[ad_1]

MUMBAI – India has unveiled plans to increase spending to pull the country out of its worst-ever economic contraction by identifying key areas that could help revive investment, demand, growth and employment.

Some commentators are comparing it to Franklin D Roosevelt’s New Deal when large public works and infrastructure projects got the United States’ economy back on track after the Great Depression of the 1930s.

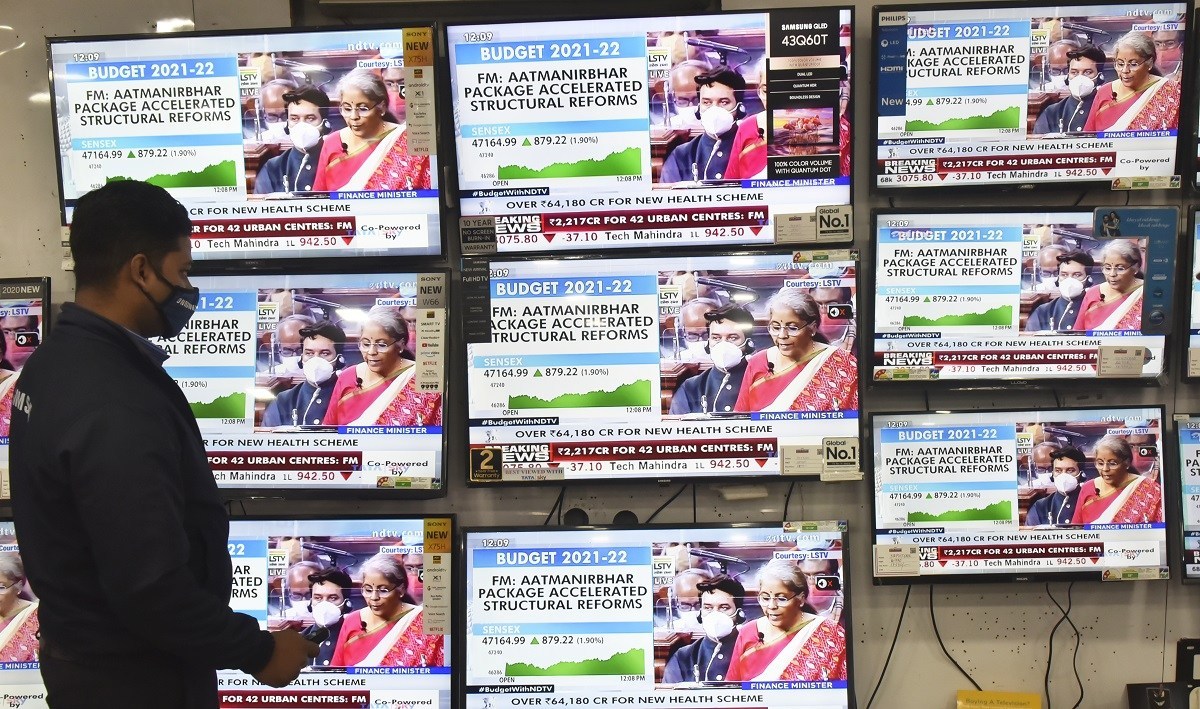

Finance Minister Nirmala Sitharaman, presenting the budget in Parliament on Monday, said the government planned to focus on increasing spending on key pillars such as health and wellbeing, capital expenditure, manufacturing, infrastructure, development of human capital, and research and development.

Stock markets cheered the news. The National Stock Exchange Nifty-50 rose 4.7% and BSE’s 30-stocks Sensex gained 5%. Yields on 10-year government securities rose 15 basis points to 6.06% on the government’s plans to spend more than planned.

The budget forecast nominal gross domestic product (GDP) to increase by 14.4% compared with an estimated contraction of 7.5% in the year to March 2021. Still, the economy, as with company sales, will begin to grow in real terms only from next year after recouping pandemic losses.

Sitharaman said the fiscal deficit would be 9.5% for the year ending March 31, a huge rise over the initial estimate of 3.5%. The fiscal deficit would be elevated 6.8% in the year to March 2022. She expects the fiscal deficit, or the shortfall between government revenue and spending, to stabilize at 4.5% of GDP from the year ending March 2026.

In a key announcement, the government said overseas companies could invest up to 74% in Indian insurers from 49% at present. Barring certain conditions, overseas companies could even control local insurance companies, opening an avenue for overseas investment to flow to insurers and indirectly in local stocks and bonds.

It also promised to remove a lingering thorn in the side of India’s financial sector by setting up so-called “Bad Banksâ€, or financial institutions that would soak up bad loans of commercial banks, reducing the need to set aside a large chunk of profits as reserves and enabling them to extend more loans to individuals and companies.

The Reserve Bank of India last month said in its Financial Stability Report that gross bad loans at banks could double to 14.8% by September, the highest in two decades, compared with 7.5% as of September last year. That estimate was made under a severe stress scenario of the broader economy. The so-called Bad Bank could hasten recoveries of bad loans by centralizing the process and reducing the legal wrangles that each bank now faces.

Growth in credit to sectors related to other than agriculture rose 6.53% as of January 1, the fastest pace since the imposition of a countrywide lockdown in March last year.

Still, loan growth has been grinding down with a steady slowing of economic growth since an ill-prepared demonetization was thrust on the banking system in November 2016, which removed 86% of currency notes overnight and left millions of self-employed and small and medium companies out of work. GDP has declined from 7.9% in the year ending March 2016 to 4.2% in the year to March 2020.

The finance minister spelled out plans, among others, for construction of highways in Tamil Nadu, Kerala, West Bengal and Assam, ironically all due to hold state assembly elections in four months.

Stocks traders and individuals cheered the absence of Covid-related increases in personal taxes. Investors were concerned the government would impose or increase taxes on savings, income, wealth or trading income and profits to fund increased spending following the pandemic.

The sale of stakes in state-owned companies, government-owned land and other state-owned assets is key to the government’s plan to fund the sharp rise in spending. The government has set a target to raise 1.75 trillion rupees selling stakes in state-owned companies on stock exchanges. This is lower than the more than 2.1 trillion rupees for the year to March 2021.

Yet, bankers and fund managers are raising questions on the high dependence on this avenue. For the year ending March 31, 2021, the government has barely managed to raise a fraction of the amount targeted even though the stock indices were trading at historical highs.

“The execution of these ideas is critical,’’ Deepak Parekh, one of the most senior bankers and chairman of Housing Development Finance Corp, the country’s biggest mortgage lender, told a television channel. “It’s a construction-led recovery.’’

The government also plans to privatize an insurance company and a couple of state-owned banks. A crucial potential gap in selling these assets could be the timing and hope that both local and international conditions are favorable at the time of the sale.

Unlike most private sector companies, especially private banks which are trading at historical highs, almost all shares of state-run companies are trading at multi-year lows. That means state-owned company share sales may not fetch the values anticipated and in some cases such as Air India, the company may not attract buyers at all.

The government’s sale of its stake in Hindustan Zinc is often cited as a favorable precedent. Traders say the company’s share value has risen several times since the sale to a London-based Indian entrepreneur Anil Agrawal, who owns Vedanta.

[ad_2]

Source link