[ad_1]

This article is an on-site version of our FirstFT Asia newsletter. Sign up here to get the newsletter sent straight to your inbox every weekday morning.

Good morning. To help make FirstFT the best it can be, we would like to know what you like or dislike about the newsletter. Please help us improve FirstFT by taking our short survey. Thank you.

The militant group Hamas has fired rockets deep into Israel after days of violence at Jerusalem’s al-Aqsa mosque between Israeli policemen and Muslim protesters left hundreds of Palestinians wounded.

The rocket fire came after a 6pm deadline that Hamas had issued to Israel to withdraw its forces from the compound of the mosque, a holy site for both Muslims and Jews. Television images showed smoke rising from the hills near Jerusalem, farther into Israel than any rockets fired in recent years.

The Israeli military responded with air strikes in the Gaza Strip, including one that appeared to target a senior Hamas military commander. The Israel Defense Force’s spokesman Jonathan Conricus said the military had a “green light†to hit military targets until Hamas “gets the message and learns its lesson.â€

Health officials in Gaza said up to 20 people had been killed, including nine children, and 65 injured in the air strikes. More air strikes are expected.

Coronavirus digest

-

India’s biggest steelmaker expects disruption from the country’s brutal second wave of coronavirus to last until September as it slashed production because of oxygen shortages and shrinking industrial demand.

-

European governments spent billions to prop up their airlines as the pandemic reverses a privatisation drive.

-

New coronavirus infections in the US have fallen to the lowest level in 11 months — a sign the country is on track to regain a sense of normality by the summer.

-

On May 17, Britons will be allowed to hug again for the first time since coronavirus restrictions were put in place.

-

The decision by US banks JPMorgan and Goldman Sachs to call back their staff to offices as soon as next month highlights contrasting attitudes with their European counterparts.

Follow the latest on our live blog, and sign up for our Coronavirus Business Update newsletter, delivered to your inbox every Monday, Wednesday and Friday.

In the news

Colonial pipeline hackers regret ‘creating problems’ DarkSide, the hacker group blamed for this weekend’s ransomware attack on the Colonial petroleum pipeline, has insisted it only wanted to make money and regretted “creating problems for societyâ€. The pipeline expects to restore most operations by the end of the week. (FT, NYT)

For more essential energy news, forward-thinking analysis and insider intelligence, sign up for our Energy Source newsletter delivered every Tuesday and Thursday.

Meituan shares slide after chief posts ancient poem The share price of the Chinese food delivery app Meituan fell as much as 9.8 per cent on Monday after its chief executive posted an ancient poem that investors interpreted as criticising Chinese President Xi Jinping on social media.

Nakanishi steps down as head of Japan’s Keidanren Hiroaki Nakanishi has been forced to step down as chair of Japan’s Keidanren business lobby after a recurrence of cancer, removing a powerful reformist voice from the top of corporate Japan.

1MDB sues banks over $23bn loss Malaysia’s disgraced state investment fund 1MDB is suing Deutsche Bank, Coutts and JPMorgan, and more than 20 individuals including Malaysia’s former prime minister in an effort to recover more than $23bn in losses.

US investors revolt against executive pay in record numbers Six S&P 500 companies this year — including General Electric, AT&T, IBM and Starbucks — have failed to win a majority of shareholder support for pay packages. That compares with 10 instances in all of 2020 when a majority of shareholders voted against a company’s bonus plan, according to ISS Corporate Solutions.Â

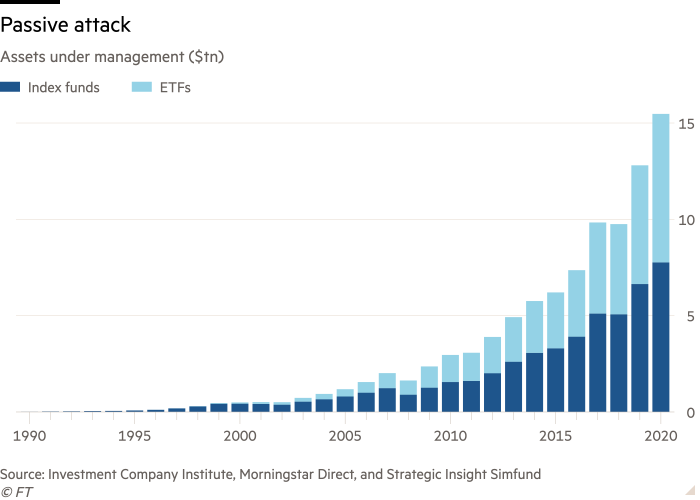

Global passive assets hit $15tn Assets under management in exchange traded funds are eclipsing traditional index-tracking mutual funds for the first time, after the global passive investment industry vaulted past $15tn in assets last year, according to data compiled for the FT.

-

Higher capital gains taxes on wealthy investors proposed by the Biden administration could hasten a shift out of mutual funds and into exchange traded funds, US asset management executives are predicting.

The day ahead

China CPI and producer price data April’s consumer price index for China will be in focus when it is out on Tuesday. The figures are expected to show a rise of 1 per cent year on year, according to economists surveyed by Bloomberg. Producer price data out the same day are forecast to climb 6.5 per cent over the same period — their fastest pace of growth since 2017.

The FT has revamped its Trade Secrets newsletter, offering premium subscribers even better coverage of one of the most important stories in the world right now. Expect more on the inside story of global trade, with punchy and pithy analysis from a team of FT correspondents led by Alan Beattie in Brussels, delivered straight to your inbox at 7pm Hong Kong time Monday to Thursday. Click here to sign up.

What else we’re reading

UK’s services sector starts to count the real cost of Brexit The services sector accounts for around 80 per cent of the British economy, including fashion, tourism, auditing and architecture. Yet throughout Britain’s negotiations on its departure from the EU, the services sector was rarely a priority — with the exception of the City of London.

US-China rivalry drives the retreat of market economics Old ideas are like old clothes — wait long enough and they will come back into fashion, writes Gideon Rachman. Thirty years ago, “industrial policy†was about as fashionable as a bowler hat — but the US-China rivalry has made it in style again.

Meet the academic who has fired up moonshot investing Four years ago, finance professor Hendrik Bessembinder published a paper showing that despite the equity market’s gains over the past century, most stocks are duds. Now, some cite Bessembinder’s work as evidence that aggressively investing in a narrow clutch of potential superstars is the way forward.

The battle for the future of milk Start-ups and multinationals are competing in the $17bn plant-based drinks market — and the stakes are high. Advocates argue that lower greenhouse gas emissions from plant milk production, compared with cattle, point to a high-tech approach that could help feed humanity and curb global warming.

Sign up for our Due Diligence newsletter for the top stories from the world of corporate finance, including detailed analysis of the dealmakers making the news.

The rise of Elise Stefanik The first-term Republican congresswoman has gone from a rising star of the moderate wing of the Republican party to one of Donald Trump’s most enthusiastic supporters. This week she is widely expected to be elected House GOP conference chair, making her the most senior Republican woman on Capitol Hill.Â

Podcast of the day

The Tories conquer Hartlepool Last week’s local elections resulted in gains for Boris Johnson’s Conservatives, including a historic win in the Hartlepool by-election. What does this mean for Labour and Keir Starmer’s leadership? FT’s Sebastian Payne breaks down what you need to know.

Thank you for reading. Please send your recommendations and feedback to firstft@ft.com

[ad_2]

Source link