[ad_1]

Ant Group, an affiliate of e-commerce giant Alibaba Group, was set to make its market debut in November — and it was going to be a big one.

In fact, it was to be the biggest initial public offering (IPO) in history, a US$37 billion share sale, part of the US$313 billion dual listing of the giant financial technology (fintech) payments company.

And then, the roof caved in.

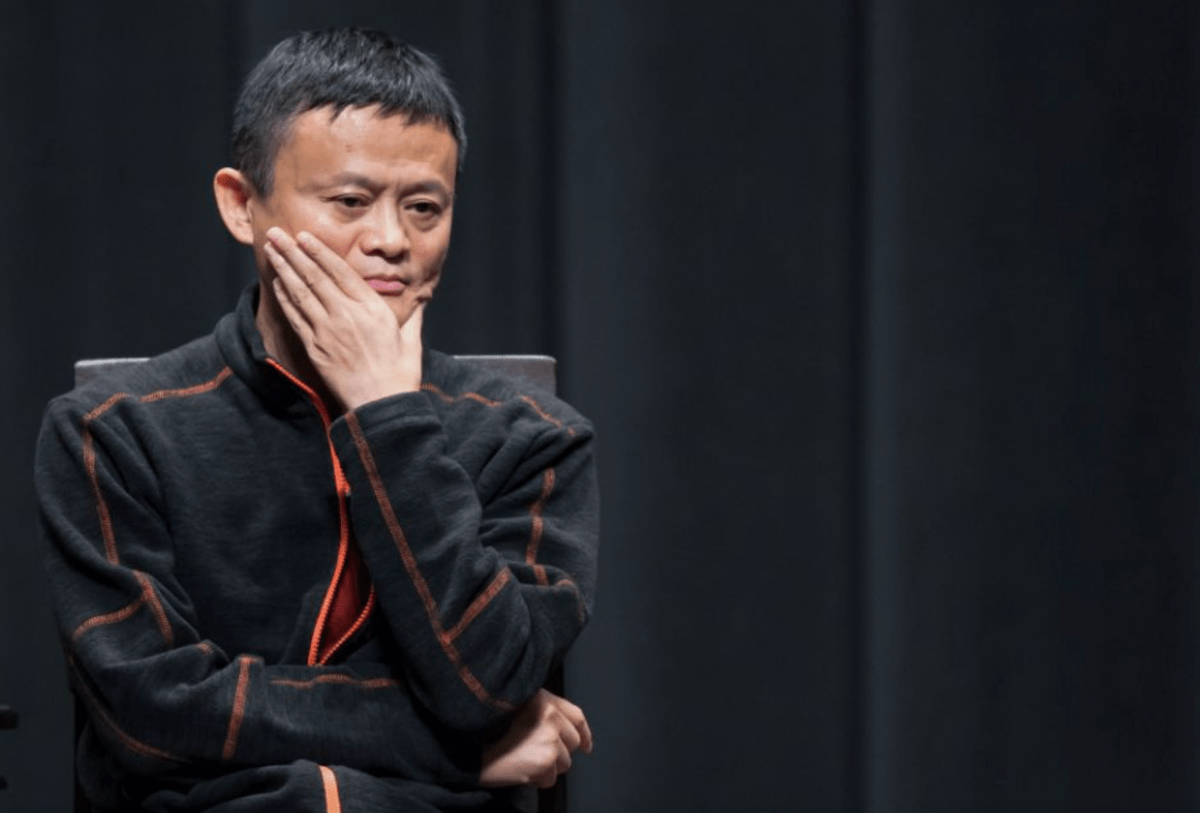

An October speech by its illustrious founder Jack Ma, in which he blasted China’s regulatory system and the aging dinosaurs who run it, kicked off a series of events that eventually led to the suspension of Ant’s US$37 billion IPO, Reuters reported.

The aging dinosaurs apparently had thin skins, and for a while, Jack Ma disappeared … only to reappear weeks later, after reportedly getting a dressing down from vindictive Chinese authorities.

According to Blooomberg News, Ant Group has agreed on a restructuring plan with Chinese regulators under which it will be turned into a financial holding company.

The plan calls for putting all of Ant’s businesses into the holding company, including its technology offerings in areas like blockchain and food-delivery, according to a report on Bloomberg’s website.

Sources say an official announcement could come before the start of China’s Lunar New Year holiday which begins on Feb. 11, Reuters reported.

In a call with analysts just a day earlier, Alibaba’s CEO Daniel Zhang had warned of “substantial uncertainties†over Ant Group’s business prospects and initial public offering plans, Forbes reported.

“Due to recent significant changes in the fintech regulatory environment in China, Ant Group is in the process of developing its rectification plan, which will need to go through the relevant regulatory procedures,†he said.

Regulators have since warned the wider technology industry that they intend to impose tighter regulations, reversing a once laissez faire approach they took towards the sector and internet finance platforms — a system that ironically worked well, according to analysts.

Ant’s businesses include payment processing, consumer lending and insurance products distribution, Reuters reported.

Bloomberg also said that Ant was still exploring possibilities to revive its initial public offering, citing one person familiar with the matter.

However, it said that it was unclear how long authorities would need to sign off on a listing given the financial holding company framework was so new.

Meanwhile, Ma was conspicuously absent from a list of China’s entrepreneurial greats published by state media Tuesday, underscoring how the iconic Alibaba co-founder has run afoul of Beijing, Bloomberg reported.

Ma, lionized at home for creating some of his country’s largest corporations, didn’t make the cut in a Shanghai Securities News front-page commentary lauding the leading lights of technology, Bloomberg reported.

Instead, the official Chinese paper held up archrival Pony Ma as “rewriting the mobile age†with Tencent Holdings Ltd.

Also on its list were BYD Co. Chairman Wang Chuanfu, Xiaomi Corp. co-founder Lei Jun and Huawei Technologies Co.’s Ren Zhengfei.

Alibaba has also recently been placed under heavy regulatory scrutiny, Forbes magazine reported.

The Hangzhou-based company has been the subject of an anti-monopoly probe that started in December.

It’s said to be under investigation for alleged monopolistic business practices like “er xuan yi,†which means choose one of two. It’s a policy that forces merchants to sell exclusively on just one platform.

On Tuesday, Alibaba said that it had established a special task force to conduct internal reviews, and will cooperate with the State Administration for Market Regulation (SAMR) in its ongoing investigation, Forbes magazine reported.

Alibaba had just reported another quarter of strong earnings. Sales for the three months ended in December jumped another 37% to 221.08 billion yuan ($34.24 billion). Net profit came in at 79.4 billion yuan for the same period, which included the company’s annual Singles’ Day shopping bonanza.

Sources: Reuters, Channel News Asia, Bloomberg, Yahoo! Finance, Forbes magazine

[ad_2]

Source link