[ad_1]

Stock investors are watching the Fed the way small children ponder the Cat in the Hat, who stands on a ball while holding a fish on a rake and balancing a cup and a cake on his head.

The objects that Fed Chairman Jerome Powell is juggling are $4.2 trillion in new Treasury debt to finance this year’s US government deficit. The market is watching Powell’s balancing act with morbid fascination, attuned to any sign of trouble.

Wednesday’s Federal Open Market Committee meeting commanded the market’s undivided attention. And Powell did not disappoint: the FOMC’s statement declared that everything was terrible, the US economy was weak, inflation was low. And it said that the Fed wouldn’t so much as entertain the thought of raising interest rates or reducing its gigantic purchases of Treasury bonds in the foreseeable future.

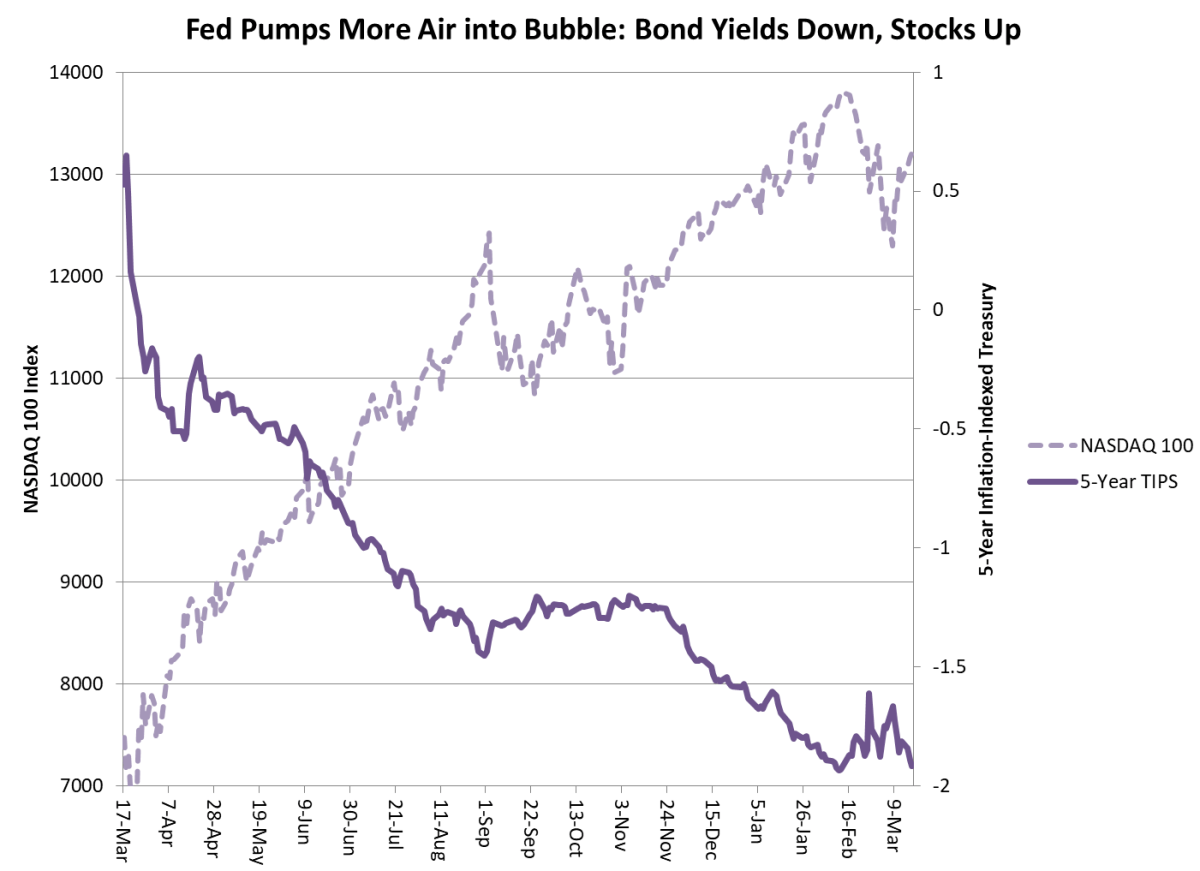

Tech stocks were down in the morning but ended the day with gains after the Fed issued its statement at 2pm Eastern time. The benchmark Treasury 5-year inflation-indexed bond yield was up before the meeting as investors crowded around the exits, but returned to its all-time low yield in response to the Fed.

As long as the US government can sell 5-year bonds at an after-inflation yield of about negative 2 percent, which means that investors are paying the Treasury to hold their money for them, the US government can run any kind of deficit it likes. And if you have to pay the US government or high-quality corporate borrowers to hold your money, stocks look good, even at the highest valuations in history. The earnings yield on the Nasdaq 100 is just 3%, assuming that earnings forecasts pan out. But a risky 3% looks more attractive than a sure-thing negative 2 percent. If this seems goofy, it is – but that’s the Fed’s fault, not mine.

No one expects it to last forever. Yields on 10- and 30-year Treasury debt are jumping. But investors really don’t think 10 or 30 years ahead. The 5-year inflation-indexed yield remains the lodestar, and the market thinks that Powell’s juggling act will last at least a little while longer.

[ad_2]

Source link