[ad_1]

ExxonMobil appointed two new directors to its board on Monday, its latest move to placate activist shareholders pushing for a strategic overhaul after the US oil supermajor suffered its worst year on record.

The company announced that Michael Angelakis, chief executive of investment firm Atairos and a former chairman of the Philadelphia Federal Reserve, and Jeff Ubben, head of Inclusive Capital Partners, another fund, would join the board. Ubben previously ran ValueAct Capital Partners, a well-known activist investor.

Describing the additions as part of an “ongoing board refreshmentâ€, Darren Wood, Exxon’s chief executive, said: “Michael and Jeff’s expertise in capital allocation and strategy development has helped companies navigate complex transitions for the benefit of shareholders and broader stakeholders.â€

The appointments come 48 hours before Exxon’s annual investor day, the build-up to which has been dominated by an activist campaign launched in December by Engine No 1, a newly established fund. Wall Street hedge fund DE Shaw, which owns a stake in Exxon, has also been pushing the oil producer to cut back its capital spending.

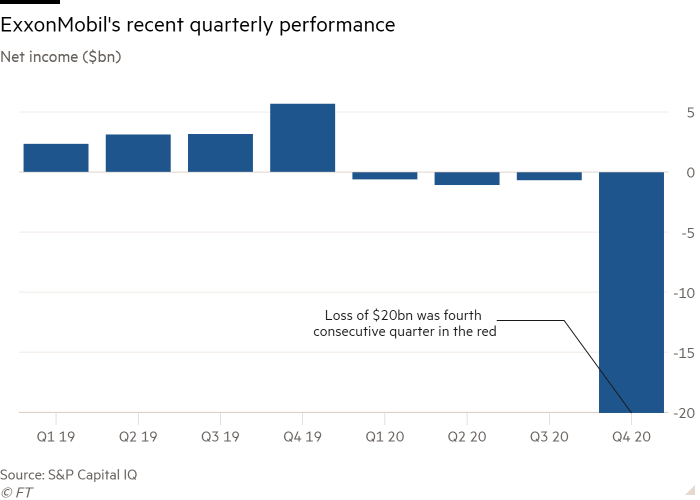

The growing investor disquiet follows the worst annual financial performance in Exxon’s history, including four consecutive quarterly losses and the writedown of almost $20bn of assets it now deems non-strategic.

Like peers, Exxon slashed planned capital spending last year following the crash in the oil price. But it is sticking with plans to increase crude production in the coming years, hoping a rebound in the oil price and a dearth of supply caused by rivals’ upstream under-investment will reward the strategy.

Engine No 1 in January nominated four independent directors to join Exxon’s board, each with energy experience, and said its nominees would “ensure a clean break from a strategy and mindset that have led to years of value destruction and poorly positioned the company for the futureâ€.

Engine No 1 said on Monday that the appointments announced by the oil group showed Exxon “has now conceded the need for board change, what is missing are directors with diverse track records of success in the energy industryâ€.

DE Shaw welcomed the appointments, hailing them as “significant positive developments for all shareholdersâ€.Â

Edwin Jager, a managing director at DE Shaw, said the new executives “will bring significant capital markets and capital allocation experience to the boardroom and will provide meaningful value to the company as it focuses on its investment priorities while navigating the transition to a low-carbon futureâ€.

The appointments come almost a month after Exxon added Tan Sri Wan Zulkiflee, the former chief executive of Malaysia’s state oil company Petronas, to its board in another concession to the activists.

Exxon also in February announced the formation of a new low-carbon business and in January began reporting its scope 3 emissions (greenhouse gas pollution from products it sells), moves that have also followed investor pressure but were in the works before the activist campaigns became public last year.

Critics say Exxon has been slower than its peers in developing a strategy for a transition to cleaner fuels.

Andrew Logan, a senior director at Ceres, which co-ordinates investor action on climate change, said that “this move could actually backfire on the company, as it looks as though it is packing the board to dilute the potential impact of the alternative director slateâ€.

Twice weekly newsletter

Energy is the world’s indispensable business and Energy Source is its newsletter. Every Tuesday and Thursday, direct to your inbox, Energy Source brings you essential news, forward-thinking analysis and insider intelligence. Sign up here.

[ad_2]

Source link