Julie Evans thought she’d get a refund from the IRS this year, so she got to work on her taxes first thing in January. A former administrative assistant, Evans was out of work for all of 2020. To save money, she is living with her adult children in Kent, Washington, and scraping by on unemployment benefits. “The idea of $400 or so [refund] was enticing,†she said.Â

Instead, Evans got a shock: a $1,600 tax bill. “I don’t know where I’m going to come up with the money,†the 59-year-old told HuffPost.

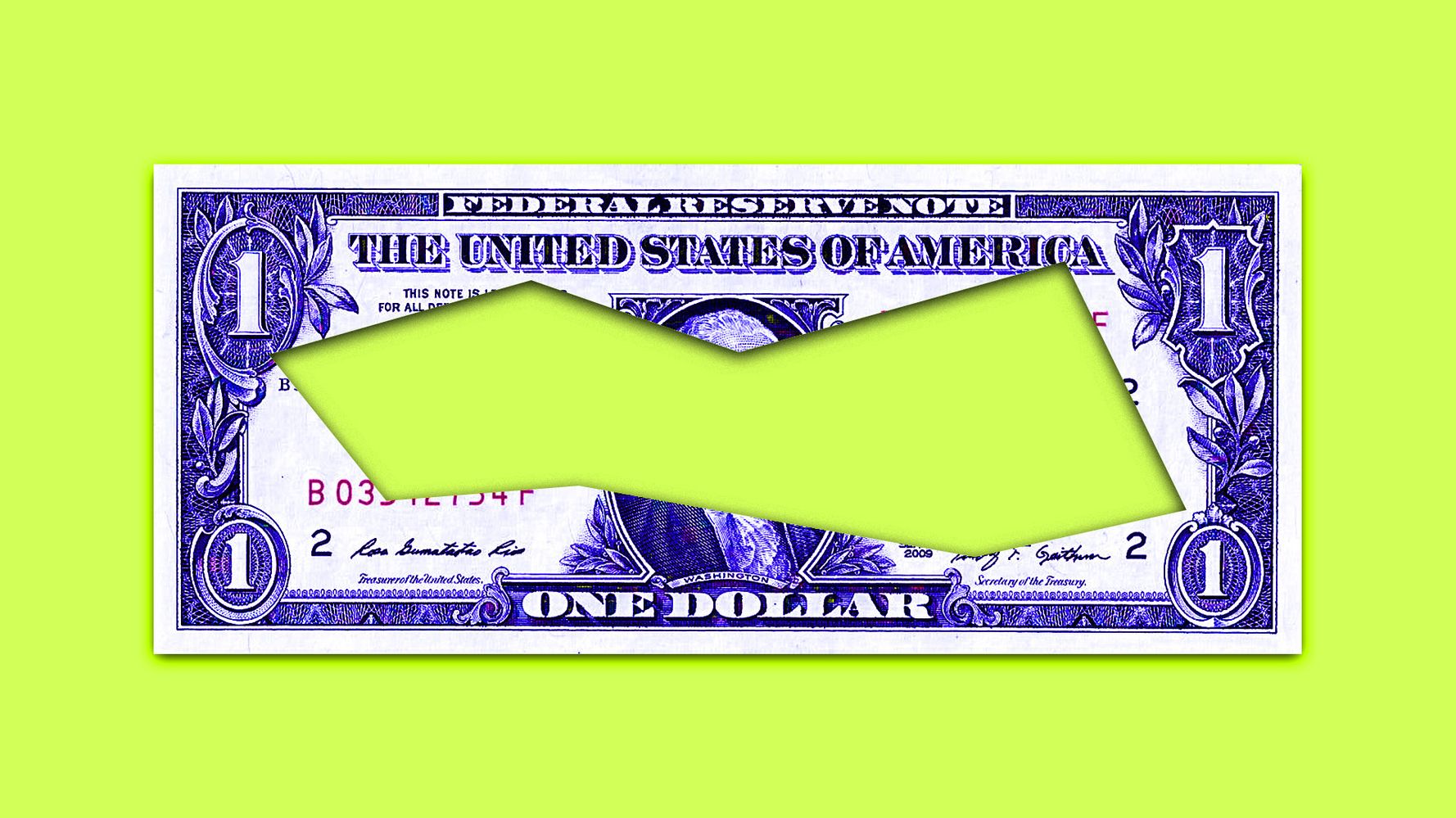

The U.S. is about to face what has to be one of the more nonsensical policy failures of the pandemic: Millions of Americans, already struggling financially, could be hit with a huge tax bill because they received unemployment insurance last year.

Perversely, because of the relative generosity of the benefits passed by Congress last spring ― $600 a week on top of state benefits ― tax bills might reach into the thousands of dollars, according to a report released by The Century Foundation last week, as well as conversations HuffPost had with unemployed workers.

Households could see tax bills between $1,000 and $2,000, said Brian Galle, a professor at Georgetown Law School and the report’s co-author. Some bills could reach as high as $3,000; others may not owe money but won’t get the refunds they’re expecting.Â

Most of these people still don’t have jobs. “Asking people who are out of work to dig into their pockets and come up with another $3,000 when they’re already having trouble paying rent — this is just a bad combination of events,†Galle said.

For many, the bills will come as a surprise: Who would think that the government would tax the money it provided to help people avoid going broke?Â

Shannon O’Brien, 48, lost his job as a bartender in a casino near Albany, New York, when the shutdown began in March 2020. When he sketched out his taxes last month, O’Brien was surprised to find he owes $1,000 to the federal government and $600 to the state because of his unemployment benefits.Â

“It doesn’t seem logical,†he said.

He’s gone from earning a little more than $1,000 a week — mostly in tips — to getting a couple hundred dollars from the state. He’s thousands of dollars in debt and recently sold his car.

Only a few of his bartender colleagues have been called back to work, since the casino’s bars are mostly still shut down, he said. The only other nearby work option is an Amazon warehouse, but O’Brien cares for his elderly mother and is leery of taking a job that would potentially expose both of them to COVID-19.

So he’s been waiting, hoping federal lawmakers would act to help him, first, by extending the $600 additional unemployment payments, or at least paying some of that retroactively — a policy conversation that seems to have vanished, he pointed out.Â

“No one cares,†he said. “We’re all out here deep in debt.†And it’s not like it’s his fault, he added: “They literally closed the economy down for a year.â€

If he winds up getting a stimulus check this year, O’Brien said he’ll have to use it to pay his taxes.

The situation is “sort of asinine,†said Elizabeth Pancotti, a policy director at Employ America who co-authored the Century Foundation report. “It seems very silly that you have to pay Uncle Sam when you lose your job. There is no logical and ethical reason why we would tax these benefits.â€

She pointed out that other federal benefit programs — like the Supplemental Nutrition Assistance Program — are not taxed like this.

In fact, unemployment benefits weren’t taxed at all until 1978, when members of Congress — spurred on by conservative economist Martin Feldstein — expressed worry that if jobless payments weren’t taxed like income, workers would have an “incentive†to remain unemployed. (Feldstein also believed that Social Security discouraged people from saving for retirement, and that tax cuts for the rich trickled down to the working classes.)

The reasoning behind the tax-the-unemployment-benefits theory is wrong. Most people aren’t aware that the payments are taxed in the first place. Plus, research suggests that unemployment benefits — particularly in the U.S., where they’re fairly stingy — don’t keep folks from working.Â

And during a pandemic, much of the point of expanded unemployment benefits was to keep would-be workers at home to prevent the virus from spreading.

In normal times, the taxes on unemployment benefits aren’t a big issue: People are unemployed for a few weeks, and don’t make enough money to owe anything back in taxes. But in a recession, when folks are out of work for longer periods of time, the issue comes up. In 2009, facing this problem, Congress exempted about $2,000 of benefits from taxes.

But the scale of the unemployment crisis the U.S. faced in 2020 was far worse than the Great Recession. At the peak in April, the unemployment rate hit a record 14.7%. It fell from there, but still millions remained on the job loss rolls, including freelance workers and part-timers who were included as benefits recipients in Congress’s stimulus package in March 2020.

Last year, 40 million Americans received unemployment benefits totaling an astonishing $580 billion, the Century Foundation estimated.

Though states are supposed to ask the unemployed if they want their taxes withheld, there seems to have been a breakdown in the system. Fewer than 40% of states withheld taxes from unemployment checks, Century’s report found.Â

Some of the problem was that Congress expanded eligibility for benefits, and those newly eligible part-time and contract workers weren’t give the option to withhold money.

Policymakers should’ve seen this coming, Pancotti said. Forgiving these taxes was a decision the Treasury Department could have made under former President Donald Trump.

“There was no reason to wait until the last minute to do this,†she said. A spokesperson for the Treasury Department declined to comment.

We give money to people to survive, and then we take it back.

Stephanie Freed, co-founder of Extend PUA

Even if money was withheld from unemployment checks, it likely wasn’t enough, and will only cover federal taxes. That means people in places with high local taxes, like New York City, could still be on the hook for more.

That’s what happened to 29-year-old Sarah Ford, who was working in events production in New York when the pandemic hit and has been out work ever since, picking up some freelance gigs here and there. She asked for taxes to be taken out of her unemployment checks from the start (an option that not all filers had last year), but she still owes $2,000 in city taxes. Her partner, who was also unemployed in 2020, owes $650.

“This is just another cut of thousands from this pandemic,†said Ford, who also volunteers with an activist group devoted to helping unemployed workers in the pandemic called Extend PUA. (PUA stands for pandemic unemployment assistance, the program that offered benefits to workers who typically don’t qualify for unemployment insurance.)

Ford said she should be able to pay her tax bill with the money she has coming in from freelance work now.

Most people are in less of a hurry to file. Workers are already starting to panic, said Stephanie Freed, the 32-year-old co-founder of Extend PUA. People she’s spoken with are putting off doing their taxes because they can’t afford to pay the bill.

It’s a situation that truly doesn’t make much sense, she said. “Unemployment insurance should never be taxed,†she said. “We give money to people to survive, and then we take it back.â€

Freed herself says she expects to face a tax bill for the unemployment insurance she received last year after losing her job as a production electrician in the entertainment industry. She’s been too afraid to look yet.

Evans, the Washington woman, said she’s hoping to pay her taxes in installments, and that she’d probably use additional stimulus money for car payments, food and rent for the facility where she’s storing her furniture and belongings.

Like so many women in the U.S., she’s starting to worry about what’s to come. “I am looking at turning 60 this year and have no appreciable retirement savings or income,†she said. “I was divorced over 20 years ago, and since then, I have been doing every job imaginable in order to support myself and my kids — at times holding three jobs.â€Â Â

Meanwhile, there are a few lawmakers looking to fix the problem. A bill proposed by Sen. Dick Durbin (D-Ill.) and Rep. Cindy Axne (D-Iowa) would exempt the first $10,200 of unemployment money from income tax. Sen. Bernie Sanders (I-Vt.) wants Congress to make sure none of the payments are taxable.

These solutions might be untenable, given the cost — which Galle, the Century Foundation report co-author, estimates would be about $20 billion — and the spending limits the Senate faces in trying to pass another COVID-19 relief bill under the limitations of the reconciliation process.

Also, if Congress does pass something, it could take months to wind its way through the system, forcing people to pay their tax bills then file amended claims to try and get the money back.

The pandemic might have kept these folks out of the workforce, but now these government policy choices could very well keep them in debt, along with all that entails. Evans talked about the fees that pile up when she misses payments on her storage unit; O’Brien is worried about getting to work now that he’s without a car.

A quicker option lies with the Treasury Department, Galle said. He pointed to a law that exempts disaster relief money from federal taxes, and said he’s been pushing for the department to take this route.

So far, though, he hasn’t gotten much attention.Â

O’Brien was passionate that this issue should be front and center, instead of the other progressive policy ideas he keeps hearing about, like student loan debt forgiveness or payments to parents.

“Just fight for something we need now,†he said.

Calling all HuffPost superfans!

Sign up for membership to become a founding member and help shape HuffPost’s next chapter

[ad_2]