. The iPhone mini will be replaced by an additional version of the 6.7-inch iPhone Pro Max next year.

Apple introduced the 5.4-inch mini last year but slashed production orders for the first half of 2021 after demand was lower than expected. The company has also scaled back production plans for this year’s mini model compared with last year, sources said.

Upshot: Apple is going all-in on 5G. It is also reshuffling its product offering to optimise sales. Apple declined to comment.

Mercedes’ top 10

-

The US and its allies said China teamed up with criminal gangs to commit widespread cyber attacks. Beijing slammed the allegations as a “malicious smearâ€. (FT)

-

Swedish telecoms group Ericsson fears that sales in China may plunge as a result of Stockholm banning Huawei from building 5G networks. (FT)

-

The latest blow to the global chip supply chain comes from south-east Asia. Crucial hubs in Vietnam and Malaysia have been hit by record coronavirus cases. (FT)

-

Is India the new hope for tech investors? The country’s tech IPO boom has arrived just as China’s internet sector suffers a regulatory crackdown. (FT)

-

The US has lured foreign chipmakers onshore with subsidies. Top American chip company Intel has not taken kindly to the move. (Nikkei Asia)

-

Beijing is making strides with its virtual currency. The digital renminbi has already been used 1.32m times as part of a trial, with transactions totalling $5.34bn. (Nikkei Asia)

-

Google and Mukesh Ambani’s Jio have teamed up to crack India’s smartphone market. But price may be a sticking point. (FT)

-

Taiwan’s TSMC confirmed it is considering its first chip production site in Japan as it builds up its overseas manufacturing footprint. (Nikkei Asia)

-

South Korea’s digital lender Kakao Bank has been forced to defend its huge valuation of at least $13.6bn ahead of its IPO next month. (Nikkei Asia)

-

The Tech Tonic podcast has a fascinating take on the use of artificial intelligence in investing. Is AI outsmarting investors or just helping some get smarter?

Our take

The Hong Kong book fair was once a symbol of freedom, displaying all sorts of Chinese language books, including those banned in China. But this year’s fair, which ended yesterday, represented the first time that publishers and exhibitors were forced to fully confront the problem of whether their books would violate the national security law that was imposed last June by Beijing.

When public libraries pulled at least 70 books from their shelves for “review†this year, Daniel C Tsang, distinguished librarian emeritus at the University of California, Irvine, advised the local publishing industry to seek “creative ways to provide access to informationâ€, including the use of online resources abroad. “Keep a diary but archive it on the cloud. Later, when the situation improves, it will make amazing reading,†he said.

Bao Pu, founder of independent publisher New Century Press, which handles sensitive topics of modern Chinese history, is counting on major libraries around the world that will allow people to search his books online. The latest title he published this month, Through the Storm: The PLA in the Cultural Revolution, was not on display at the book fair, while no local library has purchased it. But Harvard University did and the book can now be accessed from anywhere online.

Sam Cheng, co-founder of Hillway Culture, is one of the few bold publishers to sell books deemed to be “sensitive†under the new law. He virtually sold out all those books but to fulfil his mission as an independent publisher, he is “considering anything to spread our books around the worldâ€. E-books are among the options he is looking at to protect his content from being censored.

— Kenji

Smart data

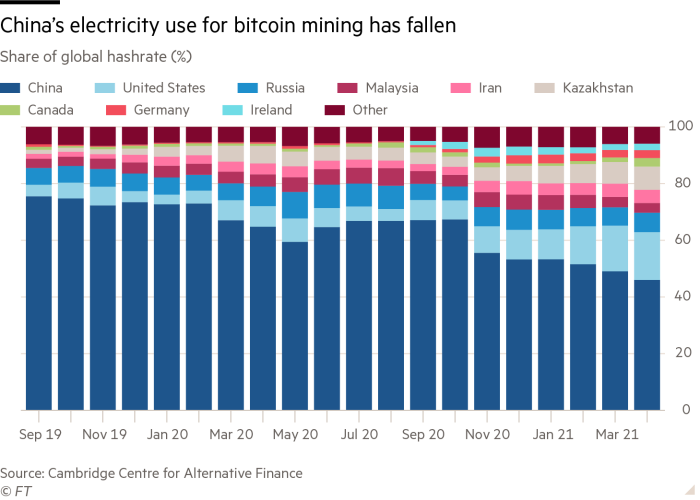

Reinforcing our cover story last week, this chart shows China’s rapid decline as a cryptocurrency mining power. China’s share of global electricity usage for bitcoin mining fell to less than half for the first time this April, while Kazakhstan has catapulted to third place as its share of mining increased sixfold.

China’s global hashrate, the computational power required to mine new bitcoins, fell from more than 75 per cent to 46 per cent of the global total between September 2019 and April 2021, according to data from the Cambridge Centre for Alternative Finance. The following month, Beijing stepped up its crackdown on the energy-intensive industry, which it has been trying to curtail for close to a decade.

Spotlight

It is hard to think of what Taizo Shimano, president of the Japanese bicycle parts company that bears his name, would have to apologise for. The company’s profits and revenue are surging. Last year, its market capitalisation overtook that of Nissan, the Japanese automaker.

And yet, Shimano is contrite. “We deeply apologise,†he says in a Nikkei Asia interview. His problem is one many would like to have. Demand has exploded, leaving Shimano unable to satisfy all of the orders from bicycle makers around the world.

“We are reprimanded by . . . [bicycle makers],†Shimano said.

An unprecedented surge in the popularity of cycling, boosted by the pandemic, lies behind the wave of demand. All of Shimano’s 15 factories around the world are working at full tilt and the company is expecting output will rise 50 per cent year on year.

The company is investing in factories in Osaka and Yamaguchi to boost capacity and improve efficiency. It is also building a plant in Singapore. The world’s leading supplier of bicycle parts is also preparing for the next big market: e-bikes powered with lightweight batteries.

When sages speak

-

The rise of renewable energy is reshaping geopolitics. The guys at MacroPolo have come up with a New Energy Geopolitics Index to track, rank and visualise this shift among 25 countries.

-

If you are looking for an in-depth update on the trends shaping ecommerce in China, Rui Ma of Tech Buzz China has an interview with Robert Wu of BigOne Lab, an alternative data firm.

-

Jordan Schneider on the excellent ChinaTalk podcast has a fascinating chat with Yan Zheng at In-Q-Tel, which invests in start-ups for the CIA and the rest of the US intelligence community. It is relevant to Asia, by the way.

[ad_2]

Source link