[ad_1]

For most of my life, I have not been a fan of golf. With all the elitism and environmental issues and myriad other problems, it certainly ranks among the least ESG-friendly sports. And that’s not to mention how dreadfully boring it always seemed on TV.

However, the quarantine has done strange things to us all. Last summer, when everything indoors was locked down, some of my friends took up the game and invited me to join. Initially, I demurred. But when they explained that it was really just an excuse to hang out outside and drink a couple of beers in a socially distanced manner, I came around pretty quickly.

And a year later, we are still playing most weekends — even as New York City starts to reopen.

I am not alone: a surge of new players during the pandemic has been credited with saving the sport from extinction. But now comes a new twist: environmental, social and governance (ESG) fashions are hitting golf.

This week the Moral Money team received a PR pitch from a company touting its new line of sustainable golf clothes. This may seem farcical. But the mere fact that someone thinks there’s a market out there for eco-friendly golfwear is a striking sign of the times.

Personally, I won’t be rushing out to update my wardrobe. For one, I’ve managed to grow comfortable with the cognitive dissonance required to be a golfer who writes an ESG newsletter.

And besides, I think my money would be better spent on golf lessons. If I really want to cut down my environmental impact, the best thing I can do is to stop creating plastic pollution by shanking balls into the water. Billy Nauman

A survey that got our attention

On any given day, our inboxes here at Moral Money are flooded with approximately a million (give or take) pitches about ESG surveys or reports. And truth be told, it is rare we even open them.

Apologies to all the PR people reading this and shaking their fists in rage, but there are so many of you, so few of us and not enough hours in the day.

The big problem is most of these pitches follow a similar formula: [Group X] polled [Group Y] and found soaring interest in [insert ESG topic here]. Rarely do they provide any compelling information we haven’t already seen.

Sometimes, though, one will jump out and grab our attention, such as this new survey of bank risk managers from EY and the Institute of International Finance (IIF).

In their poll, they found that interest in climate risk is (yes) soaring among banks. But what stood out about this survey is that it was not designed specifically to gauge opinions on ESG.

The pollsters simply asked banks’ risk officers what they thought was the biggest threat to their business. And climate organically popped up at the top of the heap.

Over a one-year timeframe, climate ranks third behind credit risk and cyber security. And over the next five years, risk officers see climate as the top problem banks will have to deal with.

This is the 11th year EY and the IIF have run this poll, and climate risk really “came out of nowhereâ€, said Mark Watson, financial services managing director of EY Americas.

One “blindingly obvious†reason for this is the increase of extreme weather events such as wildfires and hurricanes that can interrupt day-to-day operations, he said. Banks are also concerned about upcoming climate stress tests from central banks, stranded assets and the transition risks that will accompany governments’ moves to crack down on emissions.

However, the heightened awareness is not all negative. Watson said banks were looking at climate more closely now because they saw a big opportunity. “I think people finally realise in financial services, we do not get to a zero-carbon economy without finance.â€

The obvious question is: what are they doing about it? We have, of course, seen a number of net-zero pledges of, let’s say, erm, varying ambition. But Watson thinks more serious action is on the horizon.

Banks were already appointing dedicated climate risk teams at very senior levels, he said. And he thinks banks are planning a big push on transition financing to enable large corporates, SMEs and individuals to go green.

“Once you see innovation in that space at scale, the acceleration will be enormous,†he said. (Billy Nauman)

Despite corporate racial equity pledges, minority founders endure funding woes

With the huge amount of money companies pledged for racial equity last year — including JPMorgan’s $30bn commitment, you might expect cash to be flooding into start-ups founded by minorities.

But such funds have not quickly percolated through the financial system. During the pandemic, less than 1 per cent of the $150bn businesses raised from venture capitalists went to black start-up founders, according to Crunchbase. Funding for female founders slumped too, PitchBook said.

There was “a flight to risk-lessness†during the pandemic that stung those outside the clubby network of venture capital, which historically favoured white, male founders, said Oliver Libby, a venture capitalist in New York.

Libby’s firm has been one of the few VCs to seek out minority founders well before the Black Lives Matter movement brought increased scrutiny to the lack of diversity in the corporate world. This week, his firm unveiled its first series A-focused venture fund, which comprises solely women and minority founders in its first seven portfolio companies — one of the only generalist funds founded by white VCs that has such a diverse portfolio.

The industry must do more with its financial heft to deliver meaningful change, Libby told Moral Money. A lot of large companies and limited partners were setting aside allocations for minority venture capitalists, he said. While that is “fantastic newsâ€, most of the funds are starting small.

Libby’s fund companies experienced the funding challenges first-hand last year. Travis Montaque, founder of Holler, one of the fund’s investments, said there was an investment pullback last year just as his business was enjoying significant growth.

“If we want to actually make the changes that we talked about last year as an industry, the legacy VC funds that have been around for a while — most of them are controlled by people who look like me — also have to invest in under-represented founders in a serious way, out of their main vehicles, not a sidecar, not a donor-advised fund,†Libby added. (Patrick Temple-West)

Lego learns dropping plastics is not child’s play

Legos have always enjoyed a sense of timelessness. Its plastic bricks do not decompose, ensuring parents’ blocks stored for decades in an attic can joyfully be presented to the next-generation tots eager to get building.

But the ABS plastic used by Lego has long posed an environmental problem for the Danish company. For 1kg of ABS, it needs about 2kg of petroleum. Eager to wind down plastic use, Lego has been seeking for years to develop environmentally-friendly bricks. But the problem haunting Lego’s sustainability drive is that the plastic alternatives need to lock together and still be easily separated — a metric known as “clutch powerâ€, in Lego terms.Â

On Wednesday, Lego announced a breakthrough. It is testing plastic from discarded bottles for bricks that appear to do the trick. More than 150 people had been testing more than 250 different bottle variations for three years to get to this point, the company said.

It will still be a while before the recycled plastic bricks appear in Lego products, the company added. The next phase of testing is expected to take at least a year.

While Lego’s effort might be taking a while, it underscores the increasing R&D spending for sustainable alternatives — from agriculture (see BASF’s announcement this year) to fashion. With this demand established, investors will hopefully be willing to pour cash into experimentation and progress can accelerate — brick by brick. (Patrick Temple-West)

Charts of the day

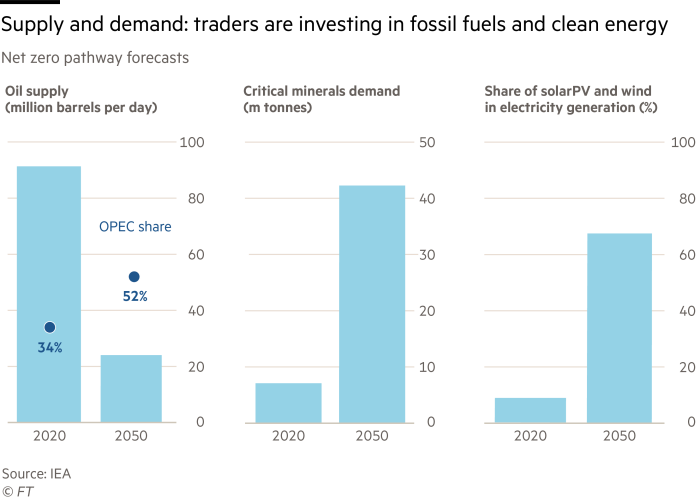

For commodities traders, the shift away from hydrocarbons is not a threat but an opportunity for profit, writes FT natural resources editor Neil Hume. Market leaders are already sinking cash into renewable power and looking to bulk up in fast-growing markets such as carbon trading, while continuing to invest in oil projects in the expectation that a supply gap will emerge over the next decade.

This year has been an unprecedented one for ESG shareholder proposals at US companies. To date, there have been 34 majority votes for ESG proposals, shattering last year’s record of 21, according to new research published on Thursday. Last year, only two votes surpassed 70 per cent, while this year 17 did.

Smart read

A bull case for ESG

Do ESG mutual funds deliver on their promises? A trio of academics published a report this month that they said offered “the most complete empirical overview of ESG mutual funds to dateâ€. Their findings are unwavering: “Simply put, analysis reveals that, at present, ESG funds do not present distinctive concerns from either an investor protection or a capital markets perspective,†they said. “There is simply nothing in our results that suggests that ESG funds are worse than conventional funds when it comes to costs, returns, or risk.â€

Further reading

-

Resignation of Brazil environment minister cheered by activists (FT)

-

The Little Hedge Fund Taking Down Big Oil (NYTimes)

-

Here’s how the EU could tax carbon around the world (Bloomberg)

-

EU tries again to strike deal on greener farming subsidies (Reuters)

-

Environmental Investing Frenzy Stretches Meaning of ‘Green’ (WSJ)

-

Twilio, Asana to List on Long-Term Stock Exchange as ESG Push Continues (WSJ)

[ad_2]

Source link