[ad_1]

How well did you keep up with the news this week? Take our quiz.

Rishi Sunak will use the Budget next week to reveal a new UK state-guaranteed loan programme as ministers turn off the taps on the emergency coronavirus schemes that have allowed businesses to borrow £73bn.

The three existing schemes will become the first main plank of the pandemic support programme to be pulled for applicants by the chancellor. Companies will have until the end of March to apply for loans, including the hugely popular bounce back loans.

But Sunak will also use the Budget to extend a package of other Covid-19 support measures for business until June, including business rates and VAT relief, the furlough job support scheme and the stamp duty holiday.

The scheme will be launched in early April, according to people familiar with the situation, leaving banks only weeks to prepare. (FT)

Coronavirus digest

-

EU leaders vented frustration over sluggish deliveries of vaccines and manufacturing delays as fear rose over the rapid spread of virus variants.

-

The UK has lowered its Covid-19 alert status from the highest possible level.

-

Israel has halted its plan to send excess vaccines abroad after the initiative came under legal scrutiny.

-

The African Union will pay three times more for Russia’s Sputnik V jab than it is paying for the Oxford/AstraZeneca and Novavax vaccines, undermining Moscow’s claim that it is supplying poor countries with cheaper vaccines.

-

David Solomon, chief executive of Goldman Sachs, has called working from home an “aberration†that must be corrected “as soon as possibleâ€.

-

Moderna expects $18.4bn this year from vaccine deals it has signed. (FT, Reuters, Guardian)

In a year of scientific breakthroughs — and political failures — what lessons can we learn for the future? Humans have never been so powerful in their war with pathogens, writes Yuval Noah Harari. Follow our live blog for the latest.

In the news

US-Saudi relations on tightrope A US intelligence report expected to be released as early as Friday on the killing of Saudi Arabian journalist Jamal Khashoggi will serve as a major test of the Biden administration’s relations with Riyadh. Washington has also carried out an air strike against Iran-linked militia groups in Syria, the first such military action since Joe Biden took office. (FT)

Nasdaq slides 3.5% A violent sell-off in US government bonds ricocheted through markets on Thursday, sending share prices lower and handing tech stocks their worst day since October. The yield on the benchmark 10-year Treasury rose as much as 0.16 percentage points to exceed 1.5 per cent for the first time in a year. In Asia trading, bond prices remained volatile as stocks continued to fall.

-

Dan Ivascyn, chief investment officer at Pimco, has warned of an “inflation head fakeâ€, where misplaced fears cause a jump in bond yields. (FT)

N Korea humanitarian crisis South Korea has warned of a worsening humanitarian crisis and food shortages in North Korea as leader Kim Jong Un grapples with the fallout from coronavirus. It has been more than a year since Pyongyang shuttered land, sea and air routes to protect its brittle healthcare system. (FT)

Gulf Stream system at weakest in a millennium Two studies published this week revealed that climate change is slowing down the ocean current, which carries warm water to Europe, more dramatically than previously expected. The slowdown has already started to affect weather patterns, such as more frequent heatwaves in southern Europe. (FT)

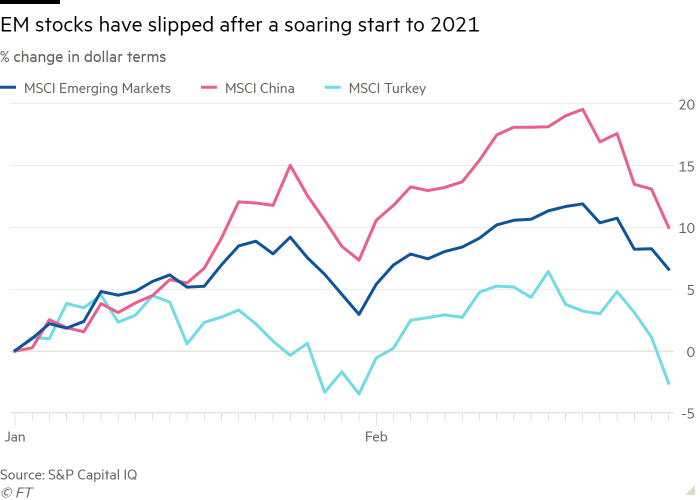

Rising interest rates cool emerging markets’ rally The rush into emerging market assets since the depths of the coronavirus crisis is facing its first serious test as rising US interest rates revive memories of the 2013 “taper tantrumâ€. Emerging market stocks have sailed almost 90 per cent higher in US dollar terms from the March nadir to a historic peak last week. (FT)

Airbnb points to ‘resilience’ Longer stays in more remote locations helped Airbnb’s earnings hold up better than expected in the pandemic-battered travel industry, as it reported its first quarterly earnings since its initial public offering. Separately, delivery group DoorDash suffered a more than 10 per cent fall in after-hours trading on fears of competition in the sector. (FT)

The days ahead

Salmond hearing Former Scottish National party leader Alex Salmond is set to appear on Friday before a parliamentary committee investigating the government’s handling of the harassment complaints against him. (FT)

FDA examines J&J Covid vaccine The US Food and Drug Administration’s vaccine advisory group will meet to discuss Johnson & Johnson’s single-shot jab, which could receive first emergency use authorisation as early as the weekend. (FT)

Economic data Investors will have a clearer idea of how US prices changed during January when the commerce department releases its personal consumption expenditures price index, the Fed’s preferred gauge of inflation. France also has final GDP data for the fourth quarter out.

Warren Buffett’s annual letter The billionaire investor is due to issue his annual letter to Berkshire Hathaway shareholders on Saturday, when he is likely to review some of Berkshire’s businesses and the impact of Covid-19. (FT)

Donald Trump’s keynote speech The 45th US president is set to make a splashy return to the fray on Sunday with a keynote speech at an annual gathering of Republicans. (FT)

“What they want to hear from Trump is: how do you move forward in 2022 and 2024†— Ford O’Connell, former Republican congressional candidate

What else we’re reading

McKinsey partners sacrifice leader in ‘ritual cleansing’ Kevin Sneader has become McKinsey’s first global managing partner since 1976 not to win a second three-year term. But few think either Sven Smit or Bob Sternfels, would represent a break with the past as the question of reform looms large. The FT View is that the consultancy has shown a lack of self-awareness bordering on narcissism. (FT)

Nigerian investors ride bitcoin frenzy Africa may have the world’s smallest crypto market — but, with the value of bitcoin in circulation just under $1tn, it has the largest proportion of retail users doing transactions under $10,000. The Central Bank of Nigeria is attempting to temper the euphoria with warnings that inexperienced investors could their lose meagre savings.

-

In other crypto news, Coinbase, the largest US-based cryptocurrency exchange, revealed that it generated $1.3bn in revenue last year, up from $534m in 2019, as it filed for a long-awaited public listing. (FT)

Why some brilliant ideas get overlooked Delayed recognition is rare, writes Tim Harford. Much more common is for people simply to reach their prime late in life. It is too tempting to hope that what we have already produced will, one day, be recognised for its brilliance. (FT)

Jay-Z’s hip-hop path to luxury influence It has been another busy week for the musician and entrepreneur, starting with an LVMH deal to expand his Armand de Brignac champagne globally. The striking thing about Jay-Z is how accurately he sensed how the world would evolve, writes John Gapper. As he once rapped: “Put me anywhere on God’s green Earth, I triple my worth.†(FT)

How the pandemic alters everything Are we at one of those hinge points in history, such as the Great Depression, where the citizenry’s political preferences turn in a new direction? To date, we have mostly had to make do with speculation, but two surveys suggest that there is a big change under way in attitudes, Martin Sandbu writes in Free Lunch — sign up here. (FT)

Video of the day

Saudi Arabia’s mega-project A 170km car-free, carbon-free city the size of Belgium, built in a straight line through a remote part of Saudi Arabia is Mohammed bin Salman’s grand plan. Will it succeed? Andrew England explores the crown prince’s pet project. (FT)

Thank you for reading. Send your recommendations and feedback to firstft@ft.com

[ad_2]

Source link