[ad_1]

Hong Kong’s crypto industry stakeholders are actively opposing a new law that would restrict trading to professional investors, shutting 93% of the population out of the market, the South China Morning Post reports.

Global Digital Finance, a body that represents crypto exchanges including OKCoin, BitMEX, Huobi and Coinbase, told the paper that the proposed law would force retail traders to turn to unregulated platforms.Â

In an effort to strengthen anti-money laundering and counter-terrorist financing measures in line with recommendations from the Financial Action Task Force (FATF), Hong Kong’s Financial Services and the Treasury Bureau published the proposal in November 2020.Â

However, the Treasury Bureau’s proposal exceeds what the FATF’s framework requires, reflecting mainland China’s tough stance on crypto.Â

Malcolm Wright, the chair of Global Digital Finance’s advisory council, highlighted that FATF members Singapore, the UK and US do not restrict retail traders’ access to the crypto market.Â

The government consulted with members of the public and industry bodies last month and the proposal is expected to be turned into a bill and introduced to Hong Kong’s legislative council in the coming months.Â

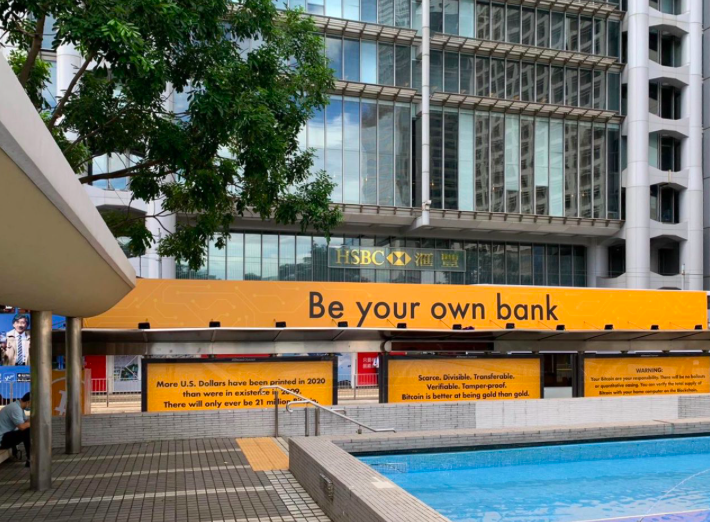

The Bitcoin Association of Hong Kong recently said, “To restrict retail individuals from accessing bitcoin would be overshooting the government’s goals of promoting innovation and financial inclusion.†The proposed restrictions could also extend to bitcoin ATMs and will expand the remit of Hong Kong’s existing crypto licensing rules for businesses, Cointelegraph reported.Â

Bitcoin Association co-founder Leonhard Weese told Cointelegraph, “Already in the status quo it is very difficult for Hong Kongers to find a legitimate platform, and buying bitcoin often requires carrying cash. There is no reason why Hong Kong should not have access to platforms of the likes of Coinbase or Cash App, which other FATF members consider safe and in compliance with anti-money laundering regulation.â€

[ad_2]

Source link