[ad_1]

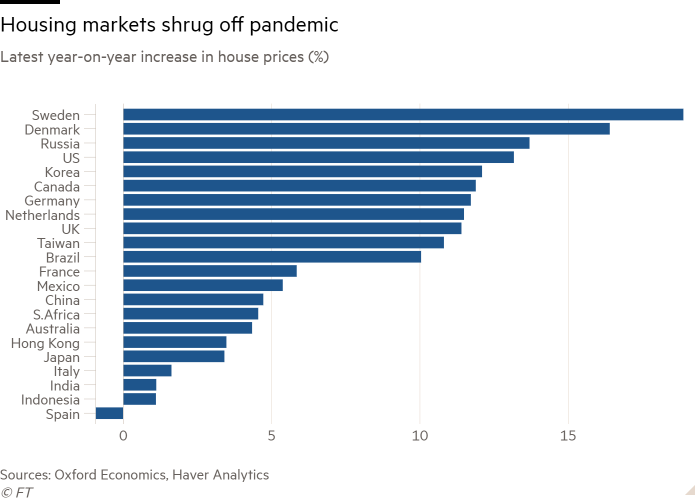

House prices have set new records in the US and parts of Europe as vast fiscal and monetary stimulus help residential property markets to continue shrugging off the impact of the coronavirus pandemic.

The median price for US existing houses rose a record 23.6 per cent year-on-year to a new high of $350,300 last month with every region of the country recording increases, the National Association of Realtors said on Tuesday.

Europe’s housing market has also kept climbing despite the Covid-19 crisis. In the Netherlands, existing house prices rose 12.9 per cent in May from a year earlier, the fastest growth rate since 2001, the Dutch Statistics Office said.

The number of residential property sales declined in both the US and the Netherlands, even as prices continued to rise, suggesting that demand is outstripping supply. The Dutch Land Registry said it recorded 16,126 residential property transactions in May, a 12.1 per cent drop from a year earlier.

Sales of previously owned homes in the US fell 0.9 per cent between April and May to a seasonally adjusted annual rate of 5.8m. Total US housing inventory of 1.2m units was 20.6 per cent lower than in May 2020, NAR said, though up 7 per cent from April.

Some economists said the drop in sales volumes could be a sign that the US housing market has peaked, after activity last year hit the highest level since 2006.

“The decline in sales and rise in inventory means that the extreme upward pressure on prices should soon start to fade,†said Ian Shepherdson, chief economist at Pantheon Macroeconomics.

Others see further rises to come, fuelled by central bank policies. “Loose monetary conditions could push asset prices even higher, risking an eventual sharp correction,†said Adam Slater, economist at Oxford Economics. “For central banks, neither this outcome nor persistently higher inflation are attractive prospects.â€

Booming home prices have caught the eye of officials at the US Federal Reserve, especially in light of its $40bn monthly purchases of agency mortgage-backed securities, which make up a portion of its $120bn bond-buying programme.

Robert Kaplan, president of the Dallas Fed, recently warned prices were at “historically elevated†levels and highlighted purchases of large amounts of residential property by financial investors. Blackstone, the private equity group, on Tuesday agreed a $6bn deal to acquire Home Partners of America, a buyer and operator of single-family rental properties with a portfolio of more than 17,000 homes.

“Increasingly, single-family buyers are getting squeezed out of the market,†Kaplan said at an event hosted on Monday by Official Monetary and Financial Institutions Forum, a think-tank. “At this stage, we’re questioning whether the housing market really needs this Fed support of $40bn a month.â€

James Bullard, president of the St Louis Fed, said at the same event it may be time to consider whether to “retire†the agency MBS purchases.

The European Central Bank said in a report this week that in the fourth quarter of last year eurozone house prices were up 5.8 per cent on the previous year — the highest growth rate since mid-2007.

It said Germany, France and the Netherlands accounted for almost three-quarters of the eurozone’s total increase in house prices last year.

Rising prices and a shortage of affordable homes have sparked public anger at large commercial landlords in several European countries. Ireland imposed a 10 per cent stamp duty on anyone buying 10 or more houses over a 12-month period to stop financial investors buying large numbers of properties.

In Germany, the planned €18bn merger between Vonovia, the country’s largest residential landlord, and its rival Deutsche Wohnen has triggered calls for rent caps and even nationalisation of the companies.

The house price issue has also become a lightning rod for criticism of the ECB’s ultra-loose monetary policy. Its president Christine Lagarde was questioned about it in the European Parliament this week.

“Young people and middle-class families are forced to participate in a rat race, overpaying in an overheated housing market,†said Michiel Hoogeveen, a Eurosceptic Dutch MEP. “This is one of the consequences of your generous money creation and low interest policies to keep weaker eurozone countries afloat.â€

In response, Lagarde said there were “no strong signs of [a] credit-fuelled housing bubble in the euro area as a whole†but she added that there were “residential real estate vulnerabilities†in some countries and some cities in particular.

[ad_2]

Source link