[ad_1]

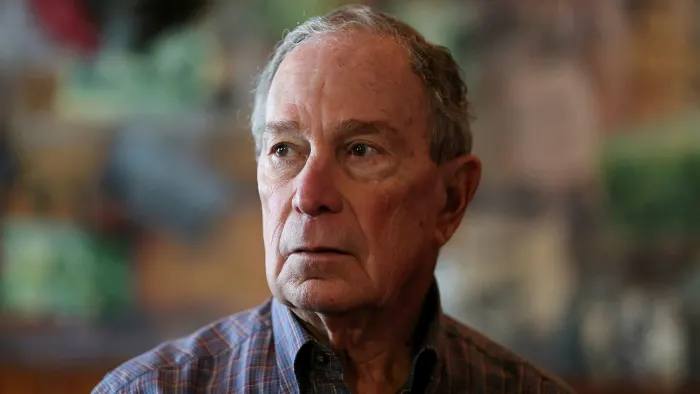

One thing to start: US tax authorities have launched an investigation into a leak of private records of billionaires including Warren Buffett, Jeff Bezos, Mike Bloomberg and Elon Musk that showed many of them have paid little tax even as their wealth ballooned.

Missed yesterday’s Greensill Capital event? Watch the discussion on-demand here as the FT team, including DD’s own Rob Smith and Arash Massoudi, take you inside the rise and fall of the controversial supply chain finance group.Â

Welcome to Due Diligence, your briefing on dealmaking, private equity and corporate finance. This article is an on-site version of the newsletter. Sign up here to get the newsletter sent to your inbox every Tuesday to Friday. Get in touch with us anytime: Due.Diligence@ft.com

Asia’s new reigning billionaires ascend the throne

Chinese entrepreneurs have long dominated the ranks of Asia’s richest people. Not any more.

India’s Mukesh Ambani and Gautam Adani sit in first and second place in a list of Asia’s wealthiest business people, according to Bloomberg data, with fortunes of $84bn and $78bn respectively.

The pair’s ascent underscores the shift taking place in India’s corporate and economic landscape, as the rapid development of recent years allowed a handful of powerful and politically savvy industrialists to dominate an ever-growing number of sectors from infrastructure to energy.

Their wealth has only accelerated during the pandemic, as the FT’s Hudson Lockett, Benjamin Parkin and Stephanie Findlay report.Â

A severe blow to India’s economy left smaller companies struggling to keep up with larger competitors, leaving investors with few options for betting on the country’s economic rebound.Â

As a devastating second wave of Covid-19 pandemic tore through the country, Ambani and Adani enjoyed the fruits of the record-breaking stock market rally that followed. The Nifty 50 index, which tracks India’s 50 largest companies, has risen about 10 per cent from its low in April as investors anticipate a recovery in domestic demand.

It’s a global trend, but one that analysts say has been particularly sharp in India, fuelling the polarisation of wealth and the country’s already striking inequality.

Ambani, chair of the oil-to-telecoms conglomerate Reliance Industries, has long ranked among the continent’s richest men and counts the likes of Google and Saudi Arabia’s Public Investment Fund among his many foreign investors. He’s been at work negotiating several high-profile deals in the past year, including an attempt to purchase the retailer Future Group, a move that has been challenged by Amazon as the two companies compete for control of India’s ecommerce market.

Adani’s rise, on the other hand, has been particularly swift and striking.

He enjoyed a 130 per cent boost to his fortune this year thanks to a soaring rally in listed Adani Group companies, which operate across ports, power and renewable energy. That has added about $44bn to his net worth.

But the prominent place of Indians atop Asia’s rich list also underscores the tough year for China’s once-mighty technology moguls.

They’ve been on the receiving end of a regulatory clampdown by Beijing, after it called off the $37bn initial public offering of Jack Ma’s fintech business Ant Group in November.

Indeed, the third-richest man in Asia is Zhong Shanshan, founder of the bottled water business Nongfu Spring, with a net worth of about $71bn. Tencent founder Pony Ma and Ma follow him in fourth and fifth position, respectively.

As for the two Indian industrial moguls, perhaps they can celebrate their achievements with a few rounds on Ambani’s new UK golf course.Â

Cevian, your friendly neighbourhood activist

What’s the difference between “constructive activism†and a buy-and-hold strategy?Â

Cevian, Europe’s biggest activist investor and one which prides itself on a friendlier approach than some rivals, has built up a stake in the FTSE 100 insurer Aviva.Â

Its message to Aviva chief executive Amanda Blanc, who joined last year, is clear: go further and deeper.

The Swedish activist, which has taken aim at companies from Ericsson to Danske Bank and Thyssenkrupp to ABB, wants Aviva to return £5bn in excess capital next year after a recently announced flurry of disposals. The figure surpasses estimates by most analysts. It also wants cost cuts of £500m rather than the £300m targeted by management.

Some may conclude that backing a management team to be a bit better than the market currently expects constitutes a simple “long†position, rather than an activist attack. But the share-price gain on the news suggests a shift in the dynamic.Â

It could be that having a bogeyman high up on the shareholder roll helps Blanc force through change at Aviva.

But it also increases pressure to change the core business. Previous attempts to improve Aviva’s operational performance, and win back investor favour, have foundered.Â

Cevian’s demands on the cost line, including pushing for leaner management, could be trickier to navigate than non-core disposals. So far, discussions with the company have been positive, say people familiar with the matter.Â

As the FT’s Lex column puts it: “Aviva is a tempting target. Large, lethargic and underperforming, it has been a graveyard for managerial ambitions for at least a decade.†Whether or not such ambitions can be resurrected will depend on the numbers.

Private equity’s promised landÂ

Back in 2019, the founders of KKR declared Japan their “highest priority†in the world. The excitement proved contagious, as other global private equity groups from Bain Capital and Blackstone to Apollo quickly followed.

Driving that optimism in recent years has been the corporate governance-driven rise in deals by the likes of Hitachi, Panasonic and Toshiba selling non-core assets and a succession crisis at many of the smaller-sized Japanese companies that have forced them to consider sales to private equity.

Now, Kazuhiro Yamada, the head of Carlyle’s Japan business, tells the FT that a new post-Covid business environment and carbon neutrality targets are further expected to accelerate that trend in 2021.Â

“Consumer behaviour and [the] business model changed drastically as a result of Covid-19, so companies that were hit have no choice but to carry out structural reforms,†Yamada says.

Combined with tougher business conditions created by the pandemic, companies are also buying new technologies and withdrawing from traditional areas that are not environmentally friendly to meet pressures for lower carbon emissions.

So while CVC’s recent $20bn buyout offer for Toshiba appears to have evaporated for now, the prediction from the US fund with the longest history in this country probably means that we’ll be seeing more private equity drama in corporate Japan.

Further reading: As private equity firms book the next flight to Tokyo, public markets have struggled to find investor appeal, the FT’s Leo Lewis writes.

Job moves

-

Saudi Arabia’s Public Investment Fund has named head of international investments Turqi Alnowaiser and head of Mena (Middle East and north Africa) investments Yazeed Alhumied as deputy governors, newly created roles they will assume in addition to their existing responsibilities.

-

Linklaters has hired Ieuan Jolly as partner in New York, where he will focus on growing the firm’s technology, media and telecoms practice as well as co-chair of its US data solutions, cyber and privacy practice. He joins from Loeb & Loeb.

Smart reads

Ties that bind Jeffrey Epstein built a sprawling sex trafficking ring with money gleaned from his best billionaire client, the Ohio retail mogul Les Wexner. Their friendship, which Wexner says faded long ago, continues to haunt him to this day. (Vanity Fair)

Duty free The ultra-rich have found (perfectly legal) loopholes to avoid paying taxes. Their methods reveal a US financial system that enables dynastic wealth to thrive, while the middle class foots the bill. (ProPublica)Â

Start your engines The pick-up truck is an American icon. Electric vehicle start-ups are hoping to woo truck enthusiasts with their own models, while traditional players such as Ford and GMC churn out their own models to get in the race. (FT)

News round-up

Nvidia asks Chinese regulators to approve $40bn Arm deal (FT)

Lithuania revokes licence of fintech implicated in Wirecard scandal (FT)

Marqeta IPO puts spotlight on fintech fees (FT)

Private jet operator Vista Global holds Spac merger talks (FT)Â

Berkshire leads $750m Nubank funding round, values it at $30bn (Reuters)Â

Aramis: IPO hopes to ride used-car prices higher (Lex)Â

TPG-backed PropertyGuru eyes $2bn Thiel Spac deal (Bloomberg)

[ad_2]

Source link