[ad_1]

Andrew Bailey’s trenchant criticism of the European Commission has deepened anxieties in the City of London that the UK and EU will fail to agree a series of equivalence deals that will allow the UK to trade more freely in Europe’s financial services market following Brexit.

The Bank of England governor on Wednesday accused Brussels of making a “mistake†in shutting the City out of its markets since the start of the year and vowed to carry on setting financial regulation in the UK’s interest.

The EU, meanwhile, insists the UK must outline its plans for future regulations before it can consider granting “equivalence†status to Britain in most areas of financial services.

“The EU has argued it must better understand how the UK intends to amend or alter the rules going forward,†Bailey said in a speech to financial executives. “This is a standard that the EU holds no other country to and would, I suspect, not agree to be held to itself.â€

With both sides adopting increasingly entrenched positions, the prospect of a breakthrough looks slim — especially as the EU is eager to capture a greater share of the market, which London has dominated for so long.

Lord Jonathan Hill, the former EU financial commissioner who is leading a government review into the UK listings regime, told the Financial Times recently that he did not think Brussels would back down.

“Given that their strategy is to build up the EU, why on earth would they? And the more we ask, the more they think it gives them leverage,†he said.

His scepticism was echoed on Thursday by Michel Barnier, the EU’s former chief Brexit negotiator, who dismissed suggestions that the EU would rush to award an equivalence decision to the UK and warned of attempts by some firms to get backdoor access to the single market.Â

Barnier said the EU would not take any risks with its “financial stability†and “financial sovereignty†when considering an equivalence decision. The bloc needed “further clarification [from the UK] in particular regarding whether or not the UK will diverge from EU rulesâ€.Â

“The EU will consider an equivalence decision when it is in the EU’s interest,†Barnier said.Â

With leaders in Brussels under fire for their handling of the bloc’s coronavirus vaccine procurement, a row with the UK where it succeeds in gaining business from London might help to divert attention. According to one UK official, the “EU’s best hope of getting more business is if we remain paralysedâ€.

But after a difficult few weeks, Bailey might have also welcomed the distraction of Brexit.

This week Bailey faced allegations from a former judge that he misrepresented to MPs his reasons for asking not to be named in a highly critical report into his handling of a £236m investment scandal.

The spat came shortly before the BoE was rocked by the sudden departure of Alex Brazier, the head of the bank’s financial stability strategy, who was seen internally as “future governor materialâ€.

The central bank has also been accused by its internal watchdog of having “knowledge gaps†about the effectiveness of its flagship quantitative easing programme, adding to the pressure on Bailey.

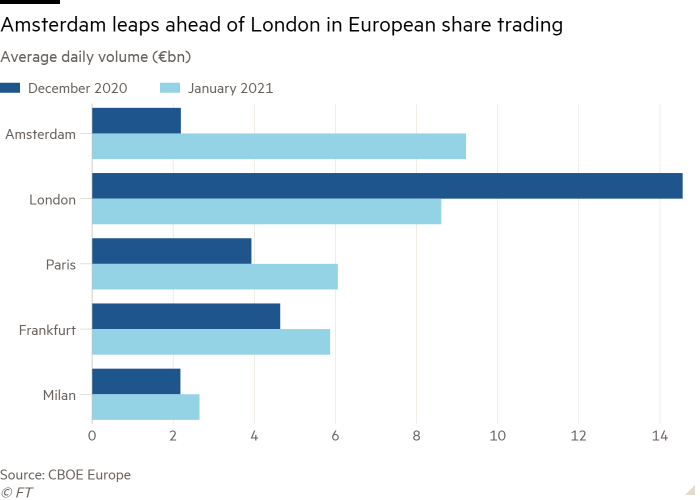

Caught in the middle of the regulatory argument, the City is increasingly concerned. With share trading in Amsterdam overtaking that of London last month, UK-based brokers and traders are now reconciled to finding other ways to trade in the EU.

On Tuesday, broker Numis became the latest to be forced into moving some of its business to the bloc, saying that it intended to establish an EU-based office in the next 12 months.

“Brexit will have a minimal impact on our financial performance in the short term, however we believe comprehensive EU market access is strategically important for the business in the longer term,†it said.

Most large banks and financial institutions prepared for a hard Brexit over a year ago — shifting people and assets to offices in the EU — which meant that there were no sudden shocks when the UK left the single market on January 1.

TheCityUK, which represents businesses in the financial services sector, has called for progress on regulatory equivalence with the EU, pushing for the speedy establishment of a framework for future regulatory co-operation.

Miles Celic, chief executive of TheCityUK, said that the industry was “pragmatic about the increased friction†but urged the two sides “to move quickly and get these additional agreements in placeâ€.

That looks less likely in the short term with UK regulators refusing to outline how its regulations will change in the future and Brussels insisting that is a prerequisite for granting equivalence status in many areas of financial services.

Amid the impasse, Bailey, with the support of the Treasury, is now seeking to shift regulations in a direction that benefits the City and London’s future — even if that requires divergence from Brussels.

In areas such as its refusal to follow new EU regulations, which will include counting software as banks’ capital, the UK insists it can demonstrate it is not seeking to create a light touch financial regulation regime, but is in fact aiming to make London the best place to operate financial services efficiently and safely.

The Treasury said it had already set out plans to reinforce the City’s success, “making it more open, technologically advanced and a global leader in green financeâ€.

It still hopes for a better deal with the EU, but that is no longer its top priority. “We still believe a full set of mutual equivalence decisions is in everyone’s interest, and remain open to discussions with the EU, but we are clear that we have global ambitions for the sector,†the Treasury added.

[ad_2]

Source link