[ad_1]

The top five companies behind single use plastics — the materials used to make shopping bags, straws and food packaging that often end up in landfills or cluttering beaches — are responsible for close to a quarter of the global total, fuelled by demand from the US and China.Â

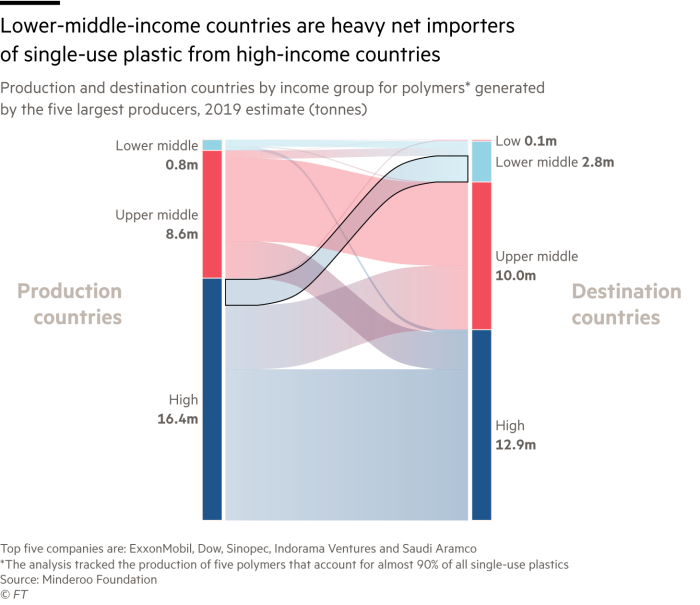

Oil major ExxonMobil, chemicals group Dow and Chinese oil refiner Sinopec top the list of almost 300 companies that in 2019 collectively produced some 110m metric tonnes of polymers, the building blocks of single use plastics, according to research by philanthropic group the Minderoo Foundation.Â

Chemicals company Indorama Ventures and oil company Saudi Aramco were the fourth- and fifth-largest producers, respectively.

The top five companies collectively generated about 26m metric tonnes of plastic waste, according to the report, which was based on UN, World Bank and national customs data, and research by consultancy Wood Mackenzie. Close to half of that — or 11m tonnes — was used in the US and China.

Plastic waste is “a massive problem . . . On this trajectory, we will have more plastics in our ocean by weight than fish by 2050â€, said Sander Defruyt, who leads the New Plastics Economy initiative at the Ellen MacArthur Foundation.Â

Its root cause was our “throwaway society†— countries must move from a system “based on the extraction of resources to one that is based on the circulation of resourcesâ€.

Plastics are made from fossil fuel-based chemicals, and break up into smaller and smaller pieces when they are disposed of, rather than decompose in the way that food does. Although disposable plastic items can often be recycled, many are not and millions of tonnes of plastic waste find their way into the ocean each year.Â

As images of plastic-strewn beaches have become familiar sights, governments have started cracking down on the material with plastic bans or taxes.

Last year, England banned single use plastic straws, stirrers and cotton buds, and raised the charge on plastic bags. China outlawed single use bags and cutlery in major cities, and is planning to extend plastic bans in the years to 2025.

In a drive to entice eco conscious shoppers, consumer brands, including coffee chain Starbucks and fast food retailer McDonald’s, have started replacing disposable plastic items with paper alternatives. In April, grocer Morrisons announced it would become the first UK supermarket to completely remove plastic bags from stores.

In its 2020 annual report, Dow said plastics were facing “increased public scrutinyâ€.

“Local, state, federal and foreign governments have been increasingly proposing — and in some cases approving — bans on certain plastic-based products including single-use plastics,†which could affect demand, it said.

Nevertheless, producers expect global demand for plastics to increase, driven by population growth and an expanding middle class. The pandemic also prompted an increase in the use of disposable items, which have been seen as a way to minimise the virus’ transmission.

Exxon said in its 2020 annual report that global demand for chemicals would rise by more than 40 per cent by 2030. Exxon’s chemicals division was its only profitable segment in 2020, with demand “resilient†throughout the pandemic in key areas including “food packaging, hygiene and medicalâ€.Â

Helen McGeough, global analyst team lead for plastic recycling at ICIS, said government bans tended to be narrow in scope. “The real challenge†for producers was the risk that “manufacturers start to switch away from plastics†to please shoppers, she said.

According to the Minderoo report, single use plastics account for more than a third of all the plastics produced each year, most of which are made from “virgin†materials — those manufactured from fossil fuels, rather than recycled material. The analysis tracked the production of five polymers that account for almost 90 per cent of all single use plastics.

Many disposable plastic items are technically possible to recycle, but often end up in landfills, or being burnt or discarded directly into the environment.

The question was “whether the systems are in place in terms of collection and reprocessingâ€, said McGeough. A global lack of such systems means big producers may not have enough recycled material to rely on that alone, she added.

Defruyt said governments should introduce “extended producer responsibility†schemes that required companies to pay for the management of the waste they produced. Given the scale of the challenge: “The only place where this funding can come from is from industry.â€

In a statement, Exxon said it “shares society’s concern about plastic waste and agrees it must be addressed. Nearly 3bn people worldwide do not have access to proper waste collection or disposal systemsâ€.Â

Exxon declined to comment on whether it had targets for making a greater proportion of its plastics from recycled materials, but said it was “working on advanced recycling solutionsâ€.

Indorama Ventures — which the Minderoo report said scored highly for resource “circularity†compared with most other producers — said it had committed to investing $1.5bn to recycle 50bn plastic bottles into 750,000 tons of recycled material annually by 2025.

Dow declined to comment, but pointed to its target of enabling 1m metric tons of plastic to be collected, reused or recycled by 2030.

Saudi Aramco said: “Plastics have played an essential role in elevating living standards in many economies . . . Solving the plastic waste challenge requires the participation and long-term commitment of all elements of society, including consumers, manufacturers, technology developers, the finance community, governments and civil society.â€

Sinopec did not respond to requests for comment.

Additional reporting by Chris Campbell and Patrick Mathurin

[ad_2]

Source link