[ad_1]

Myanmar’s military has seized power in a coup, detaining Aung San Suu Kyi and other senior members of the country’s ruling party after several days of rising tensions over the results of a recent election.

Aung San Suu Kyi, Myanmar’s 75-year-old state counsellor, President Win Myint and other members of the ruling National League for Democracy party were arrested at their residences in the capital Naypyidaw early on Monday.

Later in the morning, Myanmar’s military said that it had taken control of the country and declared a state of emergency for a year, handing power to Senior General Min Aung Hlaing, its commander-in-chief.

Residents of the commercial capital Yangon and other cities said that service for all four of the country’s telecoms companies had been cut off, some internet service providers were down and terrestrial television services were restricted to the military’s Myawaddy TV channel.

US President Joe Biden has threatened to impose sanctions on Myanmar over the military’s actions.

John Reed, our south-east Asia correspondent, describes how the coup blindsided the west. (FT)

Coronavirus digest

Gideon Rachman weighs in on why the European Commission failed the vaccine challenge. Keep up with the latest on our live blog and keep up to date with the global race to vaccinate with our tracker.

In the news

Robinhood gets another cash injection The online broker at the centre of the boom in day trading has raised $2.4bn in its second capital infusion in a week to shore up finances strained by turbulent trading. Robinhood’s CEO is expected to testify to Congress later this month. Meanwhile, the frenzy of retail trading rallied silver prices rallied to their highest level in eight years on Monday. (FT, Politico)

-

The crucial role played by clearing houses in financial markets has been thrust into the spotlight after contentious moves by US brokers to restrict retail investors’ bets on stocks at the heart of the Reddit-fuelled trading boom. (FT)

India turns on the spending taps India is abandoning its fiscal restraint as it prepares to step up capital investment and implement financial sector reforms to support its battered economy. Meanwhile, Prime Minister Narendra Modi has doubled down on his controversial agricultural reforms, and Twitter temporarily blocked access to accounts in India belonging to politicians and activists following pressure from Mr Modi’s government. (FT, Al Jazeera)

S Korea politicians back short-selling ban South Korean politicians are pressuring financial regulators to extend a ban on short selling in an effort to win the votes of retail investors, who have piled into markets ahead of important by-elections due in April. (FT)

Kuaishou IPO boosts biggest rival to China’s TikTok Kuaishou, which is set for a splashy initial public offering in Hong Kong this week, is likely to hit a valuation of more than $60bn at its IPO. With a captive audience — more than 262m Chinese check the app an average of 10 times a day — the app is pivoting business model to advertising and ecommerce. (FT)

HK acquits ex-JPMorgan banker over ‘princeling’ hire Catherine Leung, JPMorgan’s former vice-chair of Asian investment, has been acquitted of bribery charges connected to the bank’s hiring of well-connected Chinese “princelings†to win business in the country. (FT)

Spac round-up Houston billionaire Tilman Fertitta is returning his business empire to the public markets after a gap of more than a decade. Holding company Fertitta Entertainment, which includes Golden Nugget casinos and Landry’s restaurants, will be floated through a reverse-merger with a special purpose acquisition company. Separately, Wheels Up, the private jet charter start-up, also announced plans to go public via a Spac. (FT)

The day ahead

Australia rate decision It’s expected that Governor Philip Lowe may follow a wait-and-see approach on Tuesday for monetary policy as “members agreed to keep the size of the bond purchase program under review†following the December meeting. (Daily FX)

Navalny sentence hearing Allies of Kremlin critic Alexei Navalny are expected to rally in his support as a court in Moscow considers jailing him for alleged violation of suspended sentence terms on Tuesday. (FT)

Earnings round-up It’s a big earnings day for tech on Tuesday with Amazon, Alphabet, Alibaba and Panasonic reporting results. Markets will also have an eye on energy with ExxonMobil and BP earnings due. (FT)

What else we’re reading

GameStop is just latest case of misallocated capital Price-insensitive investors are driving an increasing disconnect within economies and markets, writes John Plender. And the resulting gyrations in the market raise tricky questions about market efficiency, regulation and financial stability. (FT)

Brexit reveals power of credit card duopoly The hike in interchange fees between the UK and Europe might feel like a niche issue but it is a symptom of a deeper malaise, writes Patrick Jenkins. It is worth reflecting on the nature of an industry that can get away with quintupling a charge from one day to the next. Go deeper on the Brexit-induced fee hike with our #fintechft newsletter. (FT)

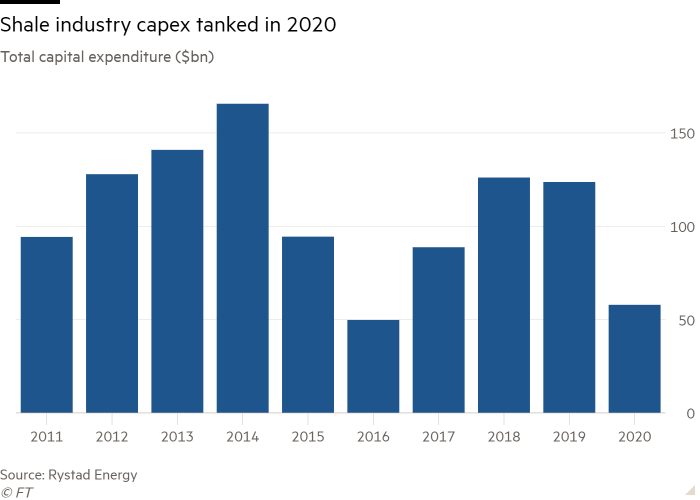

Can US shale oil ever lure back investors? When the worst oil crash in decades struck last year, US shale companies were forced to slash capital expenditure, sack workers, idle rigs and cut production. Now a more resilient industry is emerging from the ashes and aiming to woo investors. Separately, Exxon and Chevron chief executives reportedly discussed a merger last year. (FT, WSJ)

Should Covid vaccines be mandatory at work? For the moment, companies are treading warily, unsure how to handle staff who object to jabs on medical or religious grounds, or because they are pregnant. In the throes of the pandemic, has time lost all meaning for you? Join the club, writes Gillian Tett. (FT)

Trump’s campaign to subvert the 2020 election Between November 12 and January 20, Donald Trump set forth on a 77-day democracy bending push. In a new investigation, the New York Times examines the forces at work, and why the Capitol riot was all but inevitable. (NYT)Â

Wanted: the corporate world’s next Big Baddie After Big Pharma stepped up in the pandemic, who’s the next villain? Big Meat? Big Box Set? The twenties should open up opportunities for some new evil industries ready for the Big Branding, writes Robert Shrimsley. (FT)

Video of the day

SoftBank: piecing the puzzle together What exactly is SoftBank? The FT explains why the Japanese multinational is like a jigsaw puzzle, with the enigmatic founder and chief executive Masayoshi Son at its core. (FT)

Thank you for reading. Send your recommendations and feedback to firstft@ft.com

[ad_2]

Source link