[ad_1]

The writer is chief economist at Enodo Economics

China has already made one attempt to turn the renminbi into an international currency and reduce its dependence on the dollar. It is now trying again, and this time things really could be different.

The renewed effort to dethrone the dollar is based in large part on China’s technological prowess. It is banking that the development of the necessary financial infrastructure, the country’s world-beating mobile payments systems and a successful launch of the digital version of the renminbi will make it easier to use and promote the currency beyond China’s borders.

The approach is unorthodox. But if Beijing succeeds in its quest it will undermine the dollar-led global order, at least in China’s sphere of geopolitical influence, and challenge the way America wields power.

Given that China is the second-largest economy and the world’s biggest trading nation, the renminbi should be used far more extensively than it is. However, Beijing’s determination to retain capital controls has prevented it from following a conventional path to reserve currency status.

China is still operating restrictions on money flows, so why has the outlook for the renminbi brightened?

A reserve currency has to serve as a medium of exchange, a store of value and a unit of account. According to Mark Carney, the former governor of the Bank of England, history has showed that the most important of these attributes is the first one.

Since its first abortive bid to challenge the dollar between 2009 and 2015, China has made progress in setting up a digital renminbi payments system that, by being cost-effective and easy to use, satisfies Carney’s criterion for usefulness.

The People’s Bank of China is well advanced in preparations for the digital renminbi, which will initially serve the domestic economy. But the central bank is also working with its counterparts in Hong Kong, Thailand and the United Arab Emirates, alongside the Bank for International Settlements, on using a digital ledger of transactions that is distributed among counterparties. The aim is to harness central banks’ digital currencies to make multicurrency cross-border payments simpler and cheaper.

Success will depend partly on other countries’ willingness to embrace China’s financial innovations and western nations could well resist. But the project offers benefits that should appeal in particular to emerging markets poorly served by current arrangements in which a “correspondent†bank often acts as intermediary for another to facilitate transfers.

China has also made progress on boosting the renminbi’s attractiveness as a store of value, establishing its credentials as a stable, low-inflation economy even as financial markets worry that unprecedented fiscal and monetary stimulus will unleash inflation in the US, tarnishing the dollar.

Importantly, central banks and financial institutions that regard the renminbi as a credible store of value now have more rein to express their view. China has opened its capital markets more to foreign investors, triggering hefty inflows into stocks and bonds over the last couple of years.

True, China retains capital controls. But a successful rollout of the digital renminbi, which will be firmly under the control of the PBoC, is likely to make the Communist party more comfortable with relaxing controls because the authorities will have full visibility over two-way flows.

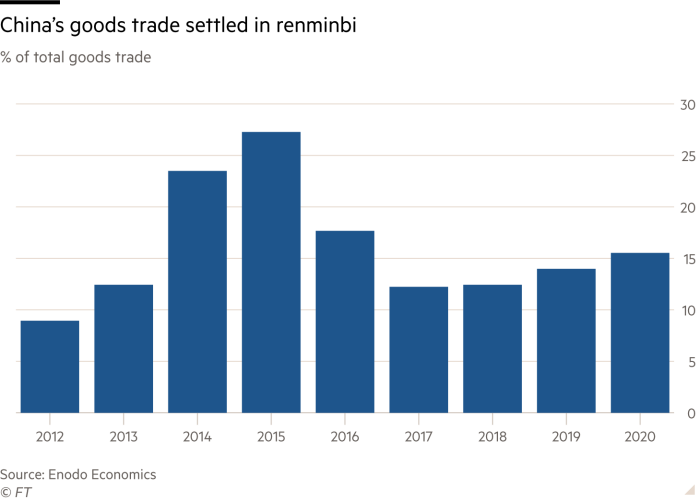

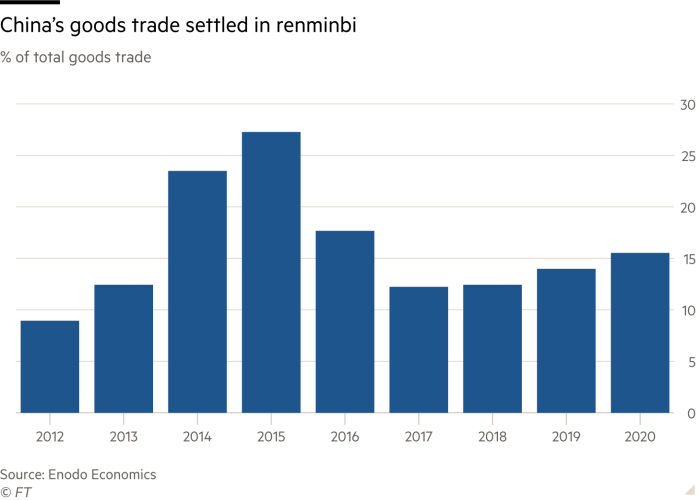

Finally, the renminbi’s functions as a unit of account have also increased since the initial bid to internationalise the renminbi. Trade invoicing in renminbi still has to regain its peak 2015 levels, but in the meantime China has launched renminbi-denominated futures contracts in a number of commodities, including oil and gold.

Those who doubt the renminbi will become a reserve currency will point to the absence of the rule of law in China, the lack of independent institutions, and the opaque and unpredictable policymaking of an authoritarian regime. But those who doubt the dollar can remain the undisputed apex currency only have to point to the recent attacks in the US on the democratic institutions that are also meant to be an indispensable underpinning of reserve currency status.

China is now striving to capitalise on a reputation for innovation in payments to carve out a sphere of currency influence, defined not by common interests or political culture but by shared infrastructure and technical standards. While interests can change, the hard wiring of digital and economic connectivity is far harder to break once established. And it is China that enjoys first-mover advantage.

Â

[ad_2]

Source link