[ad_1]

Analysts are predicting that “Dr Copper†will go on a sustained rally as the China-led global economy shows signs of climbing out of the coronavirus slump, though some long-term investors are adamant about staying away.

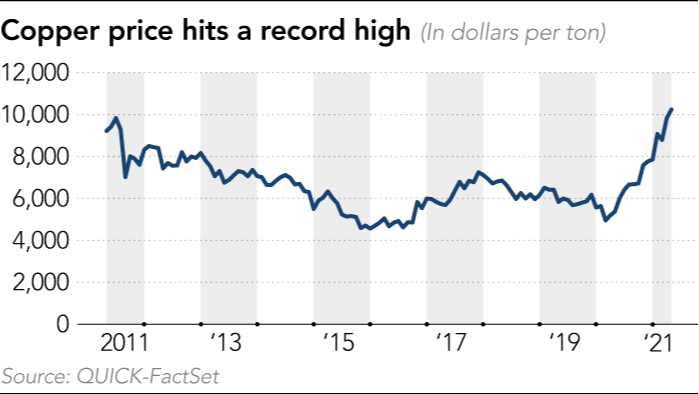

The benchmark copper price on the London Metal Exchange in early May hit a record high, at $10,460 a ton, and has since remained above $10,000. Its price had not been near that threshold for a decade; to reach it, it almost doubled in a year.

Market analysts are not surprised.

The leap “was expectedâ€, said Takayuki Honma, chief economist at Sumitomo Corporation Global Research. “Sooner or later the price would have gone above $10,000.â€

The impact of the pandemic has done little to soften demand, mainly due to China’s speedy recovery.

China is the world’s biggest copper buyer, consuming half of all global output. The country’s imports of unwrought copper and products rose 9.8 per cent during the January-April period compared with a year earlier.

“There is almost no reason for copper prices to go down,†said Tetsu Emori, chief executive of Japanese investment advisory Emori Fund Management. Emori noted that copper was turning into an attractive commodity for investors, especially as major countries push for decarbonisation, which is expected to boost demand for electric vehicles as well as wind and solar power generation stations.

Copper is mainly used to make electric cables and is indispensable to infrastructure builders. It earned its “Dr†honorific for its uncanny ability to predict the health of the world economy.

China’s recovery has triggered a price jump for many commodities despite the pandemic. In just one year, iron ore prices jumped 78 per cent and the benchmark price of lumber tripled. Prices of other metals such as nickel and aluminium have also risen.

Many analysts say copper is unlikely to fall well below $8,000 a ton.

“Copper is now exploring a new price equilibrium point,†said Honma at Sumitomo Corporation Global Research. He forecasts that “copper’s new price level will go up a notchâ€.

His bullish view is not groundless.

Goldman Sachs estimates that copper demand will grow nearly 600 per cent, to 5.4m tons, by 2030 due to the green transition. However, the market could face an 8.2m ton supply gap by 2030.

New mine development has been limited for the past decade, and mining companies remain cautious about doubling down on new developments amid rising costs.

Promising mines are located in places where it is difficult to deliver large equipment. A rise in environmental awareness is also causing an increase in environmental mitigation costs. Even if companies start exploring mines now, it would take at least five years for one to yield anything.

Across Asia, meanwhile, shares in mining and trading companies have soared on rising demand for copper.

The stock of Japanese trading house Marubeni Corp has surged more than 34 per cent since the beginning of the year, while nonferrous-metal producers such as Dowa Holdings and Eneos Holdings have posted strong year-to-date gains.

Similar trends can be seen in other parts of the region. In South Korea, shares in copper manufacturer Poongsan Corp have jumped more than 46 per cent this year, while those of Korea Zinc are riding 16 per cent gains. Chinese copper miner Jiangxi Copper’s stock price has risen 47 per cent in Hong Kong, while Zijin Mining Group’s price has soared 31 per cent.

This article is from Nikkei Asia, a global publication with a uniquely Asian perspective on politics, the economy, business and international affairs. Our own correspondents and outside commentators from around the world share their views on Asia, while our Asia300 section provides in-depth coverage of 300 of the biggest and fastest-growing listed companies from 11 economies outside Japan.

Money has flowed into shares of related companies as hopes for an extended copper rally give investors an appetite for risk. It is also a part of a trend in which investors are rotating out of highflying growth stocks and into cyclical stocks in anticipation of economies recovering from their Covid swoons.

As a result, the mining sector has outpaced tech stocks in recent months.

Shares in big tech names such as Apple and Alibaba Group Holding remain in negative territory compared with the start of the year and those of Japan’s SoftBank Group and Taiwan Semiconductor Manufacturing Company only show modest gains.

The MSCI ACWI metals and mining index, composed of large and mid-cap stocks across 23 developed and 27 emerging markets, has advanced 20 per cent this year, well above the 4 per cent gain recorded by the MSCI ACWI information technology index.

Deluged by inflows, copper exchange-traded commodity funds are also showing significant jumps in returns.

The WisdomTree Copper ETC has recorded about an 80 per cent return in the past year, with assets under management at one point growing to a record of more than $900m. The United States Copper index fund, with more than $300m in AUM, has also logged a one-year return of more than 80 per cent.

Japan’s trading houses last year attracted global attention when it was revealed Warren Buffett’s Berkshire Hathaway had purchased a little over 5 per cent of the shares of Marubeni, Sumitomo Corp and three other big traders.

Buffett, known as a value investor who holds stocks for long periods, said in a statement that the trading companies “have many joint ventures throughout the world and are likely to have more . . . I hope that in the future there may be opportunities of mutual benefit.â€

Trading houses are deeply involved in the real economy. They supply energy, metals, commodities and a range of other products in resource-poor Japan.

Meanwhile, some long-term investors are cautious about putting their money in a sector that depends heavily on economic conditions and market cycles.

Masafumi Oshiden, head of Japan Equity at BNY Mellon Investment Management in Tokyo, said: “It is still difficult to make a positive assessment based on ESG [environmental, social and governance] criteria.â€

Companies are under growing pressure from activists and investors to act to tackle climate change, while governments around the world have started to announce their commitments to decarbonisation. Mining companies have been urged to shift towards cleaner production processes and commit to greater transparency in order to align with ESG values.

Oshiden, whose investments focus on the prospects of enhancing long-term corporate value, points out that mining companies do not fit this strategy yet. “Earnings are also hard to predict for trading houses,†he said, “which operate in multiple fields of business.â€

A version of this article was first published on May 24 by Nikkei Asia. ©2021 Nikkei Inc. All rights reserved.

Related stories

[ad_2]

Source link