[ad_1]

Aviva to funnel £10bn of workers’ pension money into climate-friendly investments as it unveils plan to become net zero by 2040

- Aviva is committing a ‘substantial’ portion of the money it collects from auto-enrolment pension funds to investments which tackle climate change

- Every employee over the age of 22 who earns more than £10,000 per year pays into an auto-enrolment pension, unless they opt outÂ

- And Aviva serves 3.5m of those workers, who will now be helping to fund the UK’s green recovery from the pandemicÂ

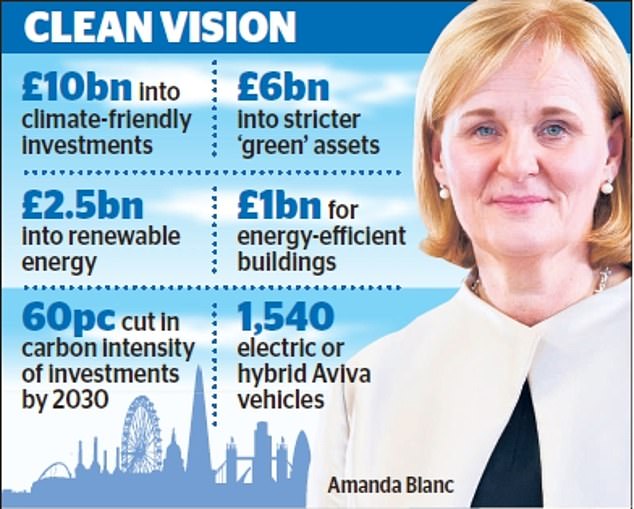

Aviva is set to funnel £10billion of workers’ pension money into climate-friendly investments by the end of next year as it unveils an ambitious plan to become net zero by 2040.Â

The pensions and savings giant is committing a ‘substantial’ portion of the money it collects from auto-enrolment pension funds to investments which tackle climate change.Â

Every employee over the age of 22 who earns more than £10,000 per year pays into an auto-enrolment pension, unless they opt out.Â

And Aviva serves 3.5m of those workers, who will now be helping to fund the UK’s green recovery from the pandemic as £10billion of their retirement savings are used to fund projects from nuclear power sites to energy-efficient housing.Â

Following the example of other institutions, such as insurance marketplace Lloyds of London and government-backed pension fund Nest, Aviva will also ditch its coal investments.Â

By the end of 2022, it will sell off all its shares in companies which make more than 5 per cent of their revenue from coal – unless they have signed up to the Science Based Targets initiative which helps cut emissions. And it will also stop offering insurance for any companies making more than 5 per cent of their revenues from coal.Â

Aviva’s chief executive Amanda Blanc said: ‘Aviva is taking bold steps to help tackle the climate crisis. As the UK’s leading insurer, we have a huge responsibility to change the way we invest, insure and serve our customers.Â

‘For the world to reach net zero, it’s going to take leadership and radical ambition. And it is going to take Aviva to play our part.’ Under Blanc’s plan, the carbon dioxide emissions from Aviva’s own operations and supply chain will hit net zero by 2030.Â

This will involve buying in 100 per cent renewable electricity for all its offices, which total 230,231 square metres, and swapping the leases on its 1,540-strong vehicle fleet from diesel-guzzling cars to all electric and hybrid models. By 2040, Aviva’s entire investment portfolio will be net zero on carbon dioxide emissions.Â

Business and Energy Secretary Kwasi Kwarteng said: ‘Business have a huge role in tackling climate change.Â

‘It is fantastic that Aviva is taking radical action across its business, which will help the UK eliminate its contribution to climate change.

‘We must work with companies like Aviva to harness the strength of the UK’s financial sector to unleash the private capital necessary to reduce carbon emissions and support new jobs as the UK builds back greener.’Â

Aviva’s policy comes just weeks after its rival M&G announced a new £5billion fund to invest in private firms which are pioneers in creating green technology.Â

In the medium term, Aviva is aiming to cut the carbon intensity of its investments – or how much carbon dioxide a firm produces relative to the intensity of its work – by 25 per cent in the next four years and 60 per cent by 2030.Â

To do this, its asset management arm Aviva Investors – which looks after more than £350billion of savers’ money – will plough £6billion into green assets by 2025.Â

And it will commit £2.5billion to low carbon and renewable energy infrastructure, which is slightly broader than the strict ‘green’ definition and includes areas such as nuclear power.

[ad_2]

Source link