[ad_1]

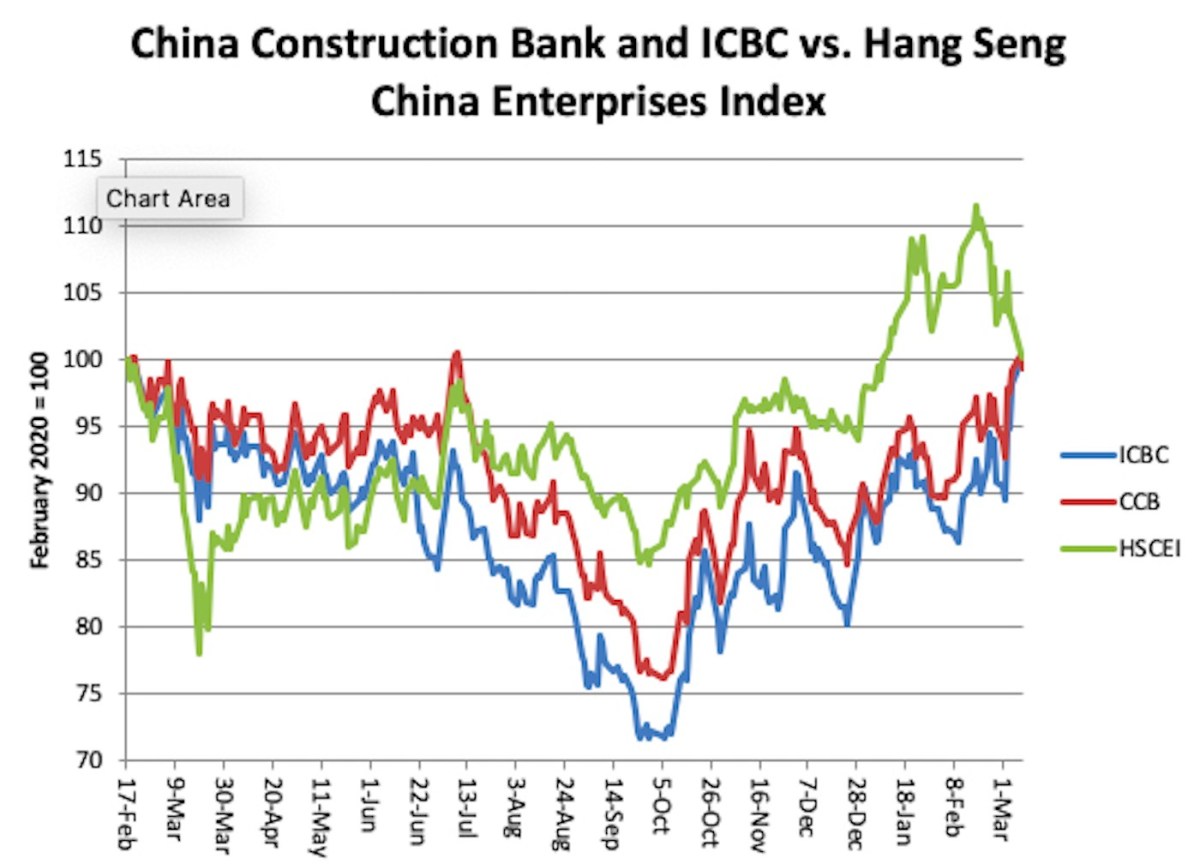

It’s been a bad month for Chinese equities, with some noteworthy exceptions: China’s major banks are up about 10% over the past month while the overall Hang Seng China Enterprises Index is down about 10%.

On February 16 we made a case for Chinese bank stocks, noting that the big state-owned financial institutions were trading at some of their lowest valuations in history in the middle of an economic recovery that promised to bring about an improvement in credit conditions.

We also observed that the traded volatility of Chinese bank stocks (as gauged by the price of traded options) was lower than that of Western banks trading at far higher multiples. Something had to be wrong, we opined, and what probably was wrong was that bank stocks were too cheap.

Both the HSCEI and the major banks are trading just where they were in mid-February 2020, just before the Covid crash hit the markets. Price return to the banks and the broad index has been roughly equal, but total return is much higher for the big banks, which pay dividends in the 6% range.

The correction in Chinese tech stocks presents a short-term buying opportunity, and we wouldn’t discourage readers from taking it. As a long-term investment for generous income with the prospect of modest price appreciation, though, we continue to like the big Chinese banks.

[ad_2]

Source link